Form W 7 Rev January Fill in Capable

What is the Form W-7 Rev January Fill In Capable

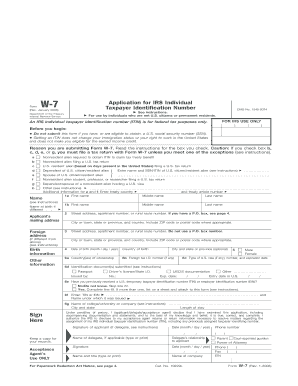

The Form W-7, officially known as the Application for IRS Individual Taxpayer Identification Number (ITIN), is designed for individuals who are not eligible for a Social Security number but need to file taxes in the United States. The revised version from January includes updates that ensure compliance with current IRS regulations. This form is essential for non-resident aliens, their spouses, and dependents who require an ITIN for tax reporting purposes.

How to use the Form W-7 Rev January Fill In Capable

Using the Form W-7 involves several key steps. First, gather all necessary documentation that supports your application, such as a valid passport or other identification. Next, fill out the form accurately, providing personal information such as your name, address, and reason for needing an ITIN. After completing the form, submit it along with your tax return or any other required documents to the IRS. It is crucial to ensure that all information is correct to avoid delays in processing.

Steps to complete the Form W-7 Rev January Fill In Capable

Completing the Form W-7 involves a systematic approach:

- Step 1: Download the latest version of the form from the IRS website.

- Step 2: Fill in your personal details, including your name, mailing address, and date of birth.

- Step 3: Indicate the reason for applying for an ITIN by checking the appropriate box.

- Step 4: Provide supporting documentation to verify your identity and foreign status.

- Step 5: Review the form for accuracy and completeness before submission.

- Step 6: Submit the form to the IRS, either with your tax return or separately, as required.

Required Documents

When applying for an ITIN using the Form W-7, you must submit specific documents to establish your identity and foreign status. Acceptable documents include:

- A valid passport.

- A national identification card that includes your photo.

- A birth certificate (for dependents).

- Other government-issued documents that display your name and address.

It is important to provide original documents or certified copies, as photocopies are not acceptable.

Eligibility Criteria

To be eligible for an ITIN through the Form W-7, applicants must meet certain criteria. Primarily, you must be a non-resident alien or a foreign national who is required to file a U.S. tax return. Additionally, you may qualify if you are a dependent or spouse of a U.S. citizen or resident alien. It is essential to ensure that you meet these criteria before submitting your application to avoid unnecessary delays or rejections.

Form Submission Methods

The Form W-7 can be submitted to the IRS through various methods:

- By Mail: Send the completed form along with your tax return to the address specified in the form instructions.

- In-Person: You may apply for an ITIN in person at designated IRS Taxpayer Assistance Centers.

- Through an Acceptance Agent: Authorized Acceptance Agents can help you complete and submit the form on your behalf.

Each submission method has its own processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete form w 7 rev january fill in capable

Complete Form W 7 Rev January Fill In Capable effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents quickly without any hold-ups. Manage Form W 7 Rev January Fill In Capable on any device using airSlate SignNow apps for Android or iOS and streamline any document-centric process today.

The simplest way to modify and eSign Form W 7 Rev January Fill In Capable with ease

- Obtain Form W 7 Rev January Fill In Capable and then select Get Form to begin.

- Utilize the services we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and then click the Done button to secure your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Form W 7 Rev January Fill In Capable to maintain exceptional communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 7 rev january fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'Form W 7 Rev January Fill In Capable' and how can it benefit my business?

The 'Form W 7 Rev January Fill In Capable' is a crucial form for individuals seeking an Individual Taxpayer Identification Number (ITIN) from the IRS. Using airSlate SignNow, you can easily fill in and eSign this form online, streamlining your application process. This functionality not only saves time but also minimizes errors, ensuring your submission is accurate and compliant.

-

How much does airSlate SignNow cost for accessing 'Form W 7 Rev January Fill In Capable' features?

airSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring you can access 'Form W 7 Rev January Fill In Capable' features without breaking the bank. You can choose from monthly or annual subscriptions, making it flexible for businesses of any size. Additionally, there may be promotional offers that you can take advantage of for even greater savings.

-

Is airSlate SignNow user-friendly for filling in 'Form W 7 Rev January Fill In Capable'?

Yes, airSlate SignNow is designed with user experience in mind, allowing anyone to easily fill in 'Form W 7 Rev January Fill In Capable' without prior technical knowledge. The intuitive interface guides users through the process, ensuring that all necessary fields are completed correctly. This ease of use signNowly reduces the time spent on document management.

-

Can airSlate SignNow integrate with other software for managing 'Form W 7 Rev January Fill In Capable'?

Definitely! airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage 'Form W 7 Rev January Fill In Capable' and other documents effectively. Popular integrations include CRM systems, cloud storage solutions, and project management tools, which streamline your workflow and keep everything organized. This flexibility makes airSlate SignNow a versatile choice for businesses.

-

What security measures does airSlate SignNow offer for 'Form W 7 Rev January Fill In Capable'?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like 'Form W 7 Rev January Fill In Capable'. The platform employs advanced encryption protocols and complies with industry standards to protect your data. Additionally, features like two-factor authentication ensure that your information remains secure throughout the signing process.

-

Can I access 'Form W 7 Rev January Fill In Capable' on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to access and fill in 'Form W 7 Rev January Fill In Capable' from any smartphone or tablet. The mobile app provides the same user-friendly experience as the desktop version, making it convenient for users who are on the go. This flexibility allows you to manage your documents anytime, anywhere.

-

How quickly can I get my 'Form W 7 Rev January Fill In Capable' signed using airSlate SignNow?

With airSlate SignNow, you can have your 'Form W 7 Rev January Fill In Capable' signed in a matter of minutes. The platform allows for instant notifications, so once you've sent the document for signing, you can track its progress in real-time. This rapid turnaround is essential for meeting deadlines and maintaining compliance.

Get more for Form W 7 Rev January Fill In Capable

Find out other Form W 7 Rev January Fill In Capable

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online