Nevada Llc Company Form

What is the Nevada limited company?

A Nevada limited company, often referred to as a limited liability company (LLC), is a popular business structure that combines the benefits of both a corporation and a partnership. This type of entity provides its owners, known as members, with limited liability protection, meaning their personal assets are generally protected from business debts and liabilities. Additionally, Nevada is known for its business-friendly environment, offering various advantages such as no state income tax and strong privacy protections for business owners.

How to obtain the Nevada limited company

To establish a Nevada limited company, you need to follow several steps. First, choose a unique name for your LLC that complies with Nevada naming requirements. Next, appoint a registered agent who will serve as your official point of contact for legal documents. After that, file the Articles of Organization with the Nevada Secretary of State, which requires basic information about your LLC, including its name, registered agent, and address. Once your application is approved, you will receive a Certificate of Organization, officially recognizing your LLC.

Steps to complete the Nevada limited company

Completing the formation of a Nevada limited company involves a series of essential steps:

- Choose a unique name that adheres to state guidelines.

- Designate a registered agent with a physical address in Nevada.

- File the Articles of Organization with the Nevada Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Create an operating agreement outlining the management structure and member roles.

- Comply with any local business licenses or permits required for your specific industry.

Legal use of the Nevada limited company

The legal use of a Nevada limited company encompasses various aspects, including compliance with state laws and regulations. An LLC must maintain its good standing by filing annual lists and paying the required fees. Additionally, members should ensure that the company operates within the scope of its stated purpose and adheres to any specific industry regulations. This legal framework provides protection and legitimacy, allowing the business to operate effectively while safeguarding the personal assets of its members.

Required documents

When forming a Nevada limited company, several key documents are necessary:

- Articles of Organization: This document outlines the basic information about your LLC.

- Operating Agreement: While not mandatory, this internal document details the management and operational structure of the LLC.

- Employer Identification Number (EIN): Required for tax purposes, this number can be obtained from the IRS.

- Business licenses and permits: Depending on your business type, you may need additional licenses to operate legally.

State-specific rules for the Nevada limited company

Nevada has specific rules governing the formation and operation of limited companies. These include requirements for maintaining a registered agent, filing annual reports, and paying associated fees. Additionally, Nevada law allows for greater privacy for business owners compared to many other states, as it does not require the disclosure of member identities in public filings. Understanding these state-specific regulations is crucial for ensuring compliance and protecting your business interests.

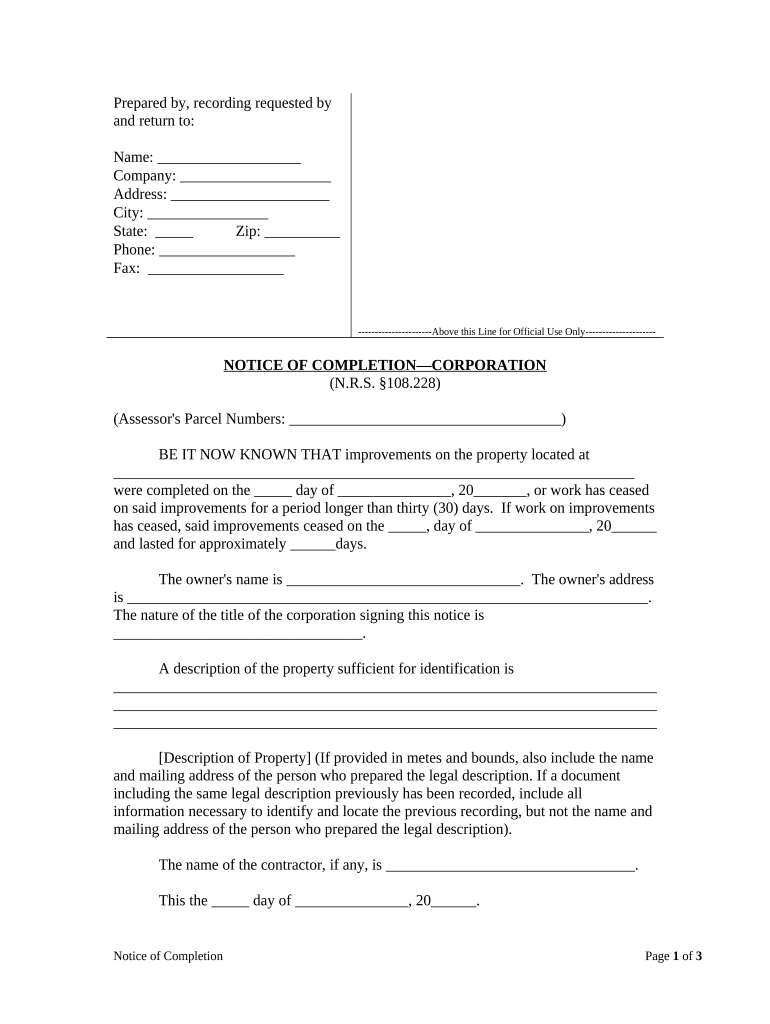

Quick guide on how to complete nevada llc company

Complete Nevada Llc Company effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Nevada Llc Company on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to alter and eSign Nevada Llc Company without any hassle

- Obtain Nevada Llc Company and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Underline relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that use.

- Generate your eSignature with the Sign feature, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Nevada Llc Company and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nevada limited company?

A Nevada limited company, also known as an LLC, is a business entity that combines the benefits of both corporations and partnerships. It offers liability protection to its owners while allowing for flexible management and tax treatment. Starting a Nevada limited company is an excellent choice for entrepreneurs seeking to safeguard their personal assets.

-

How much does it cost to set up a Nevada limited company?

The cost to establish a Nevada limited company typically includes the state filing fee, which is around $425, along with additional costs for registered agent services and potential legal assistance. Ongoing expenses may include annual fees and business licenses. Choosing an efficient provider can ensure you remain compliant while managing your costs.

-

What are the key benefits of forming a Nevada limited company?

Forming a Nevada limited company provides numerous advantages, including strong asset protection, tax flexibility, and ease of management. Nevada's business-friendly laws create an attractive environment for LLCs, minimizing personal liability for business debts. Additionally, LLCs enjoy straightforward operational requirements, making compliance simpler.

-

Can a Nevada limited company operate in other states?

Yes, a Nevada limited company can operate in other states by registering as a foreign LLC. Each state has its own registration and compliance requirements, so it's important to check local regulations. Operating under a Nevada limited company structure allows for broader business opportunities across state lines.

-

What features should I look for in services for my Nevada limited company?

When selecting services for your Nevada limited company, look for features such as document preparation, eSignature capabilities, and compliance tools. A reliable service should also provide customer support and integration options for accounting or project management software. These features will help streamline your business processes.

-

How does airSlate SignNow support businesses with a Nevada limited company?

airSlate SignNow empowers businesses, including those operating as a Nevada limited company, to easily send and eSign documents. Our platform is user-friendly and cost-effective, saving you time and ensuring compliance with legal standards. Easily integrate with your existing tools, making document management a breeze.

-

Are there any restrictions on the types of businesses that can form a Nevada limited company?

Generally, there are few restrictions on the types of businesses that can form a Nevada limited company. However, certain professional services, such as legal or medical practices, may require additional licensing or compliance. It’s advisable to consult with a legal expert to ensure that your business qualifies.

Get more for Nevada Llc Company

Find out other Nevada Llc Company

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy