Living Trust for Individual Who is Single, Divorced or Wwidow or Widower with Children Nevada Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Nevada

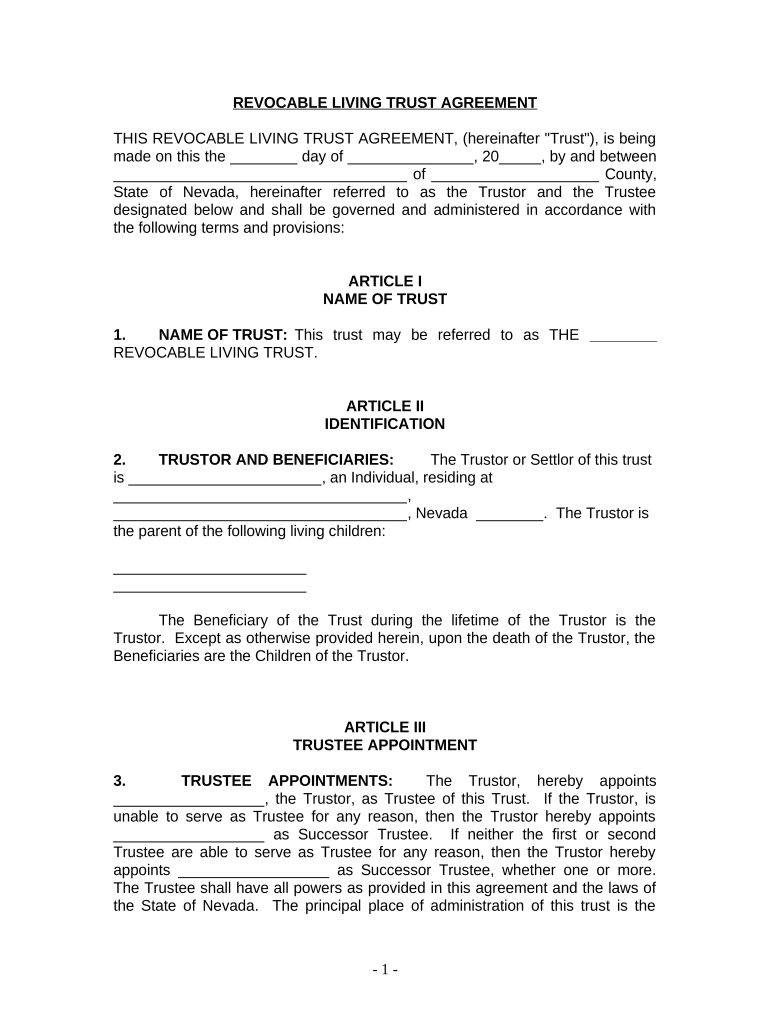

A living trust for individuals who are single, divorced, or widowed with children in Nevada is a legal document that allows a person to manage their assets during their lifetime and dictate how those assets will be distributed after their death. This type of trust is particularly beneficial for those with children, as it provides a way to ensure that their assets are passed on according to their wishes while avoiding the lengthy probate process. The trust can be revocable, allowing the individual to make changes as needed, or irrevocable, which generally provides more protection from creditors.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Nevada

Completing a living trust involves several key steps to ensure it is valid and meets legal requirements:

- Identify your assets: List all properties, bank accounts, investments, and personal belongings you wish to include in the trust.

- Choose a trustee: Select a trusted individual or institution to manage the trust on your behalf.

- Draft the trust document: Clearly outline the terms of the trust, including how assets will be managed and distributed.

- Sign and notarize the document: Ensure that the trust is signed in the presence of a notary public to validate it legally.

- Fund the trust: Transfer ownership of your assets into the trust to make it effective.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Nevada

Several key elements are essential for a living trust to be effective:

- Trustee designation: The individual or entity responsible for managing the trust.

- Beneficiaries: Individuals or organizations that will receive the assets from the trust.

- Asset description: A detailed list of all assets included in the trust.

- Distribution instructions: Clear guidelines on how and when the assets should be distributed to beneficiaries.

- Revocation clause: A statement outlining whether the trust can be altered or revoked during the grantor's lifetime.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Nevada

Nevada has specific regulations governing living trusts that individuals need to be aware of:

- Trusts do not need to be recorded with the state, but it is advisable to keep them in a secure location.

- Nevada law allows for the creation of both revocable and irrevocable trusts.

- There are no state inheritance taxes, making trusts a tax-efficient option for estate planning.

- Trusts can be administered with minimal court oversight, providing greater privacy.

How to Use the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Nevada

Using a living trust effectively involves understanding its management and the responsibilities of the trustee:

- The trustee is responsible for managing the trust assets, paying any debts, and ensuring that the trust terms are followed.

- Regular reviews of the trust are recommended to ensure it reflects any changes in circumstances, such as marriage, divorce, or the birth of additional children.

- Beneficiaries should be kept informed about the trust's existence and its implications for their inheritance.

- Consulting with an estate planning attorney can provide guidance on best practices for managing and utilizing the trust.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Nevada

A living trust is legally recognized in Nevada and can be used to manage various types of assets, including real estate, bank accounts, and investments. It serves as a tool for estate planning, ensuring that the grantor's wishes are honored after their passing. The trust can help avoid probate, which can be a lengthy and costly process. Additionally, it provides privacy since the trust does not become public record unlike a will. Properly executed, a living trust is a powerful legal instrument for individuals seeking to protect their assets and provide for their children.

Quick guide on how to complete living trust for individual who is single divorced or wwidow or widower with children nevada

Complete Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With Children Nevada effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Handle Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With Children Nevada on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With Children Nevada effortlessly

- Locate Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With Children Nevada and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form - via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With Children Nevada to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with Children in Nevada?

A Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with Children in Nevada is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed upon your death. This type of trust can help ensure that your children are taken care of according to your wishes, avoiding probate and minimizing legal complications.

-

How does a Living Trust benefit someone who is single, divorced, or a widow or widower in Nevada?

A Living Trust can provide peace of mind by clearly outlining your wishes for your children and other beneficiaries. It can help protect your assets from probate, provide privacy regarding your estate, and ensure that your loved ones receive their inheritance without unnecessary delays or costs.

-

What are the costs associated with creating a Living Trust in Nevada?

The cost of establishing a Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with Children in Nevada varies depending on complexity and the service provider. Typically, you can expect to pay between $1,000 and $3,000 for professional assistance. Online options may also exist that can provide cost-effective solutions.

-

Can I customize my Living Trust for my specific needs?

Yes, when creating a Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with Children in Nevada, you have the ability to customize it based on your personal circumstances. You can specify guardians for your children, designate beneficiaries, and outline how and when assets should be distributed. Customization ensures that your unique wishes are clearly articulated.

-

Is it difficult to manage a Living Trust after it is created?

Managing a Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with Children in Nevada is generally straightforward. You retain control of the assets during your lifetime, allowing you to make changes or revoke the trust if necessary. It is advisable to periodically review the trust to ensure it remains aligned with your goals and family needs.

-

What happens to my Living Trust if I move out of Nevada?

If you move out of Nevada, your Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with Children may still be valid, but you may want to review and possibly update it to comply with your new state's laws. It's crucial to consult with an attorney who specializes in estate planning in that state to ensure your trust remains effective.

-

Are there any tax benefits associated with having a Living Trust in Nevada?

While a Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with Children in Nevada does not provide direct tax benefits, it can help with estate tax planning. Depending on the size of your estate, having a trust may reduce potential estate taxes and provide strategies for tax-efficient wealth transfer to your children.

Get more for Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With Children Nevada

- Killian l director form

- Biofuel registration form

- Burning permit sonoita form

- Cottonseed sampler certification application aac r3 5 102 form

- Az at your service office of the arizona governor doug ducey form

- Livestock inspectionsarizona department of agriculture form

- Complete the brandamendment application arizona department of form

- Rob smook form

Find out other Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With Children Nevada

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement