Ny Trust Form

What is the NY Trust

The NY Trust is a legal arrangement that allows individuals to manage their assets for the benefit of designated beneficiaries. This type of trust can be utilized for various purposes, including estate planning, asset protection, and tax management. In New York, trusts are governed by the New York Estates, Powers and Trusts Law (EPTL), which outlines the requirements and regulations for creating and maintaining a trust.

How to use the NY Trust

Using a NY Trust involves several steps, starting with the creation of the trust document. This document must clearly outline the terms of the trust, including the trustee's powers and the beneficiaries' rights. Once established, the trust can hold various assets, such as real estate, bank accounts, and investments. The trustee is responsible for managing these assets according to the trust's terms, ensuring that the beneficiaries receive their intended benefits.

Steps to complete the NY Trust

Completing a NY Trust involves a series of important steps:

- Define the purpose: Determine the specific goals for the trust, such as asset protection or tax benefits.

- Select a trustee: Choose a reliable individual or institution to manage the trust.

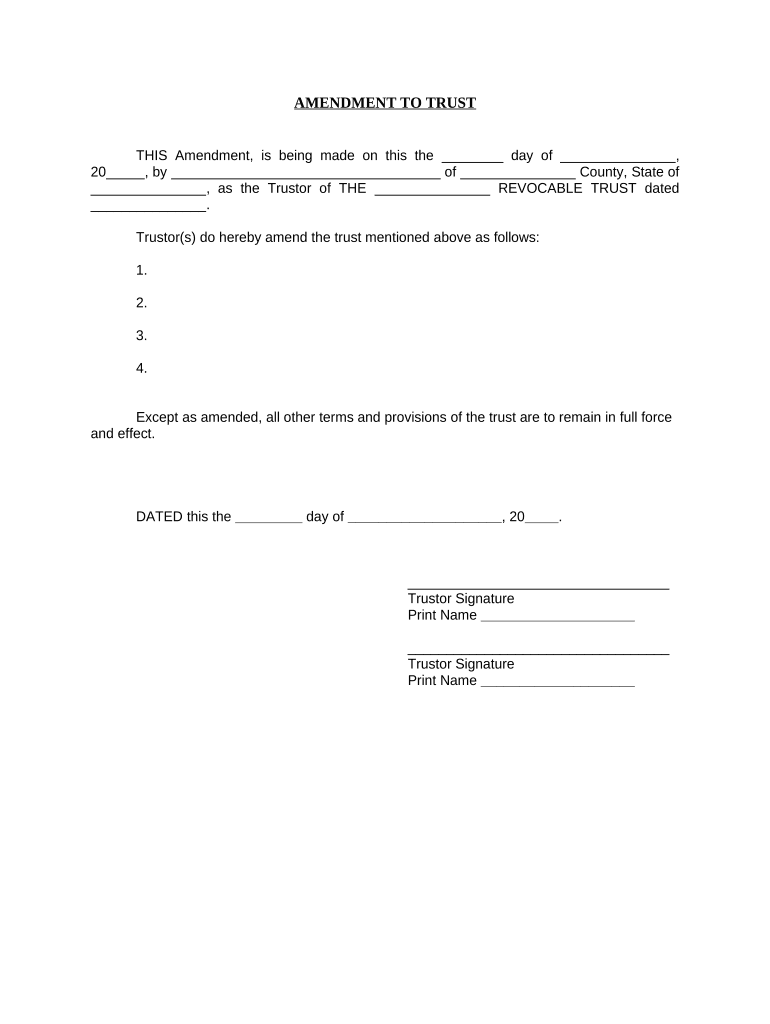

- Draft the trust document: Work with a legal professional to create a comprehensive trust document that adheres to New York laws.

- Fund the trust: Transfer assets into the trust, which may require additional documentation.

- Review and update: Regularly review the trust to ensure it meets current needs and complies with legal requirements.

Legal use of the NY Trust

The legal use of the NY Trust is primarily governed by state law, which ensures that the trust is valid and enforceable. To be legally binding, the trust must be executed in accordance with the EPTL, which includes proper signing and witnessing. Additionally, the trust must comply with federal tax regulations, making it essential to consult with a legal expert to navigate these complexities.

Key elements of the NY Trust

Several key elements define the structure and function of a NY Trust:

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: The individuals or entities entitled to receive benefits from the trust.

- Trust property: The assets held within the trust, which can include cash, real estate, and investments.

- Trust terms: The specific instructions and provisions outlined in the trust document.

State-specific rules for the NY Trust

New York has specific rules and regulations that govern the establishment and operation of trusts. These include requirements for the trust document, the age and competency of the trustee, and the rights of beneficiaries. Familiarity with these state-specific rules is crucial for ensuring compliance and protecting the interests of all parties involved.

Quick guide on how to complete ny trust

Effortlessly Prepare Ny Trust on Any Device

Managing documents online has become a common practice among companies and individuals. It offers an ideal environmentally friendly option to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it in the cloud. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without hindrances. Handle Ny Trust on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Ny Trust with Ease

- Locate Ny Trust and click on Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Finish button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ny Trust to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a NY trust and how can airSlate SignNow help?

A NY trust is a legal arrangement where one party holds property or assets for the benefit of another. airSlate SignNow simplifies the trust management process by allowing you to easily create, send, and eSign all necessary documents electronically, ensuring compliance and efficiency in handling your NY trust.

-

How does airSlate SignNow ensure the security of my NY trust documents?

AirSlate SignNow employs industry-standard encryption and secure cloud storage to protect your NY trust documents. With features like two-factor authentication, you can rest assured that your sensitive information regarding your NY trust is kept safe from unauthorized access.

-

What are the pricing plans for using airSlate SignNow for managing a NY trust?

AirSlate SignNow offers flexible pricing plans tailored to the needs of individuals and businesses managing a NY trust. You can choose between monthly and annual subscriptions, ensuring that you only pay for the features that best support your NY trust workflow.

-

Can I integrate airSlate SignNow with other tools I use for my NY trust?

Yes, airSlate SignNow offers seamless integrations with many popular applications such as Google Drive, Dropbox, and various CRM systems. This ensures you can manage your NY trust documents alongside your existing tools, enhancing productivity and organization.

-

What features does airSlate SignNow offer for creating and managing NY trust documents?

airSlate SignNow provides robust features such as customizable templates, advanced eSigning options, and the ability to store and track documents related to your NY trust. These features streamline the documentation process, making it easier to manage your NY trust efficiently.

-

Is airSlate SignNow user-friendly for someone new to managing a NY trust?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it accessible for those unfamiliar with digital document management. With intuitive navigation and helpful tutorials, even first-time users can easily handle their NY trust documents.

-

How quickly can I get documents signed for my NY trust using airSlate SignNow?

With airSlate SignNow's efficient eSigning technology, you can get documents signed for your NY trust almost instantly. The platform allows for real-time notifications and reminders, ensuring that all parties can respond promptly to requests for signatures.

Get more for Ny Trust

Find out other Ny Trust

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT