Living Trust Property Record New York Form

What is the Living Trust Property Record New York

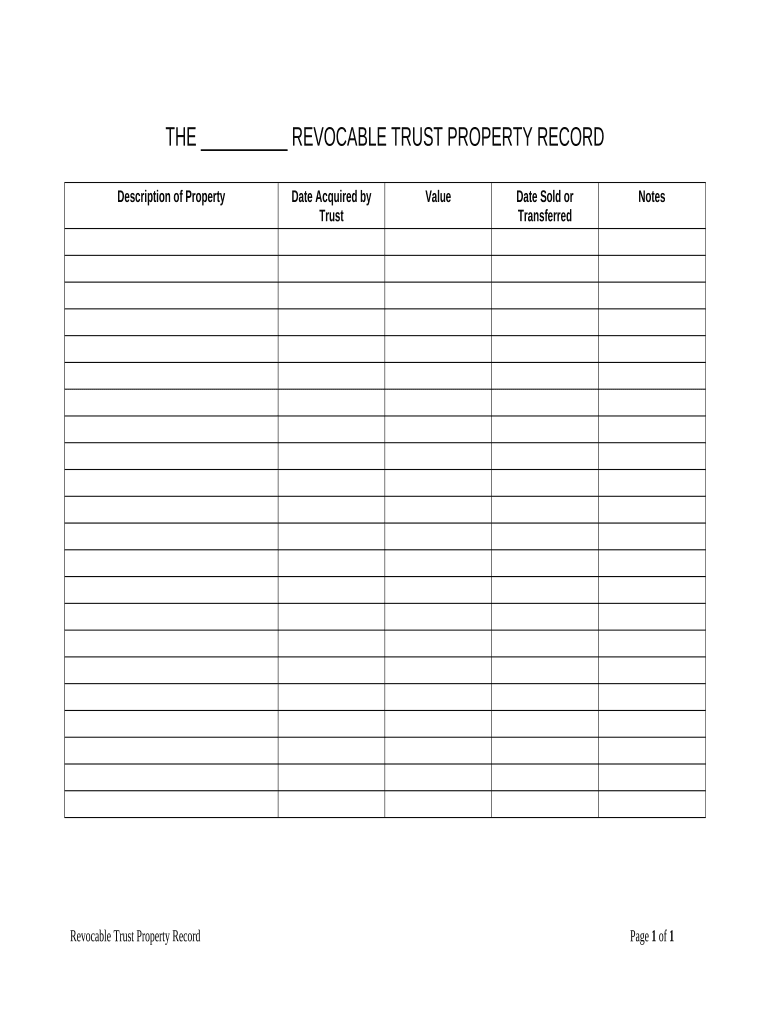

The Living Trust Property Record in New York is a legal document that outlines the assets held within a living trust. This record serves as a crucial element in estate planning, allowing individuals to manage their property during their lifetime and ensure a smooth transition of assets upon death. By establishing a living trust, property owners can avoid the lengthy probate process, maintain privacy regarding their assets, and provide specific instructions for asset distribution. This document typically includes details about the trust creator, the assets included in the trust, and the beneficiaries who will receive these assets.

How to obtain the Living Trust Property Record New York

To obtain a Living Trust Property Record in New York, individuals should first consult with an estate planning attorney who can guide them through the process. The attorney will help draft the trust document, which must comply with New York state laws. Once the living trust is created, it is essential to properly fund the trust by transferring ownership of assets into it. After the trust is established and funded, the property record can be created and maintained, ensuring that all relevant assets are documented accurately. Individuals may also need to file specific forms with the county clerk's office, depending on the assets included in the trust.

Steps to complete the Living Trust Property Record New York

Completing the Living Trust Property Record in New York involves several key steps:

- Consult an estate planning attorney to understand the requirements and implications of creating a living trust.

- Draft the living trust document, ensuring it includes all necessary legal language and complies with state laws.

- Identify and list all assets to be included in the trust, such as real estate, bank accounts, and personal property.

- Transfer ownership of the identified assets into the trust, which may require additional paperwork, such as deeds for real estate.

- Review and sign the living trust document in the presence of a notary, if required.

- Maintain the trust by updating the property record as necessary, especially if new assets are acquired or changes to beneficiaries occur.

Legal use of the Living Trust Property Record New York

The Living Trust Property Record in New York is legally binding and serves as an official record of the assets held in a living trust. This document is essential for ensuring that the trust operates according to the creator's wishes. It provides clear instructions for asset distribution, which can help prevent disputes among beneficiaries. Additionally, the living trust can be used to manage assets in the event of the trust creator's incapacity, allowing designated trustees to handle the property without court intervention. Adhering to New York state laws when creating and maintaining this record is crucial for its legal validity.

Key elements of the Living Trust Property Record New York

Several key elements are essential in the Living Trust Property Record in New York:

- Trust Creator Information: Details about the individual creating the trust, including their name and address.

- Trustee Information: Identification of the person or entity responsible for managing the trust assets.

- Beneficiaries: Names and details of individuals or organizations who will receive the trust assets upon the trust creator's death.

- Asset List: A comprehensive inventory of all assets included in the trust, such as real estate, bank accounts, and personal property.

- Signatures: Signatures of the trust creator and, if applicable, witnesses or notaries, to validate the document.

State-specific rules for the Living Trust Property Record New York

New York has specific rules governing the creation and maintenance of Living Trust Property Records. These rules include:

- The trust document must be in writing and signed by the trust creator.

- New York does not require living trusts to be recorded, but transferring real property into the trust may necessitate filing a deed with the county clerk.

- Trustees must adhere to fiduciary duties, managing the trust assets in the best interest of the beneficiaries.

- Regular updates to the trust may be necessary to reflect changes in assets or beneficiaries, ensuring compliance with state laws.

Quick guide on how to complete living trust property record new york

Effortlessly Prepare Living Trust Property Record New York on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Living Trust Property Record New York on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to Edit and Electronically Sign Living Trust Property Record New York with Ease

- Obtain Living Trust Property Record New York and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and then click the Done button to store your modifications.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Living Trust Property Record New York and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in New York?

A Living Trust Property Record in New York is a legal document that outlines how a person's assets will be managed during their lifetime and distributed after their death. It serves to avoid probate, providing a clear record of property ownership. Establishing a living trust can streamline the transfer of assets and ensure your wishes are honored.

-

How does airSlate SignNow assist with Living Trust Property Records?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning Living Trust Property Records in New York. This simplifies the process by offering templates and easy access to essential legal documents. Utilizing airSlate SignNow ensures that all necessary signatures are obtained quickly and securely.

-

What are the benefits of using a Living Trust in New York?

The primary benefits of using a Living Trust Property Record in New York include avoiding probate, maintaining privacy, and ensuring efficient distribution of assets. Additionally, a Living Trust allows for flexible management of assets during your lifetime. With airSlate SignNow, you can effortlessly manage and sign these documents online.

-

Are there any fees associated with creating a Living Trust Property Record in New York?

Yes, there may be associated fees when creating a Living Trust Property Record in New York, including legal consultation costs and filing fees. However, using airSlate SignNow can signNowly reduce costs by automating the document preparation and signing process. This leads to a more cost-effective solution for managing your living trust.

-

What features does airSlate SignNow offer for Living Trust Property Records?

airSlate SignNow offers features like customizable templates, eSigning capabilities, and secure document storage specifically for Living Trust Property Records in New York. Its intuitive interface ensures that you can easily create and manage your legal documents without hassle. These features combine to streamline the entire process of setting up a living trust.

-

How secure are the documents created through airSlate SignNow?

Documents created, sent, and stored through airSlate SignNow are protected with industry-leading encryption and security measures. This ensures that your Living Trust Property Record in New York remains confidential and secure throughout the entire process. You can trust that your sensitive information is well protected.

-

Can I collaborate with my attorney through airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration with your attorney when creating a Living Trust Property Record in New York. You can share documents securely, track changes, and obtain necessary signatures without physical meetings. This collaboration streamlines the process and saves time.

Get more for Living Trust Property Record New York

Find out other Living Trust Property Record New York

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors