SEC Gov Remarks at SEC Speaks Increasing Product Complexity Form

IRS Guidelines

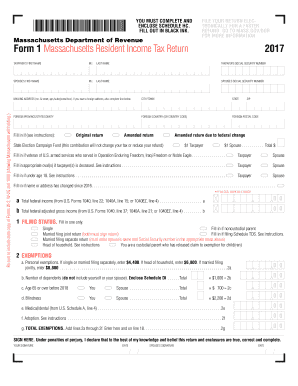

The IRS Form 140 is a crucial document for taxpayers in the United States, particularly for those who need to report specific types of income or claim deductions. Understanding the guidelines set forth by the IRS is essential for accurate completion. The IRS provides detailed instructions on how to fill out the form, including what information is required, how to calculate your tax liability, and common mistakes to avoid. It is advisable to refer directly to the IRS website or official publications for the most current guidelines and updates regarding Form 140.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 140 are critical to ensure compliance and avoid penalties. Generally, the deadline for submitting this form is April 15 of the tax year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of potential extensions that may apply, allowing for additional time to file. Keeping track of these important dates is vital to avoid late fees and ensure timely processing of your tax return.

Required Documents

To complete IRS Form 140 accurately, several documents are necessary. Taxpayers should gather their W-2 forms, 1099 forms, and any other income statements that reflect earnings for the tax year. Additionally, documentation supporting deductions, such as receipts for medical expenses or mortgage interest statements, should be collected. Having all required documents on hand can streamline the filing process and help ensure that the form is filled out correctly.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 140 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed electronically using IRS-approved e-filing software, which is often the fastest and most efficient method. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address based on their location. In-person submissions are less common but may be available at certain IRS offices. Understanding these submission methods can help taxpayers choose the best option for their needs.

Penalties for Non-Compliance

Failing to file IRS Form 140 by the deadline can result in significant penalties. The IRS imposes a failure-to-file penalty, which is typically a percentage of the unpaid tax amount for each month the return is late. Additionally, taxpayers who do not pay their taxes on time may incur interest charges on the outstanding balance. It is important to understand these potential penalties to encourage timely and accurate filing of the form.

Eligibility Criteria

Eligibility to file IRS Form 140 is determined by various factors, including income level, filing status, and specific tax situations. Generally, individuals with a certain income threshold or those who meet specific criteria related to dependents or deductions may be required to use this form. Understanding the eligibility criteria is essential to ensure compliance with IRS regulations and to determine the appropriate form for your tax situation.

Quick guide on how to complete sec speaks

Easily prepare sec speaks on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage irs form 140 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

Effortlessly modify and eSign sec go v

- Locate sec gov and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign sec gov sec to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to sec gov

Create this form in 5 minutes!

How to create an eSignature for the sec gov sec

How to create an electronic signature for the Secgov Remarks At Sec Speaks Increasing Product Complexity online

How to create an eSignature for your Secgov Remarks At Sec Speaks Increasing Product Complexity in Google Chrome

How to create an electronic signature for putting it on the Secgov Remarks At Sec Speaks Increasing Product Complexity in Gmail

How to make an electronic signature for the Secgov Remarks At Sec Speaks Increasing Product Complexity straight from your smartphone

How to create an electronic signature for the Secgov Remarks At Sec Speaks Increasing Product Complexity on iOS

How to create an eSignature for the Secgov Remarks At Sec Speaks Increasing Product Complexity on Android OS

People also ask signsec

-

What is IRS Form 140 and how is it used?

IRS Form 140 is a form used for individual income tax returns in specific states. It serves as a document that taxpayers submit to report their income, deductions, and taxes owed to the IRS. Utilizing airSlate SignNow allows for easy eSigning and management of IRS Form 140, making tax filing more efficient.

-

Can I eSign IRS Form 140 using airSlate SignNow?

Yes, airSlate SignNow offers a seamless eSigning experience for IRS Form 140. You can easily upload the form, sign it electronically, and send it securely to the IRS or other parties. This simplifies the tax filing process, ensuring your documents are signed and submitted without hassle.

-

What are the benefits of using airSlate SignNow for IRS Form 140?

Using airSlate SignNow for IRS Form 140 offers numerous benefits, including enhanced security, ease of use, and time savings. The platform ensures your documents are securely signed and stored, reducing the risk of fraud. Additionally, its user-friendly interface makes navigating the eSigning process straightforward for everyone.

-

Is airSlate SignNow cost-effective for signing IRS Form 140?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses and individuals needing to sign IRS Form 140 and other documents. With flexible pricing plans, you can choose an option that fits your needs and budget, making it an affordable choice for efficient document handling.

-

What integrations does airSlate SignNow offer for IRS Form 140?

airSlate SignNow integrates with various platforms like Google Drive, Dropbox, and CRM systems to streamline the process of signing IRS Form 140. These integrations facilitate easy access to your documents and enhance workflow efficiency. You can connect your tools to ensure a smooth signing experience.

-

How does airSlate SignNow ensure the security of IRS Form 140?

Security is a priority at airSlate SignNow, especially when handling sensitive documents like IRS Form 140. The platform uses advanced encryption for data protection and complies with industry standards to ensure your information remains confidential. This commitment provides peace of mind when signing important tax documents.

-

Can teams collaborate on IRS Form 140 using airSlate SignNow?

Yes, airSlate SignNow allows teams to collaborate effectively on IRS Form 140. Multiple users can access and sign the document, making it easier to gather necessary approvals and information. This collaborative feature enhances productivity and ensures that the tax filing process is completed efficiently.

Get more for irs form 140

Find out other sec go v

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement