Oregon Estate Real Property Form

What is the Oregon Estate Real Property

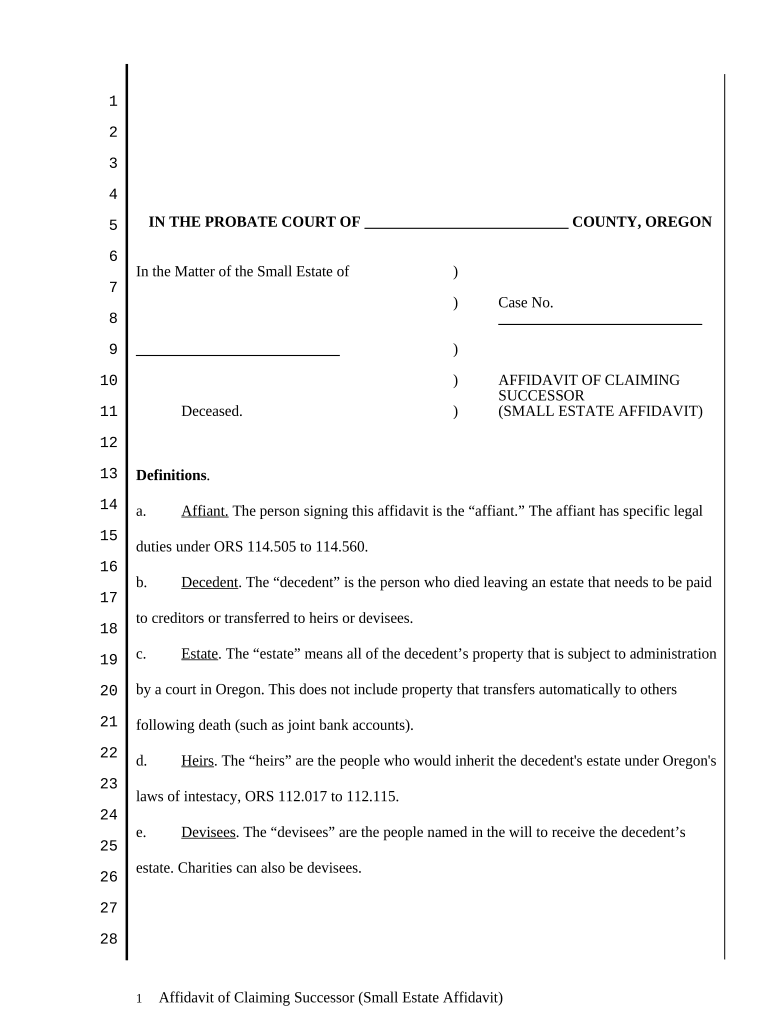

The Oregon estate real property refers to the legal documentation and processes involved in the management and transfer of real estate assets in the state of Oregon. This includes the ownership rights, responsibilities, and any legal stipulations associated with real property. Understanding this form is crucial for individuals and entities engaged in real estate transactions, estate planning, or property management within Oregon.

How to use the Oregon Estate Real Property

Using the Oregon estate real property form involves several key steps. First, gather all necessary information regarding the property, including its legal description, ownership details, and any existing liens or encumbrances. Next, complete the form accurately, ensuring all required fields are filled out. Once completed, the form must be signed by all relevant parties, which can be facilitated through a secure digital platform to ensure compliance with legal standards.

Steps to complete the Oregon Estate Real Property

Completing the Oregon estate real property form involves a systematic approach:

- Gather necessary documents, including property deeds and identification.

- Fill out the form with accurate property details and owner information.

- Review the completed form for accuracy and completeness.

- Obtain signatures from all parties involved, ensuring they are legally recognized.

- Submit the form through the appropriate channels, either digitally or via mail.

Legal use of the Oregon Estate Real Property

The legal use of the Oregon estate real property form is governed by state laws that dictate how real property transactions must be conducted. This includes compliance with the Oregon Revised Statutes, which outline the necessary legal requirements for property transfers, estate planning, and other related activities. Ensuring that the form is completed and submitted correctly is essential for the legal validity of any real estate transaction.

State-specific rules for the Oregon Estate Real Property

Oregon has specific rules and regulations that apply to the estate real property form. These include requirements for notarization, the need for witnesses in certain circumstances, and specific filing procedures with local government offices. Familiarity with these state-specific rules is crucial for anyone involved in real estate transactions to avoid legal complications.

Required Documents

To successfully complete the Oregon estate real property form, several documents are typically required. These may include:

- Proof of identity for all parties involved.

- Current property deed or title.

- Any existing agreements or contracts related to the property.

- Documentation of any liens or encumbrances on the property.

Form Submission Methods (Online / Mail / In-Person)

The Oregon estate real property form can be submitted through various methods, depending on the preferences of the parties involved. Options include:

- Online submission via a secure digital platform.

- Mailing the completed form to the appropriate local government office.

- In-person submission at designated offices, where applicable.

Quick guide on how to complete oregon estate real property

Complete Oregon Estate Real Property effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Oregon Estate Real Property on any device with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to edit and eSign Oregon Estate Real Property without any hassle

- Obtain Oregon Estate Real Property and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Oregon Estate Real Property and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Oregon estate real property?

Oregon estate real property refers to any real estate assets owned in the state of Oregon, including residential, commercial, and industrial properties. Understanding the legal intricacies and ownership rights associated with Oregon estate real property is essential for managing your estate effectively. If you're looking to manage your Oregon estate real property, airSlate SignNow can streamline document management and eSigning.

-

How can airSlate SignNow help with Oregon estate real property transactions?

airSlate SignNow simplifies the process of managing Oregon estate real property transactions by allowing users to eSign and send documents securely online. This reduces the time and paperwork typically associated with real estate deals, making it easy for you to finalize property transactions. With a user-friendly interface, airSlate SignNow is an essential tool for real estate professionals.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to fit the needs of individuals and businesses dealing with Oregon estate real property. Plans vary based on features, including advanced eSigning and document management tools. You can choose a plan that aligns with your budget and requirements for managing Oregon estate real property efficiently.

-

Are there any integrations available with airSlate SignNow for real estate management?

Yes, airSlate SignNow integrates seamlessly with various CRM and real estate management tools, enhancing your workflow for Oregon estate real property. These integrations help you manage documents and eSignatures alongside other essential applications. By using these integrations, you can maintain organized records and streamline your real estate transactions.

-

What features does airSlate SignNow offer for Oregon estate real property management?

airSlate SignNow provides a variety of features specifically beneficial for managing Oregon estate real property, including secure eSigning, customizable templates, and document tracking. These features enhance productivity by minimizing manual processes and ensuring compliance with state regulations. Utilizing these tools can signNowly improve how you handle your Oregon estate real property transactions.

-

Is airSlate SignNow secure for handling real estate documents?

Absolutely, airSlate SignNow employs industry-leading security measures to protect your sensitive Oregon estate real property documents. With advanced encryption and compliance with eSignature laws, you can trust that your documents are safe and secure during the eSigning process. The platform ensures that your transactions remain confidential and well-protected.

-

Can I use airSlate SignNow for multiple signers in Oregon estate real property agreements?

Yes, airSlate SignNow supports multiple signers, making it easy to manage agreements involving various parties in Oregon estate real property transactions. With the ability to send documents to multiple recipients for eSigning, you can facilitate smoother workflows and reduce delays. This feature is essential for collaborative real estate transactions.

Get more for Oregon Estate Real Property

- Generic motorcycle bill of sale form

- Kentucky power of attorney for sale of motor vehicle form

- North carolina general warranty deed from individual to a trust form

- Ohio transfer on death designation affidavit tod from individual to two individuals with contingent beneficiary form

- Power of attorney in colorado form

- Tental form

- Pa llc operating agreement form

- North carolina warranty deed to child reserving a life estate in the parents husband and wife grantors form

Find out other Oregon Estate Real Property

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe