Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Pennsylvania Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

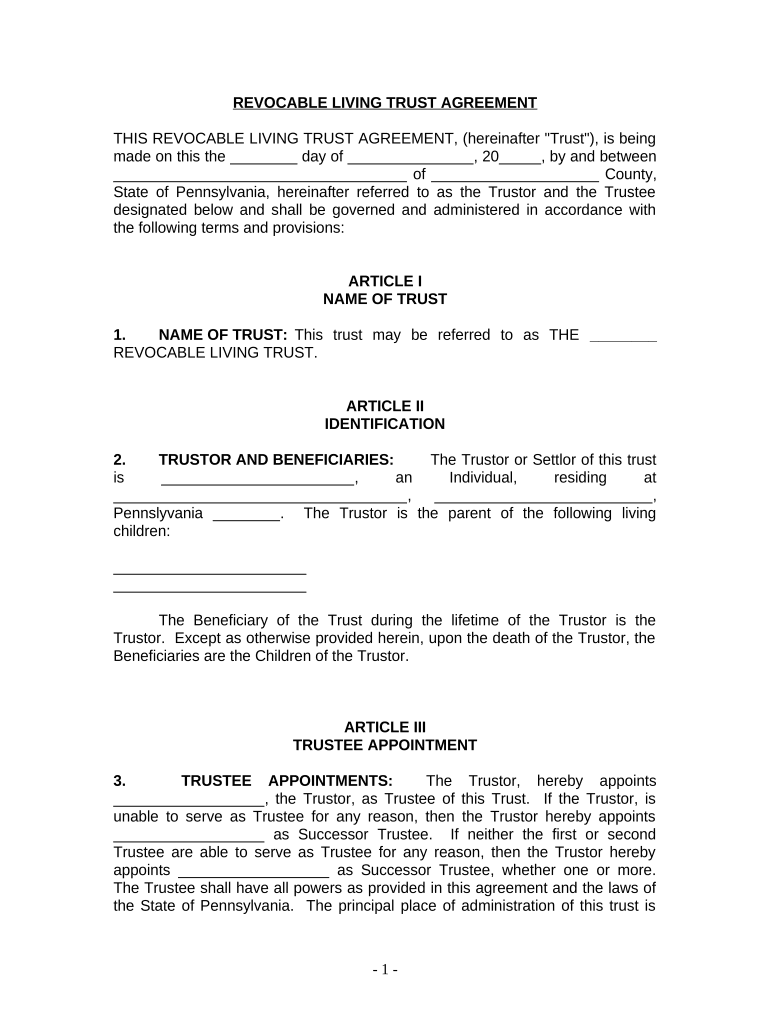

A living trust for individuals who are single, divorced, or widowed with children in Pennsylvania is a legal arrangement that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust can help avoid probate, ensuring a smoother transition of assets to your beneficiaries. It is particularly beneficial for those with children, as it allows you to designate guardianship and manage inheritance in a way that aligns with your wishes.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

Completing a living trust involves several key steps:

- Identify your assets: List all properties, bank accounts, investments, and personal items you wish to include in the trust.

- Choose a trustee: Select an individual or institution to manage the trust on your behalf.

- Draft the trust document: Create a legal document outlining the terms of the trust, including asset distribution and trustee responsibilities.

- Sign the document: Execute the trust in accordance with Pennsylvania laws, which may require notarization.

- Fund the trust: Transfer ownership of your assets to the trust to ensure they are managed according to your wishes.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

The living trust is legally recognized in Pennsylvania and can be used to manage and distribute assets according to your preferences. It allows you to retain control over your assets while you are alive and specifies how they should be handled after your death. This legal framework helps ensure that your children are provided for and that your wishes are honored without the complications of probate court.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

Pennsylvania has specific laws governing living trusts, including requirements for the creation and execution of the trust document. It is essential to comply with state regulations to ensure the trust is valid. This includes proper notarization and witnessing of the document. Additionally, understanding Pennsylvania inheritance laws can help you navigate potential tax implications and ensure your trust aligns with state requirements.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

Key elements of a living trust include:

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities who will receive assets from the trust.

- Asset list: A comprehensive list of all assets included in the trust.

- Distribution instructions: Clear guidelines on how and when assets should be distributed to beneficiaries.

How to Obtain the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

To obtain a living trust in Pennsylvania, you can work with an attorney specializing in estate planning or use online legal services that offer templates and guidance. It is important to ensure that the trust document complies with Pennsylvania laws. Consulting with a legal professional can provide personalized advice and help you navigate the complexities of establishing a living trust tailored to your needs.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children pennsylvania

Complete Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania with ease

- Find Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive data using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or inaccessible documents, tedious form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania to ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania is a legal document that allows individuals to manage and distribute their assets during their lifetime and after death. This trust helps protect your children's inheritance and offers a streamlined process for asset distribution without court involvement. Establishing a living trust can simplify your estate management and provide peace of mind.

-

How much does it cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania?

The cost to create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania varies depending on the complexity of your estate and the services you choose. Online services or software options like airSlate SignNow can be very cost-effective, often ranging from a few hundred to a few thousand dollars. It's essential to compare options and find a solution that fits your budget.

-

What are the benefits of establishing a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania provides several benefits, including avoiding probate, maintaining privacy, and ensuring timely distribution of assets to your beneficiaries. Additionally, it allows you to set specific terms regarding how and when your children will receive their inheritance. This can be particularly important for single parents or those who are divorced.

-

Can I make changes to my Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania?

Yes, one of the signNow advantages of a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania is that you can modify it whenever necessary. You can add or remove assets, change beneficiaries, and alter distributions to suit your current life circumstances. Keeping your trust up to date ensures it reflects your wishes accurately.

-

Does a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania protect against creditors?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania does not provide complete protection against creditors, as assets placed in a revocable trust can still be accessed by creditors during your lifetime. However, once the trust becomes irrevocable upon your death, it can offer some protection. Consulting with a legal expert can help clarify your specific situation.

-

How does a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania interact with life insurance?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania can be designed to receive life insurance benefits as a beneficiary. This means that upon your passing, the life insurance payout can go directly to the trust and be distributed according to your specified terms, ensuring that your children are taken care of financially. It's crucial to consult with a financial advisor to structure this properly.

-

What documentation is needed to set up a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania?

To set up a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children in Pennsylvania, you'll need to provide documentation detailing your assets, including property titles, bank accounts, and any other investments. Additionally, personal identification and beneficiary information are required. Clear and organized documentation can expedite the setup process.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

- Camp roberts hunting application form

- Application for a zoning change detroit detroitmi form

- Mechanical permit application new city of detroit detroitmi form

- City of detroit trusted automated exchange of indicator information taxii detroitmi

- Nwcg individual performance rating

- State of california notice of non responsibility form

- De la salle university letter of recommendation office of dlsu edu form

- Ferpa release form goodwin college goodwin

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Pennsylvania

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast