Living Trust for Husband and Wife with Minor and or Adult Children Pennsylvania Form

What is the Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

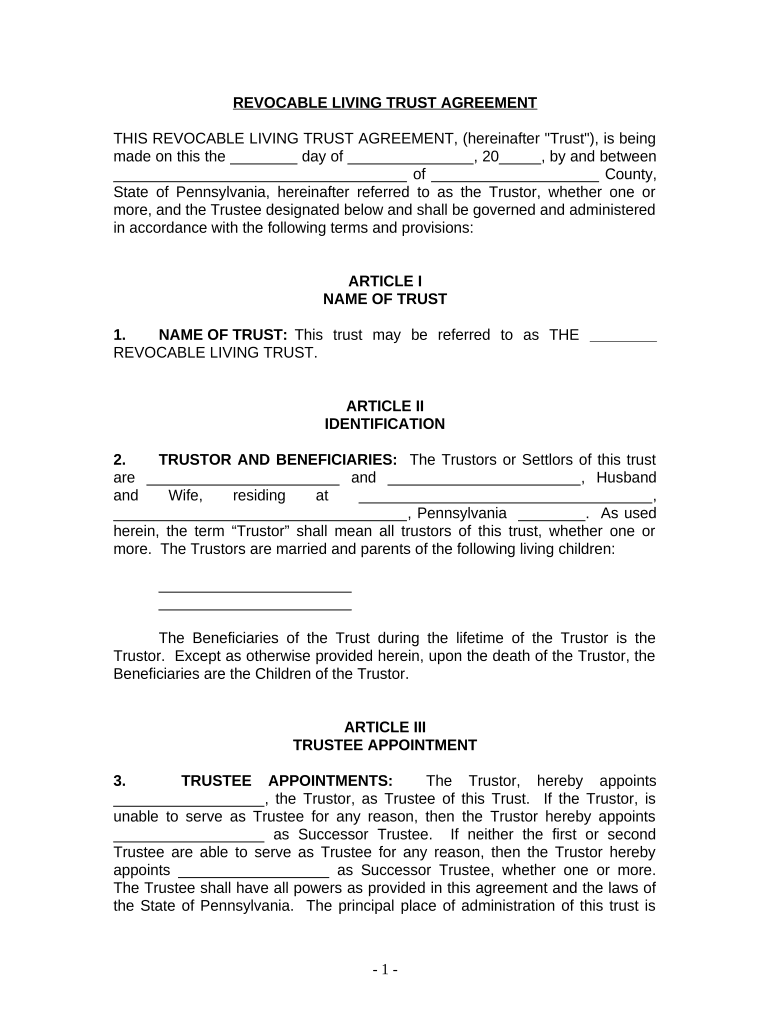

A living trust for husband and wife with minor and/or adult children in Pennsylvania is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust can help avoid the lengthy probate process, ensuring a smoother transition of assets to beneficiaries. It is particularly beneficial for couples with children, as it provides a clear plan for asset distribution and guardianship for minor children if both parents pass away.

Key Elements of the Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

Several key elements define this type of living trust:

- Grantors: The husband and wife who establish the trust and retain control over the assets.

- Trustee: The individual or entity responsible for managing the trust assets, which can be the couple themselves or a third party.

- Beneficiaries: The individuals who will receive the trust assets, typically including the couple's children.

- Asset Management: The trust outlines how assets are to be managed and distributed, including provisions for minor children.

- Revocability: Most living trusts are revocable, allowing the couple to amend or dissolve the trust as needed.

Steps to Complete the Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

Completing a living trust involves several important steps:

- Identify Assets: List all assets to be included in the trust, such as real estate, bank accounts, and investments.

- Choose a Trustee: Decide who will manage the trust, whether it's one of the spouses or a third party.

- Draft the Trust Document: Create a legal document outlining the terms of the trust, including distributions and management of assets.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary to ensure its validity.

- Fund the Trust: Transfer ownership of the identified assets into the trust, which may require additional paperwork.

Legal Use of the Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

This living trust is legally recognized in Pennsylvania, provided it meets state requirements. It serves to protect the couple's assets, streamline the transfer of property upon death, and provide for minor children. Establishing a living trust can also help minimize estate taxes and avoid probate, making it an effective estate planning tool.

State-Specific Rules for the Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

Pennsylvania has specific regulations governing living trusts. It's essential to ensure that the trust complies with state laws regarding:

- Trustee qualifications

- Asset transfer procedures

- Tax implications for the trust

- Requirements for revocation or amendment

Consulting with a legal professional can help ensure compliance with these regulations, providing peace of mind for the couple and their beneficiaries.

How to Obtain the Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

Obtaining a living trust typically involves working with an estate planning attorney or using a reputable online service that specializes in estate planning documents. The process includes:

- Consultation with an attorney to discuss specific needs and goals.

- Reviewing templates or software to draft the trust document.

- Customizing the document to reflect the couple's wishes regarding asset distribution and guardianship.

Once the document is prepared, it must be signed and notarized to ensure its legal standing.

Quick guide on how to complete living trust for husband and wife with minor and or adult children pennsylvania

Effortlessly Prepare Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly, without any holdups. Manage Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

How to Modify and Electronically Sign Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania with Ease

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania?

A Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania is a legal document that allows couples to manage their assets during their lifetime and determine how those assets will be distributed after their death. This trust provides flexibility and control, ensuring that both minor and adult children are provided for in accordance with the parents' wishes.

-

How does a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania work?

In Pennsylvania, a Living Trust for Husband and Wife with Minor and or Adult Children allows you to transfer ownership of your assets into the trust while you are still alive. This setup avoids probate, thus speeding up the distribution process to your beneficiaries and providing privacy regarding your estate.

-

What are the benefits of creating a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania?

The primary benefits include avoiding probate, maintaining privacy, and ensuring that your children are cared for as you intend. A Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania can also provide tax advantages and help manage your estate efficiently.

-

How much does it cost to set up a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania?

The cost to set up a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania can vary based on complexity and professional fees. On average, you might expect to pay between $1,500 to $3,000 if you hire an attorney, but using services like airSlate SignNow can provide a cost-effective solution.

-

Can I modify a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania?

Yes, one of the key advantages of a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania is that it can be modified or revoked at any time while both spouses are alive. This flexibility allows you to adjust the terms as circumstances change, such as the birth of additional children or changes in financial status.

-

What happens to a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania if one spouse passes away?

If one spouse passes away, the Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania typically remains intact. The surviving spouse can continue to manage the trust, and the assets will be distributed according to the terms set out in the trust agreement, ensuring the needs of both minor and adult children are met.

-

Are there any tax implications associated with a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania?

Creating a Living Trust for Husband and Wife with Minor and or Adult Children in Pennsylvania generally does not incur immediate tax implications. However, it's essential to consult with a tax advisor to understand the potential estate tax benefits and implications that could arise, especially if the estate exceeds certain thresholds.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Pennsylvania

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online