Financial Account Transfer to Living Trust Pennsylvania Form

What is the Financial Account Transfer To Living Trust Pennsylvania

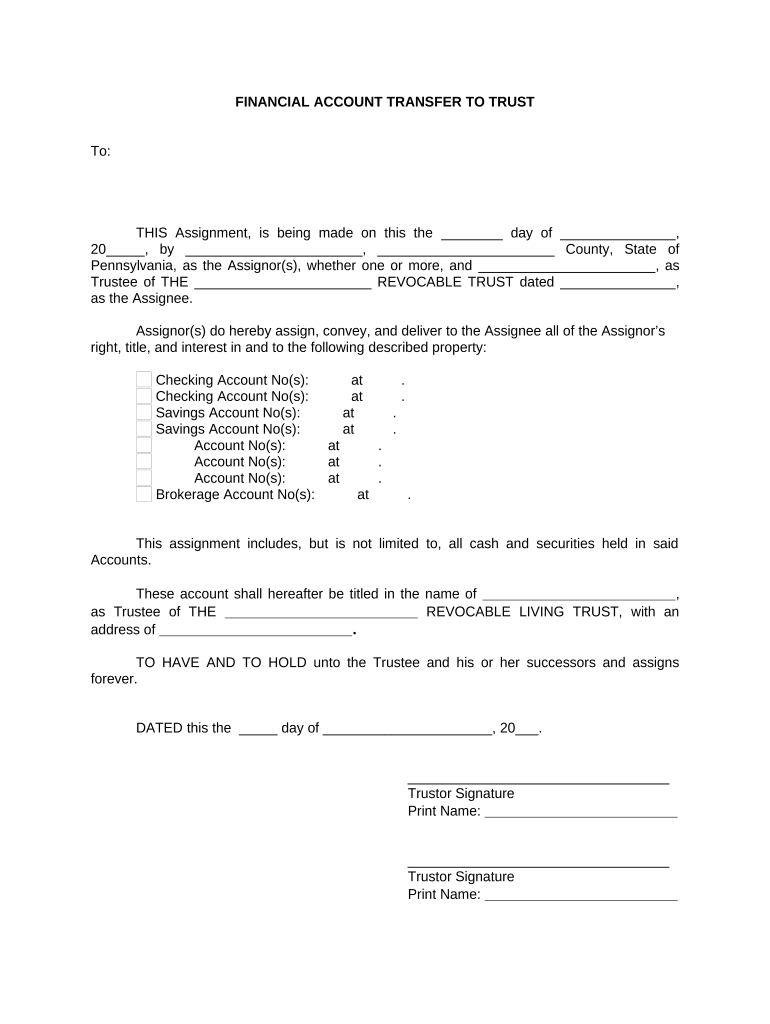

The Financial Account Transfer To Living Trust Pennsylvania form is a legal document used to transfer ownership of financial accounts into a living trust. This process is essential for individuals who want to manage their assets during their lifetime and ensure a smooth transition of those assets to beneficiaries after their passing. By transferring accounts such as bank accounts, investment accounts, and retirement accounts into a living trust, individuals can avoid probate and maintain greater control over their assets.

Steps to complete the Financial Account Transfer To Living Trust Pennsylvania

Completing the Financial Account Transfer To Living Trust Pennsylvania involves several key steps:

- Review the living trust document to ensure it is properly established and includes all necessary provisions.

- Gather all relevant financial account information, including account numbers, institution names, and current balances.

- Contact each financial institution to inquire about their specific requirements for transferring accounts into a living trust.

- Complete any required forms provided by the financial institutions, which may include a change of ownership form or a trust certification.

- Submit the completed forms along with a copy of the living trust document to the financial institutions.

- Confirm that the transfers have been completed by checking account statements or contacting the institutions directly.

Legal use of the Financial Account Transfer To Living Trust Pennsylvania

The legal use of the Financial Account Transfer To Living Trust Pennsylvania form is governed by state laws regarding trusts and estate planning. In Pennsylvania, a living trust must be properly executed to be valid. This includes having the trust document signed by the grantor and, in some cases, notarized. Additionally, the transfer of financial accounts into the trust must comply with the institution's policies and state regulations to ensure that the assets are legally owned by the trust.

State-specific rules for the Financial Account Transfer To Living Trust Pennsylvania

In Pennsylvania, specific rules govern the creation and management of living trusts. These include:

- The trust must be created during the grantor's lifetime and can be revoked or amended as needed.

- Assets transferred into the trust must be clearly identified and documented in the trust agreement.

- Beneficiaries of the trust must be named, and their rights to the trust assets must be clearly outlined.

It is advisable to consult with a legal professional familiar with Pennsylvania trust law to ensure compliance with all applicable regulations.

Required Documents

To complete the Financial Account Transfer To Living Trust Pennsylvania, several documents may be required:

- A copy of the living trust document, which outlines the terms and conditions of the trust.

- Identification documents, such as a driver’s license or passport, to verify the identity of the grantor.

- Account statements or documentation from the financial institutions showing current ownership of the accounts being transferred.

Having these documents ready can streamline the transfer process and ensure that all necessary information is provided to the financial institutions.

How to use the Financial Account Transfer To Living Trust Pennsylvania

Using the Financial Account Transfer To Living Trust Pennsylvania form involves understanding the process and ensuring that all steps are followed correctly. Begin by reviewing your living trust to confirm it is up to date. Next, gather information about the financial accounts you wish to transfer. Contact each financial institution to obtain their specific requirements for the transfer. Complete any necessary forms, ensuring that you provide accurate information. Finally, submit the forms along with the required documentation and follow up with the institutions to confirm that the transfer has been processed.

Quick guide on how to complete financial account transfer to living trust pennsylvania

Complete Financial Account Transfer To Living Trust Pennsylvania effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly option to conventional printed and signed documents, allowing you to find the suitable form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly, without delays. Manage Financial Account Transfer To Living Trust Pennsylvania on any device using the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The easiest way to alter and eSign Financial Account Transfer To Living Trust Pennsylvania without any hassle

- Obtain Financial Account Transfer To Living Trust Pennsylvania and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Financial Account Transfer To Living Trust Pennsylvania and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust Pennsylvania?

The process for Financial Account Transfer To Living Trust Pennsylvania typically involves drafting a trust document, identifying the financial accounts to be transferred, and formally changing the account ownership to the trust. This often requires completing specific forms from your financial institution and may require notarization. It's important to ensure all documents comply with Pennsylvania law to avoid potential legal issues.

-

How can airSlate SignNow assist with Financial Account Transfer To Living Trust Pennsylvania?

airSlate SignNow streamlines the Financial Account Transfer To Living Trust Pennsylvania by allowing you to easily collect signatures on necessary documents digitally. With our user-friendly platform, you can send, sign, and store your documents securely and efficiently. This reduces paperwork, speeds up the transfer process, and ensures your documents are legally binding.

-

Are there any fees associated with Financial Account Transfer To Living Trust Pennsylvania?

Yes, there may be various fees involved in the Financial Account Transfer To Living Trust Pennsylvania, including legal fees for drafting the trust and potential fees charged by financial institutions for processing the transfer. Using airSlate SignNow can help reduce costs related to document preparation and signature collection, providing an affordable solution for managing your financial accounts within a trust.

-

How long does the Financial Account Transfer To Living Trust Pennsylvania take?

The duration for the Financial Account Transfer To Living Trust Pennsylvania can vary. Once you have all required documentation prepared and signed, the actual transfer can typically be completed within a few days to a few weeks, depending on the financial institution’s processing times. Utilizing airSlate SignNow can expedite the signing process, making it quicker to finalize your trust.

-

What are the benefits of Financial Account Transfer To Living Trust Pennsylvania?

The primary benefits of Financial Account Transfer To Living Trust Pennsylvania include avoiding probate, maintaining privacy regarding your financial affairs, and ensuring a smoother transition of asset management upon your passing. Additionally, it can provide better control over your financial accounts and protect your assets from creditors. airSlate SignNow enhances these benefits by facilitating easy document management.

-

Can I integrate airSlate SignNow with other tools for my Financial Account Transfer To Living Trust Pennsylvania?

Yes, airSlate SignNow offers integrations with various platforms such as Google Drive, Dropbox, and CRM systems, allowing for a seamless experience in managing your Financial Account Transfer To Living Trust Pennsylvania documents. This integration capability ensures that you can easily import documents and store your signed files securely in the cloud. This enhances collaboration and accessibility.

-

What documents are needed for Financial Account Transfer To Living Trust Pennsylvania?

To initiate a Financial Account Transfer To Living Trust Pennsylvania, you'll typically need a copy of the trust agreement, forms from your financial institution requesting the transfer, and identification documents such as your driver's license or Social Security number. Being prepared with all necessary documents can simplify the transfer process. airSlate SignNow can help you compile and manage these documents efficiently.

Get more for Financial Account Transfer To Living Trust Pennsylvania

Find out other Financial Account Transfer To Living Trust Pennsylvania

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now