Monthly Bookkeeping Agreement DOC Instructions for Form 940

Understanding the Monthly Bookkeeping Agreement

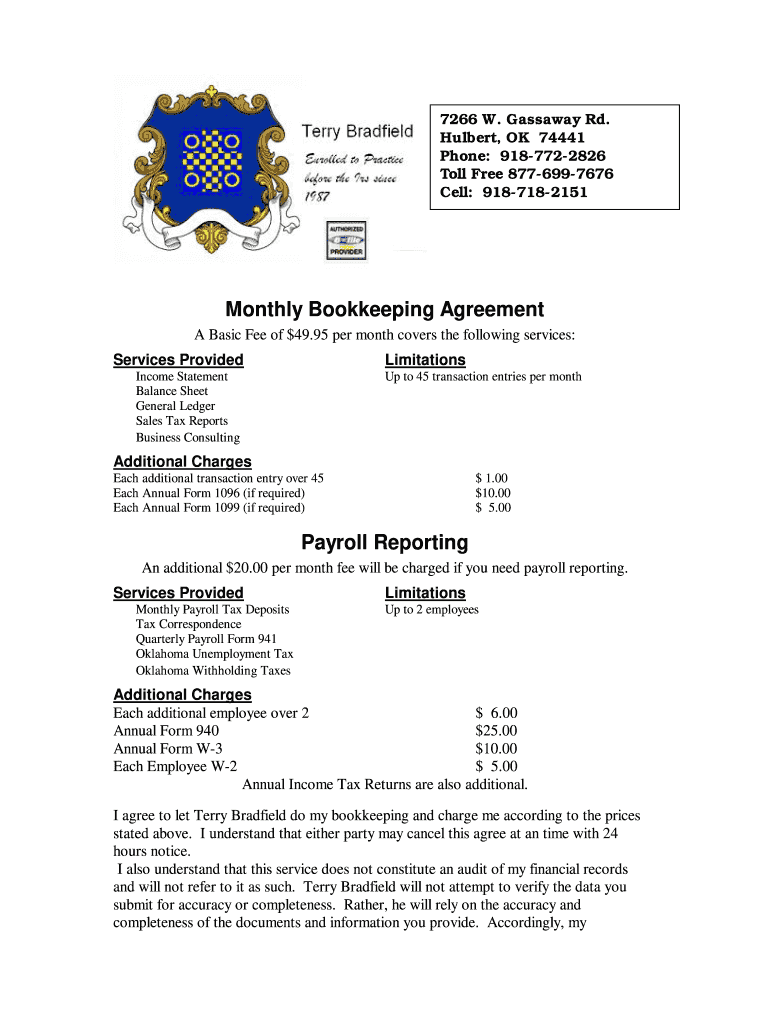

The Monthly Bookkeeping Agreement is a crucial document that outlines the terms and responsibilities between a client and a bookkeeper. This agreement ensures clarity in the services provided, payment terms, and confidentiality. It typically includes details such as the scope of work, deadlines, and any specific requirements unique to the client's business. Understanding this agreement is essential for both parties to maintain a professional relationship and ensure compliance with applicable regulations.

Steps to Complete the Monthly Bookkeeping Agreement

Completing the Monthly Bookkeeping Agreement involves several key steps to ensure that all necessary information is accurately captured. Start by gathering all relevant details, including the names and contact information of both parties. Clearly define the scope of services to be provided, such as monthly financial reporting, tax preparation, or payroll services. Next, outline the payment structure, including rates and payment schedules. After drafting the agreement, both parties should review it to ensure mutual understanding before signing. Digital signatures can be utilized to streamline this process.

Key Elements of the Monthly Bookkeeping Agreement

Several key elements should be included in the Monthly Bookkeeping Agreement to ensure its effectiveness. These elements include:

- Parties Involved: Clearly identify the client and the bookkeeper.

- Scope of Services: Detail the specific bookkeeping tasks to be performed.

- Payment Terms: Specify the fee structure and payment schedule.

- Confidentiality Clause: Include provisions to protect sensitive financial information.

- Termination Conditions: Outline how either party can terminate the agreement.

Legal Use of the Monthly Bookkeeping Agreement

The Monthly Bookkeeping Agreement is legally binding once signed by both parties. To ensure its legality, it must comply with relevant state and federal laws regarding contracts. This includes adhering to eSignature laws, which allow for electronic signatures to be considered valid and enforceable. It is important to keep a copy of the signed agreement for record-keeping purposes, as it can serve as evidence in case of disputes or misunderstandings.

Obtaining the Monthly Bookkeeping Agreement

Obtaining a Monthly Bookkeeping Agreement can be done through various means. Many templates are available online, which can be customized to fit specific needs. Alternatively, consulting with a legal professional can ensure that the agreement meets all legal requirements and is tailored to the unique circumstances of the business. Once the agreement is drafted, it can be printed, filled out, and signed by both parties.

IRS Guidelines Related to Bookkeeping Agreements

The IRS provides guidelines that may impact the terms of a Monthly Bookkeeping Agreement, especially concerning tax reporting and compliance. Bookkeepers must ensure that all financial records are maintained accurately to comply with IRS regulations. This includes understanding the requirements for reporting income, expenses, and deductions. Familiarity with IRS guidelines can help avoid penalties and ensure that both the bookkeeper and client fulfill their tax obligations.

Quick guide on how to complete monthly bookkeeping agreementdoc instructions for form 940

Learn how to effortlessly navigate the Monthly Bookkeeping Agreement document Instructions For Form 940 completion with this simple guide

Electronic filing and completing forms online is becoming increasingly common and the preferred choice for numerous users. It offers various advantages over outdated printed materials, such as ease of use, time savings, enhanced accuracy, and security.

With tools like airSlate SignNow, you can find, modify, sign, enhance, and send your Monthly Bookkeeping Agreement doc Instructions For Form 940 without being hindered by tedious printing and scanning. Follow this concise guide to initiate and complete your form.

Follow these steps to obtain and complete Monthly Bookkeeping Agreement doc Instructions For Form 940

- Begin by clicking on the Get Form button to access your document in our editor.

- Pay attention to the green label on the left that highlights required fields to ensure you don’t miss them.

- Utilize our advanced features to annotate, modify, sign, secure, and enhance your document.

- Secure your file or convert it into a fillable form using the options in the right panel.

- Review the document and verify it for mistakes or inconsistencies.

- Select DONE to complete the editing process.

- Rename your form or keep it as is.

- Choose the storage service you wish to save your document, send it via USPS, or click the Download Now button to save your document.

If Monthly Bookkeeping Agreement doc Instructions For Form 940 isn’t what you needed, you can explore our vast library of pre-imported templates that can be completed with minimal effort. Visit our platform today!

Create this form in 5 minutes or less

FAQs

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do very mixed race people fill out official documents and forms that ask for race if one is only allowed to choose one race?

None of the above?

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the monthly bookkeeping agreementdoc instructions for form 940

How to create an eSignature for the Monthly Bookkeeping Agreementdoc Instructions For Form 940 in the online mode

How to generate an eSignature for the Monthly Bookkeeping Agreementdoc Instructions For Form 940 in Google Chrome

How to create an electronic signature for signing the Monthly Bookkeeping Agreementdoc Instructions For Form 940 in Gmail

How to create an electronic signature for the Monthly Bookkeeping Agreementdoc Instructions For Form 940 right from your smartphone

How to generate an electronic signature for the Monthly Bookkeeping Agreementdoc Instructions For Form 940 on iOS devices

How to generate an eSignature for the Monthly Bookkeeping Agreementdoc Instructions For Form 940 on Android devices

People also ask

-

What is a bookkeeping agreement in Bradfield?

A bookkeeping agreement in Bradfield is a formal document that outlines the terms and conditions under which bookkeeping services are provided. It typically includes details on pricing, responsibilities, and the scope of services. This agreement is essential for ensuring clarity and protecting both parties involved in bookkeeping transactions.

-

How can airSlate SignNow help with my bookkeeping agreement in Bradfield?

airSlate SignNow simplifies the process of creating and signing your bookkeeping agreement in Bradfield. With its user-friendly interface, you can easily upload, edit, and eSign your documents, streamlining the entire workflow. This ensures that your bookkeeping agreement is executed promptly and securely.

-

What features does airSlate SignNow offer for bookkeeping agreements in Bradfield?

AirSlate SignNow offers several features for managing bookkeeping agreements in Bradfield, including customizable templates, mobile access, and real-time notifications. Additionally, it supports multi-party signing and provides robust security measures to protect your sensitive information. These features enhance the efficiency of managing your bookkeeping agreements.

-

Is airSlate SignNow cost-effective for bookkeeping agreements in Bradfield?

Yes, airSlate SignNow is a cost-effective solution for handling bookkeeping agreements in Bradfield. The platform offers different pricing plans, ensuring that businesses of all sizes can access the tools they need. Investing in airSlate SignNow can save you time and resources, ultimately improving your financial operations.

-

Can I integrate airSlate SignNow with other software for my bookkeeping agreements in Bradfield?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and bookkeeping software, enhancing your ability to manage agreements in Bradfield. Whether you use QuickBooks, Xero, or other platforms, you can automate document workflows and streamline your bookkeeping processes.

-

What are the benefits of using airSlate SignNow for bookkeeping agreements in Bradfield?

Using airSlate SignNow for bookkeeping agreements in Bradfield provides numerous benefits, including increased efficiency, enhanced security, and improved tracking of document status. You can easily manage your agreements digitally, which not only saves time but also eliminates the risks associated with paper documents. This modern approach helps in maintaining a professional image for your business.

-

How secure is my bookkeeping agreement in Bradfield when using airSlate SignNow?

AirSlate SignNow prioritizes security for all documents, including bookkeeping agreements in Bradfield. The platform uses advanced encryption and secure storage to protect your sensitive information from unauthorized access. With these security features, you can confidently manage your bookkeeping agreements knowing that your data is safe.

Get more for Monthly Bookkeeping Agreement doc Instructions For Form 940

Find out other Monthly Bookkeeping Agreement doc Instructions For Form 940

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement