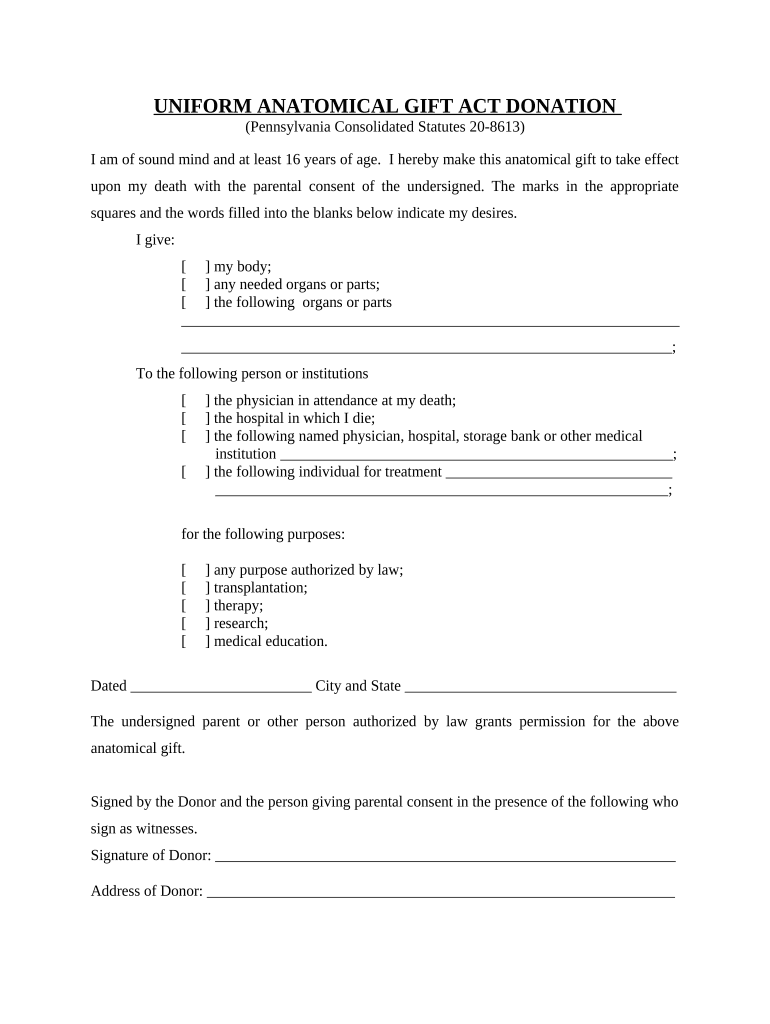

Pa Anatomical Form

Understanding the gift act

The gift act refers to legal provisions governing the transfer of property or assets without compensation. In the United States, this act is essential for ensuring that gifts are recognized as valid and enforceable under the law. It outlines the necessary criteria for a gift to be considered legally binding, including the intention of the giver, the acceptance by the recipient, and the delivery of the gift. Understanding these elements helps individuals navigate the complexities of gifting assets, whether they are tangible items or intangible assets.

Key elements of the gift act

Several key elements must be present for a gift to be legally recognized under the gift act. These include:

- Intention: The giver must have a clear intention to make a gift.

- Acceptance: The recipient must accept the gift, either explicitly or implicitly.

- Delivery: The gift must be delivered to the recipient, which can be physical or symbolic.

- Capacity: Both parties must have the legal capacity to engage in the transaction, meaning they are of legal age and sound mind.

These elements ensure that gifts are not only made in good faith but also comply with legal standards, protecting both the giver and the recipient.

Legal use of the gift act

The legal use of the gift act is crucial for individuals and organizations looking to transfer assets without monetary exchange. It can apply to various situations, such as family gifts, charitable donations, or business asset transfers. Understanding how the gift act operates can help individuals avoid potential disputes or misunderstandings regarding ownership and intent. Additionally, proper documentation and adherence to the act's requirements can safeguard against future legal challenges.

Steps to complete a gift act transaction

Completing a gift act transaction involves several important steps to ensure legality and clarity. These steps include:

- Determine the asset to be gifted and ensure it is free of liens or claims.

- Document the intent to gift, ideally in writing, to provide evidence of the transaction.

- Facilitate the delivery of the asset to the recipient, ensuring they accept it.

- Consider tax implications, such as gift tax limits, and consult a tax professional if necessary.

Following these steps can help ensure that the transaction is executed smoothly and legally.

State-specific rules for the gift act

Each state may have specific rules and regulations regarding the gift act. These can include variations in tax treatment, documentation requirements, and limitations on certain types of gifts. It is important for individuals to familiarize themselves with their state's laws to ensure compliance and avoid potential penalties. Consulting legal resources or professionals can provide clarity on any state-specific nuances related to the gift act.

Examples of using the gift act

Practical examples of the gift act can illustrate its application in everyday situations. Common scenarios include:

- A parent gifting a car to their child.

- A grandparent transferring ownership of a family heirloom.

- A business owner donating equipment to a local charity.

These examples demonstrate how the gift act facilitates various forms of asset transfer, reinforcing the importance of understanding its legal framework.

Quick guide on how to complete pa anatomical

Effortlessly prepare Pa Anatomical on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Pa Anatomical on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric workflows today.

How to modify and eSign Pa Anatomical with ease

- Locate Pa Anatomical and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choice. Modify and eSign Pa Anatomical and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the gift act and how does it relate to airSlate SignNow?

The gift act refers to the legal process through which gifts are formally documented and transferred. airSlate SignNow simplifies this process by providing an easy-to-use platform for creating, signing, and managing gift agreements digitally.

-

How much does airSlate SignNow cost for managing gift act documents?

airSlate SignNow offers flexible pricing plans tailored to meet various needs when handling gift act documents. You can choose from a free trial option or select a subscription plan that best fits your business requirements and budget.

-

What features does airSlate SignNow offer for the gift act process?

airSlate SignNow includes features such as customizable templates for gift act documents, electronic signatures, and secure cloud storage. These functionalities ensure a streamlined and efficient process for managing gift documentation.

-

Are there benefits to using airSlate SignNow for gift acts?

Using airSlate SignNow for gift acts leads to faster processing times and improved accuracy in document handling. The platform helps reduce paperwork and enhances the overall user experience for both givers and recipients.

-

Can I integrate airSlate SignNow with other apps for my gift act workflow?

Yes, airSlate SignNow offers integration capabilities with various applications, enabling a smooth workflow for gift act management. Popular integrations include CRM systems and productivity tools, which help streamline document handling.

-

Is airSlate SignNow secure for executing gift act documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and authentication protocols, to protect your gift act documents. This ensures that your sensitive information remains secure throughout the signing process.

-

How can I get started with airSlate SignNow for my gift act needs?

Getting started with airSlate SignNow for your gift act needs is simple. Sign up for a free trial on our website, explore the features available, and create your first gift act document within minutes!

Get more for Pa Anatomical

- Application notice of intent to obtain coverage under form

- Tarrant county protective order questionnaire form

- Form 55m60 worksafebc occupational first aid patient assessment

- Engleza juridica legal english universitatea quotmihail kogalniceanuquot umk form

- Virginia resale certificate form

- Purchase and sale agreement hudson and marshall form

- Sc isp 3004 e formpdffillercom

- Massachusetts road test application 2015 2019 form

Find out other Pa Anatomical

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF