Rhode Island Form

What is the Rhode Island Form

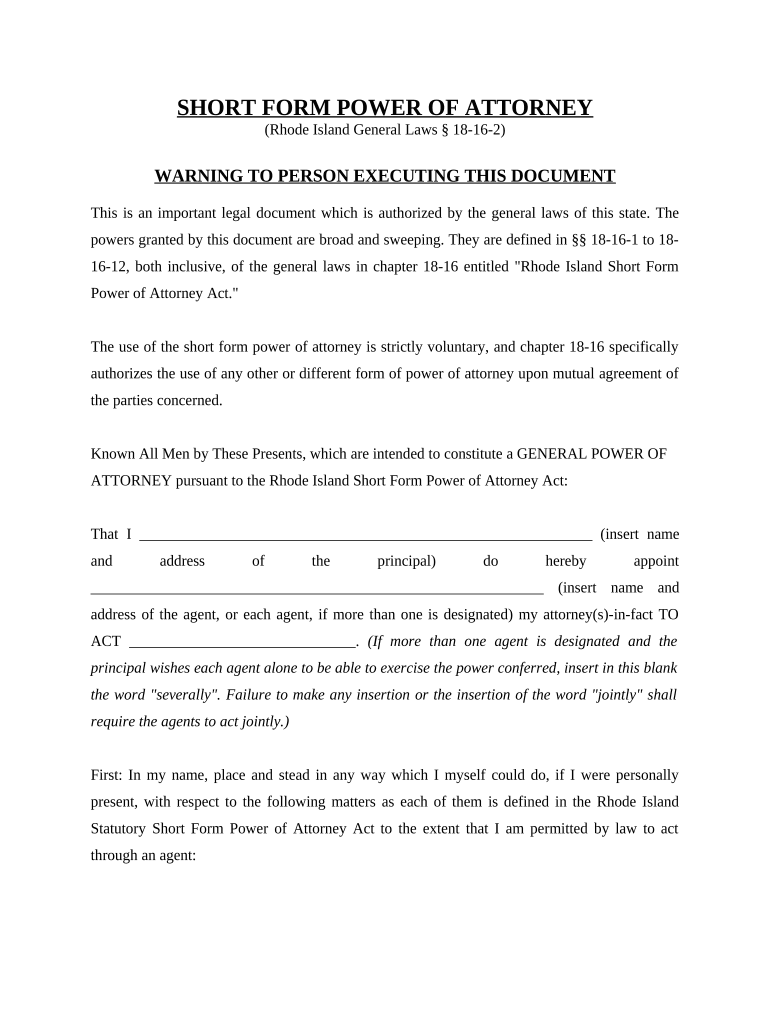

The Rhode Island form refers to various official documents used for different purposes within the state. These forms can include tax forms, legal documents, and applications that residents and businesses need to submit for compliance with state regulations. Each form serves a specific function, such as reporting income, applying for permits, or registering businesses. Understanding the purpose of the Rhode Island form you need is essential for ensuring proper completion and submission.

How to use the Rhode Island Form

Using the Rhode Island form involves several steps to ensure that it is completed accurately. First, identify the specific form required for your situation. Next, gather all necessary information and documents needed to fill out the form. Carefully read the instructions provided with the form to understand the requirements and any specific details that must be included. Once completed, review the form for accuracy before submission.

Steps to complete the Rhode Island Form

Completing the Rhode Island form can be straightforward if you follow these steps:

- Identify the correct form based on your needs.

- Gather all required information, such as personal identification, financial data, and relevant documentation.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Rhode Island Form

The legal use of the Rhode Island form is governed by state laws and regulations. To ensure that the form is legally binding, it must be completed according to the specific guidelines provided. This includes proper signatures, dates, and any required supporting documents. Failure to adhere to these legal standards can result in the form being deemed invalid.

Key elements of the Rhode Island Form

Key elements of the Rhode Island form typically include:

- Identification fields for the individual or entity submitting the form.

- Detailed sections for the information required, such as financial data or personal details.

- Signature lines and dates to validate the submission.

- Instructions for submission, including deadlines and acceptable methods.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Rhode Island form can be done through various methods, depending on the specific form and its requirements. Common submission methods include:

- Online: Many forms can be submitted electronically through state websites.

- Mail: Forms can often be printed and sent to the appropriate state department.

- In-Person: Some forms may require or allow for in-person submission at designated offices.

Quick guide on how to complete rhode island form 497325335

Effortlessly Prepare Rhode Island Form on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Rhode Island Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign Rhode Island Form with ease

- Find Rhode Island Form and select Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Rhode Island Form and ensure remarkable communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow, and how can it assist with Rhode Island forms?

airSlate SignNow is a user-friendly platform that enables businesses to send and eSign documents efficiently. It streamlines the process of handling various Rhode Island forms, making it easy to manage contracts, agreements, and other essential paperwork. With airSlate SignNow, you'll save time and reduce errors in document handling.

-

Are there any costs associated with using airSlate SignNow for Rhode Island forms?

Yes, airSlate SignNow offers a range of pricing plans tailored to different business needs. Whether you're a small startup or a large enterprise, you can find a suitable option that supports your use of Rhode Island forms at an affordable price. The platform also provides a free trial so you can explore its features before committing.

-

What features does airSlate SignNow offer for managing Rhode Island forms?

airSlate SignNow includes various features for managing Rhode Island forms, such as customizable templates, robust eSignature capabilities, and secure document storage. Additionally, the platform allows for real-time collaboration and tracking, ensuring you have full control over your important documents. These features contribute to an efficient workflow and enhanced productivity.

-

How does airSlate SignNow improve the eSigning process for Rhode Island forms?

airSlate SignNow simplifies the eSigning process for Rhode Island forms by providing an intuitive interface that guides users through signing. With mobile access and notifications, signers can complete documents on the go, ensuring faster turnaround times. This efficiency enhances the overall experience for both senders and recipients.

-

Can I integrate airSlate SignNow with other applications to manage Rhode Island forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow for Rhode Island forms. Whether you use CRM systems, cloud storage, or other business tools, these integrations help you automate processes and maintain a consistent flow of information.

-

What are the benefits of using airSlate SignNow for Rhode Island forms compared to traditional methods?

Using airSlate SignNow for Rhode Island forms offers numerous benefits over traditional methods, such as reduced paperwork, faster processing times, and enhanced security. By digitizing your document workflow, you minimize the risk of lost forms and paperwork errors. This leads to a more efficient operation and reinforces compliance with state regulations.

-

Is customer support available for users managing Rhode Island forms?

Yes, airSlate SignNow provides robust customer support for users dealing with Rhode Island forms. Their support team is available through various channels, including email, phone, and live chat, ensuring you get timely assistance when needed. This commitment to customer service helps you make the most out of your experience with the platform.

Get more for Rhode Island Form

- Pf all 12 amerigroup form

- How to apply online mku dde convecation certificate form

- Coventry prior authorization phone number form

- Resident health assessment form ahca 3110 1023

- Altius waiver of health insurance coverage form

- White mountain apache tribe scholarship application form

- Form 3613 2009 2019

- Nyc form htxhtxb cert of reg

Find out other Rhode Island Form

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document