Sc Llc Form

What is the SC LLC?

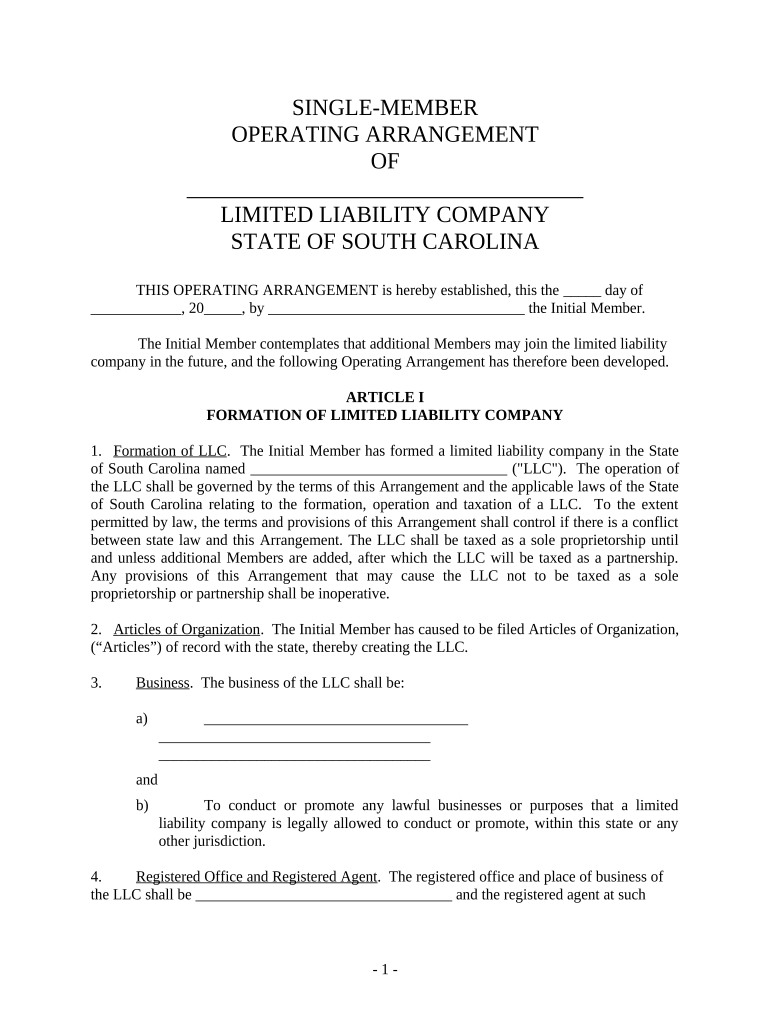

The SC LLC, or South Carolina Limited Liability Company, is a specific business structure recognized in the state of South Carolina. This type of company combines the flexibility of a partnership with the liability protection of a corporation. Owners, known as members, benefit from limited personal liability for the debts and obligations of the company. This means that personal assets are generally protected from business liabilities, making the SC LLC an attractive option for many entrepreneurs.

How to Use the SC LLC

Using an SC LLC involves several key steps. First, members must decide on a unique name for the company that complies with South Carolina naming regulations. Next, they should create an operating agreement, which outlines the management structure and operational procedures. After that, the SC LLC must be registered with the South Carolina Secretary of State by filing the Articles of Organization. Once established, the SC LLC can conduct business, enter contracts, and open bank accounts in its name.

Steps to Complete the SC LLC

Completing the SC LLC involves a series of structured steps:

- Choose a unique name for the LLC that includes "Limited Liability Company" or an abbreviation like "LLC."

- Draft an operating agreement that details the management and operational guidelines.

- File the Articles of Organization with the South Carolina Secretary of State, including necessary fees.

- Obtain any required business licenses or permits based on the nature of the business.

- Apply for an Employer Identification Number (EIN) from the IRS if the LLC will have employees or multiple members.

Legal Use of the SC LLC

The SC LLC is legally recognized as a separate entity, which provides certain legal protections. It can enter into contracts, sue or be sued, and hold property in its name. To maintain its legal status, the SC LLC must adhere to state regulations, including filing annual reports and paying any applicable taxes. Additionally, members should ensure compliance with federal and state laws relevant to their specific business activities.

Key Elements of the SC LLC

Several key elements define the SC LLC structure:

- Limited Liability: Members are not personally liable for the company's debts.

- Flexible Management: Members can choose to manage the LLC themselves or appoint managers.

- Pass-Through Taxation: Income is typically taxed at the member level, avoiding double taxation.

- Operating Agreement: While not mandatory, having an operating agreement helps clarify the management structure and member responsibilities.

Filing Deadlines / Important Dates

For an SC LLC, there are important deadlines to keep in mind:

- Annual Report: SC LLCs must file an annual report by the 15th day of the fourth month following the end of their fiscal year.

- Tax Filing: LLCs must adhere to federal and state tax filing deadlines, which typically align with personal tax deadlines for pass-through entities.

Eligibility Criteria

To form an SC LLC, certain eligibility criteria must be met:

- At least one member is required to establish the LLC.

- Members can be individuals or other business entities.

- The chosen name must comply with South Carolina naming requirements and be distinguishable from existing entities.

Quick guide on how to complete sc llc

Prepare Sc Llc effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Sc Llc on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Sc Llc with ease

- Find Sc Llc and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a standard wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Sc Llc and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an SC LLC and why should I consider it for my business?

An SC LLC, or South Carolina Limited Liability Company, combines the benefits of limited liability protection with the flexibility of a partnership. This structure protects your personal assets while allowing for pass-through taxation. By forming an SC LLC, business owners can enjoy a simplified management system and reduced paperwork.

-

How does airSlate SignNow help with SC LLC document management?

AirSlate SignNow offers a streamlined platform for managing your SC LLC documents, enabling easy uploads, eSignatures, and secure storage. With features like templates and real-time tracking, you can ensure compliance and keep your SC LLC paperwork organized. Our user-friendly interface simplifies the signing process for all members.

-

What are the costs associated with establishing an SC LLC?

The costs to establish an SC LLC generally include state filing fees and additional expenses such as registered agent services and publication fees. While the costs vary, using airSlate SignNow can save you money on document preparation and filing by simplifying the overall process. Our affordable eSignature solutions help keep your business expenses low.

-

Can I integrate airSlate SignNow with other software for my SC LLC?

Yes, airSlate SignNow supports various integrations with popular software like Google Drive, Salesforce, and Dropbox, making it easy to manage your SC LLC documents in one place. These integrations enhance collaboration and streamline your workflow, allowing for efficient document handling tailored to your SC LLC needs.

-

What features of airSlate SignNow are most beneficial for SC LLCs?

Key features of airSlate SignNow that benefit SC LLCs include eSigning, document collaboration, and workflow automation. Our platform allows you to collect signatures efficiently and ensures that all members can contribute to document creation and approval. This helps SC LLCs maintain order and compliance with legal requirements.

-

Is airSlate SignNow suitable for small businesses with SC LLCs?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small SC LLCs. Our cost-effective solutions provide essential tools for document management and eSigning without breaking your budget, making it ideal for small business owners looking to streamline operations.

-

How secure is airSlate SignNow for handling SC LLC documentation?

AirSlate SignNow employs top-notch security measures, such as bank-level encryption, to protect your SC LLC documents. Our platform ensures that all sensitive data remains confidential and that eSignatures are legally binding. You can trust us to keep your SC LLC information secure and compliant.

Get more for Sc Llc

Find out other Sc Llc

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast