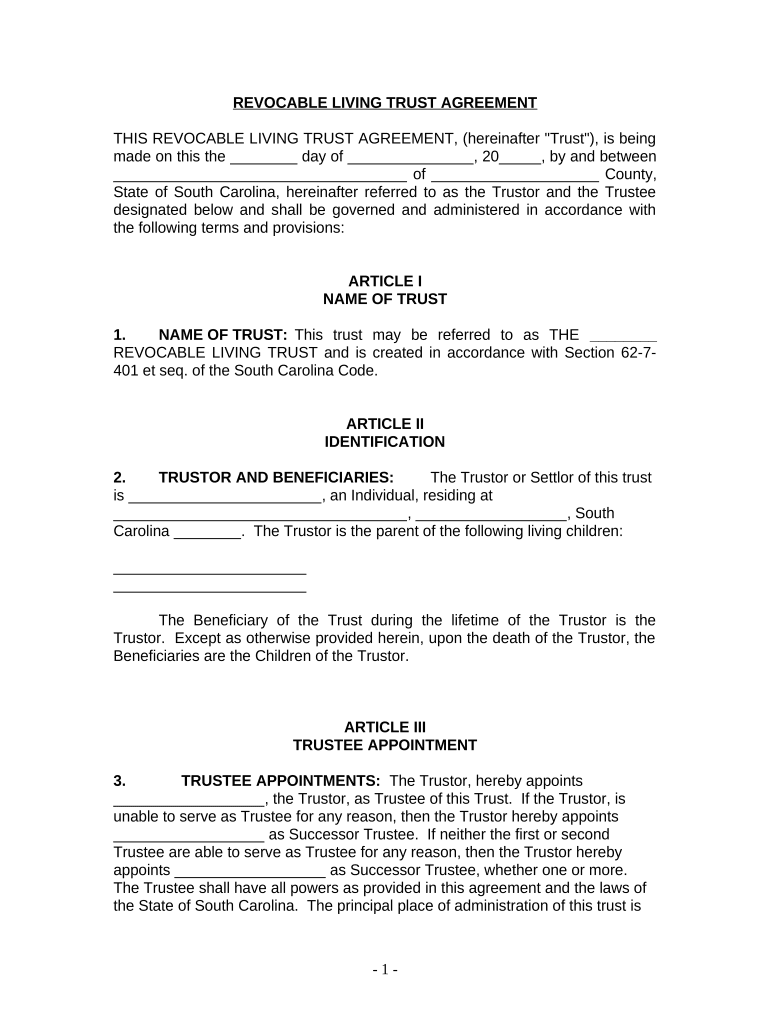

Living Trust Individual Form

What is the Living Trust Individual

A living trust individual is a legal document that allows a person to manage their assets during their lifetime and dictate how those assets will be distributed after their death. This type of trust is often used to avoid probate, which can be a lengthy and costly process. By placing assets in a living trust, the individual retains control over their property while also providing for a smooth transition of assets to beneficiaries. Living trusts can include various types of assets, such as real estate, bank accounts, and investments.

How to use the Living Trust Individual

To effectively use a living trust individual, one must first create the trust document, which outlines the terms and conditions of the trust. This document typically includes the names of the trustee (the person managing the trust) and beneficiaries (those who will receive the assets). Once the trust is established, the individual should transfer ownership of their assets into the trust. This process is known as funding the trust and is essential for the trust to function as intended. Regular reviews and updates to the trust may be necessary to ensure it reflects any changes in personal circumstances or wishes.

Steps to complete the Living Trust Individual

Completing a living trust individual involves several key steps:

- Determine the assets to be included in the trust.

- Choose a trustee who will manage the trust.

- Draft the trust document, including specific terms and conditions.

- Sign the trust document in accordance with state laws.

- Transfer ownership of assets into the trust.

- Review and update the trust as necessary.

Legal use of the Living Trust Individual

The legal use of a living trust individual is governed by state laws, which can vary significantly. Generally, the trust must be created in writing and signed by the individual establishing the trust. It is important to ensure that the trust complies with the relevant state statutes to be considered valid. Additionally, the trust should clearly outline the powers of the trustee and the rights of the beneficiaries to avoid potential disputes in the future.

Key elements of the Living Trust Individual

Key elements of a living trust individual include:

- The name of the trust and the individual establishing it.

- The designation of a trustee responsible for managing the trust.

- A detailed list of assets included in the trust.

- Instructions for how the assets should be distributed upon the individual's death.

- Provisions for the management of the trust in case the individual becomes incapacitated.

State-specific rules for the Living Trust Individual

Each state has its own regulations regarding living trusts, which can affect how they are created and enforced. It is essential to consult state-specific laws to understand the requirements for establishing a living trust individual. Some states may require notarization or witnesses for the trust document, while others may have specific provisions regarding the management and distribution of trust assets. Understanding these rules ensures that the trust is legally valid and enforceable.

Quick guide on how to complete living trust individual 497325811

Effortlessly Manage Living Trust Individual on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an exemplary green alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Living Trust Individual on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to Edit and Electronically Sign Living Trust Individual with Ease

- Locate Living Trust Individual and click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all entries and then select the Done button to confirm your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you choose. Edit and electronically sign Living Trust Individual to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust individual?

A living trust individual is a legal document that allows an individual to manage their assets during their lifetime and dictate how those assets will be distributed after their death. It offers benefits such as avoiding probate, maintaining privacy, and providing more flexibility in asset management.

-

How does airSlate SignNow support living trust individual documentation?

airSlate SignNow provides a user-friendly platform to easily create and manage living trust individual documents. With seamless eSigning capabilities, users can efficiently secure signatures on essential legal documents, ensuring a smooth process for both trust creators and beneficiaries.

-

What are the costs associated with creating a living trust individual using airSlate SignNow?

The costs for using airSlate SignNow to create a living trust individual can vary depending on your needs and subscription plan. However, it is generally a cost-effective solution, designed to fit various budgets while providing the tools necessary for managing and signing important documents.

-

What features does airSlate SignNow offer for managing living trust individuals?

airSlate SignNow offers features such as customizable templates, document collaboration, and secure eSigning, all tailored for managing living trust individual documents. Additionally, users benefit from cloud storage for easy access and sharing, ensuring that all necessary parties can participate in the trust management process.

-

Can I integrate airSlate SignNow with other applications when managing living trust individual?

Yes, airSlate SignNow allows integration with various applications, providing a seamless workflow for managing living trust individual documents. This means you can connect it with popular productivity tools and document management systems to enhance efficiency and organization.

-

What are the benefits of using airSlate SignNow for living trust individual documents?

Using airSlate SignNow for living trust individual documentation offers numerous benefits including time-saving eSigning, enhanced security for sensitive information, and improved collaboration with all parties involved. This ensures that your living trust is efficiently handled and securely maintained.

-

Is airSlate SignNow compliant with legal standards for living trust individual documents?

Yes, airSlate SignNow follows industry standards and legal regulations to ensure that living trust individual documents are executed securely and validly. The platform employs advanced encryption and authentication methods to uphold the integrity of your sensitive information.

Get more for Living Trust Individual

Find out other Living Trust Individual

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online