South Carolina Trust Form

What is the South Carolina Trust

The South Carolina Trust is a legal arrangement that allows individuals to manage and protect their assets. This type of trust can be established for various purposes, including estate planning, asset protection, and tax benefits. By placing assets into a trust, the creator, known as the grantor, can specify how and when the assets will be distributed to beneficiaries. This can help avoid probate, ensuring a smoother transfer of wealth upon the grantor's passing.

How to use the South Carolina Trust

Using a South Carolina Trust involves several steps, beginning with the creation of the trust document. This document outlines the terms of the trust, including the assets involved and the responsibilities of the trustee. Once established, the grantor can transfer ownership of assets into the trust. It is essential to communicate with all parties involved, including beneficiaries and trustees, to ensure clarity about the trust's purpose and operations. Regular reviews of the trust may also be necessary to accommodate changes in the grantor's circumstances or in the law.

Steps to complete the South Carolina Trust

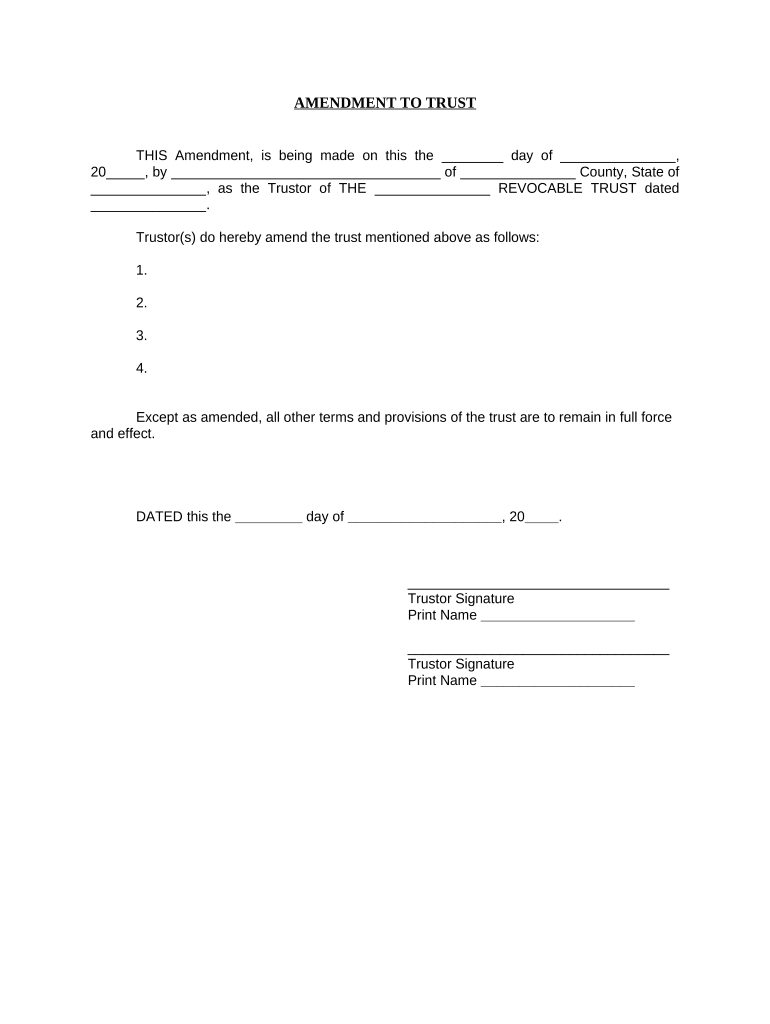

Completing a South Carolina Trust requires careful attention to detail. The following steps can guide you through the process:

- Determine the purpose of the trust and identify the assets to be included.

- Select a trustworthy individual or institution to act as the trustee.

- Draft the trust document, ensuring it complies with South Carolina laws.

- Sign the trust document in the presence of a notary public.

- Transfer the selected assets into the trust, updating titles and deeds as necessary.

- Communicate with beneficiaries about the trust's terms and their rights.

Legal use of the South Carolina Trust

The legal use of the South Carolina Trust is governed by state laws that outline the rights and responsibilities of the grantor, trustee, and beneficiaries. Trusts must be executed with proper legal formalities to be enforceable. This includes having the trust document properly signed and notarized. Additionally, the trustee must adhere to fiduciary duties, acting in the best interest of the beneficiaries and managing the trust assets prudently.

Key elements of the South Carolina Trust

Several key elements define the South Carolina Trust, including:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust according to its terms.

- Beneficiaries: Individuals or entities that will receive benefits from the trust.

- Trust Document: The legal document that outlines the terms and conditions of the trust.

State-specific rules for the South Carolina Trust

South Carolina has specific rules that govern the establishment and operation of trusts. These include regulations on the types of trusts that can be created, the requirements for trust documentation, and the duties of trustees. It is important for individuals to familiarize themselves with these rules to ensure compliance and to protect their interests. Consulting with a legal professional experienced in South Carolina trust law can provide valuable guidance.

Quick guide on how to complete south carolina trust

Effortlessly Manage South Carolina Trust on Any Device

Digital document management has gained increasing popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage South Carolina Trust on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Modify and Electronically Sign South Carolina Trust

- Find South Carolina Trust and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to finalize your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Edit and electronically sign South Carolina Trust and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is SC Trust and how does airSlate SignNow utilize it?

SC Trust is a security protocol that ensures the authenticity and integrity of electronic signatures. With airSlate SignNow, SC Trust is embedded in our platform to enhance document security, making eSigning safe and compliant with legal standards.

-

How much does airSlate SignNow cost for users seeking SC Trust features?

The pricing for airSlate SignNow varies depending on the plan you choose, but we offer a cost-effective solution for users needing SC Trust functionalities. Our plans start with basic features and scale up to comprehensive packages that fully utilize SC Trust protocols for enhanced security.

-

What features does airSlate SignNow provide under SC Trust?

Under the SC Trust framework, airSlate SignNow offers features like multi-factor authentication, secure cloud storage, and encrypted signatures. These features not only streamline the signing process but also ensure that your documents are protected against unauthorized access.

-

What are the benefits of using SC Trust with airSlate SignNow?

Using SC Trust with airSlate SignNow provides peace of mind that your documents are legally compliant and secure. This trust increases user confidence, speeds up the signing process, and reduces the risks associated with document fraud.

-

Can I integrate airSlate SignNow with other applications while using SC Trust?

Yes, airSlate SignNow can seamlessly integrate with numerous applications while maintaining SC Trust standards. This integration enhances your workflow, allowing you to automate processes without compromising security.

-

How does SC Trust affect the signing experience for the user?

SC Trust signNowly enhances the signing experience by ensuring that each document is signed securely and verified through our platform. This builds confidence for users and clients alike, knowing that their documents are protected throughout the signing process.

-

Are there any specific compliance standards that airSlate SignNow meets with SC Trust?

Yes, airSlate SignNow complies with several legal standards regarding electronic signatures, including ESIGN and UETA, under the SC Trust framework. This compliance assures users that their electronic signatures are legally binding and recognized.

Get more for South Carolina Trust

- 60 spoa form

- 60 spoa 2602b form

- Sag station 12 form

- Sag aftra taft hartley report extreme reach form

- Cobb county liquor by the drink excise tax reporting bb form

- Delray beach building permit application form

- Psa pass 2014 form

- Certificate of liability insurance east bay municipal utility district form

Find out other South Carolina Trust

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself