South Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate South Carolina Form

What is the South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

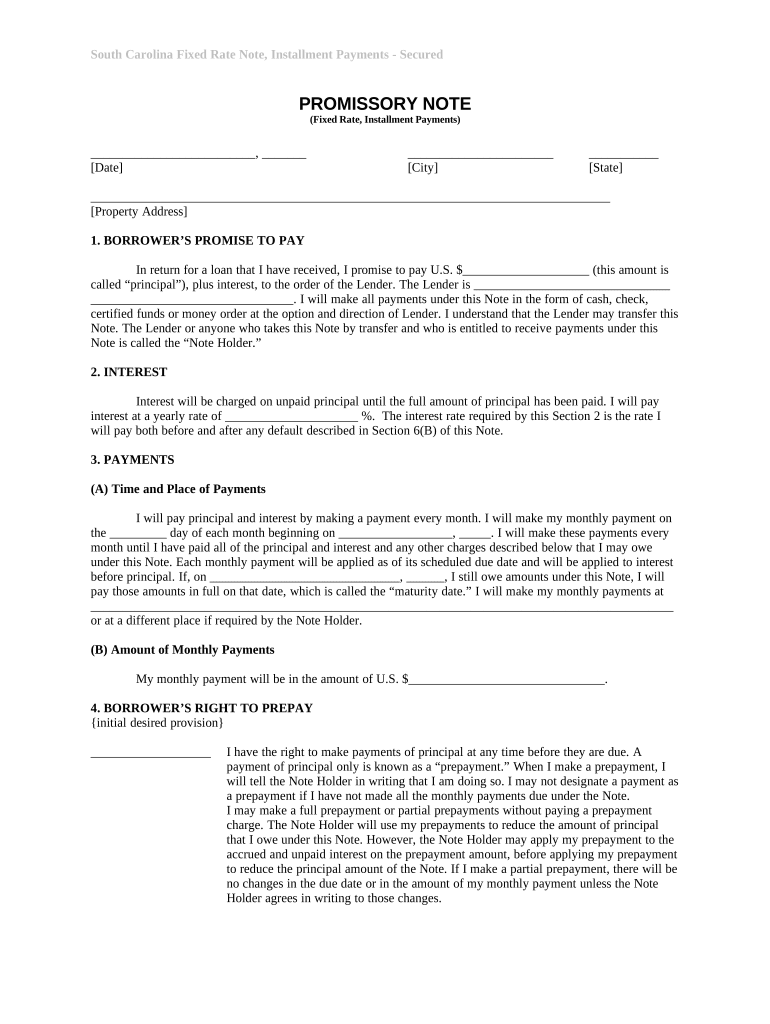

The South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan over a specified period, with a fixed interest rate. This type of promissory note is secured by residential real estate, meaning that the property serves as collateral. If the borrower defaults on the loan, the lender has the right to take possession of the property through foreclosure. This document is essential for both lenders and borrowers as it clearly defines the terms of the loan, including payment schedules, interest rates, and consequences of non-payment.

How to Use the South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate

To effectively use the South Carolina Installments Fixed Rate Promissory Note, both parties should first agree on the loan terms, including the amount borrowed, interest rate, and repayment schedule. Once these terms are established, the borrower and lender should complete the form accurately. It is crucial to include all necessary details, such as property descriptions and signatures, to ensure the document is legally binding. After completing the form, both parties should retain copies for their records, and the lender should securely store the original document.

Steps to Complete the South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the South Carolina Installments Fixed Rate Promissory Note involves several steps:

- Gather Information: Collect all necessary details, including borrower and lender information, loan amount, interest rate, and property details.

- Fill Out the Form: Accurately enter all required information into the promissory note form.

- Review Terms: Ensure that both parties understand and agree to the terms outlined in the document.

- Sign the Document: Both the borrower and lender must sign the document to make it legally binding.

- Store the Document: Keep a copy of the signed promissory note for future reference and secure the original with the lender.

Key Elements of the South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements must be included in the South Carolina Installments Fixed Rate Promissory Note to ensure its validity:

- Borrower and Lender Information: Full names and addresses of both parties involved.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed interest rate applicable to the loan.

- Payment Schedule: Detailed repayment terms, including the frequency and amount of payments.

- Collateral Description: Clear identification of the residential real estate securing the loan.

- Default Terms: Conditions under which the lender can take action if the borrower fails to meet payment obligations.

Legal Use of the South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate

The legal use of the South Carolina Installments Fixed Rate Promissory Note is governed by state laws. It is essential that the document complies with the South Carolina Uniform Commercial Code and any other applicable regulations. Both parties should ensure that the note is executed properly, with all required signatures and notarization if necessary. This compliance helps protect the rights of both the borrower and lender and ensures that the note is enforceable in a court of law.

State-Specific Rules for the South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate

In South Carolina, specific rules apply to the execution and enforcement of promissory notes secured by real estate. These include requirements for notarization, witness signatures, and recording the note with the county clerk if it is secured by real property. Understanding these state-specific rules is crucial for both parties to ensure that the document is valid and enforceable. Additionally, it is advisable to consult with a legal professional to navigate any complexities related to state laws and regulations.

Quick guide on how to complete south carolina installments fixed rate promissory note secured by residential real estate south carolina

Effortlessly prepare South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate South Carolina on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary forms and securely preserve them online. airSlate SignNow equips you with all the tools essential for quickly creating, modifying, and eSigning your documents without delays. Handle South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate South Carolina on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The simplest method to edit and eSign South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate South Carolina with ease

- Find South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate South Carolina and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate South Carolina to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

A South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to pay back a loan with fixed monthly payments. This type of note is secured by an interest in a residential property, ensuring that the lender can claim the property if the borrower defaults. This document is crucial for both parties in understanding their financial obligations.

-

How do South Carolina Installments Fixed Rate Promissory Notes work?

South Carolina Installments Fixed Rate Promissory Notes operate by having borrowers pay a fixed interest rate over a set period. These notes typically require the borrower to make consistent monthly payments until the total loan amount, plus interest, is repaid. This structured payment plan allows borrowers to manage their finances more effectively while providing lenders a reliable repayment schedule.

-

What are the benefits of using a South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

The benefits of a South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate include fixed monthly payments that simplify budgeting and reduced risk for lenders due to property security. This arrangement can also lead to easier approval rates for borrowers as lenders may feel more confident with collateral. Such notes provide clarity in repayment terms, fostering better relationships between borrowers and lenders.

-

What features can I find in airSlate SignNow that support this type of promissory note?

airSlate SignNow offers features such as customizable templates, secure e-signatures, and document tracking to streamline the process of creating a South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate. These tools ensure that all parties can easily access and sign documents, reducing the time spent on paperwork. Additionally, users can integrate SignNow with various applications to enhance their document management workflows.

-

Is there a cost associated with creating a South Carolina Installments Fixed Rate Promissory Note using airSlate SignNow?

Yes, there are costs associated with using airSlate SignNow to create a South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate. However, the platform offers various pricing plans to fit different budgets, ensuring that users find a cost-effective solution for their document needs. The investment often pays off through time savings and improved efficiency in processing documents.

-

Can I integrate airSlate SignNow with other tools while working on my promissory note?

Absolutely! airSlate SignNow allows for smooth integrations with various popular applications, making it easier to manage your South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate within your existing workflow. Integrations enhance functionality and enable users to connect with CRM, project management, and financial platforms. This flexibility can signNowly improve overall productivity.

-

What types of users benefit from a South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Both borrowers and lenders benefit from using a South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate. Borrowers gain a clear understanding of their repayment obligations, while lenders receive added security for their investment through property collateral. This mutual benefit establishes a trustworthy framework for financial transactions in real estate.

Get more for South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate South Carolina

- Map 3044 facility submission of application on behalf of consumer form

- Meap application semco energy form

- Ipr2015 01076 no 20 motion patent owners motion for sanctions ptab jul 30 2015 form

- Novo nordisk patient assistance application form

- Functional behavior form

- Nys common core mathematics curriculum form

- Affidavit of parent agreeing to name changedoc piercecountywa form

- Wedding announcement box elder news journal form

Find out other South Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate South Carolina

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract