Renunciation and Disclaimer of Property Received by Intestate Succession South Dakota Form

What is the Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

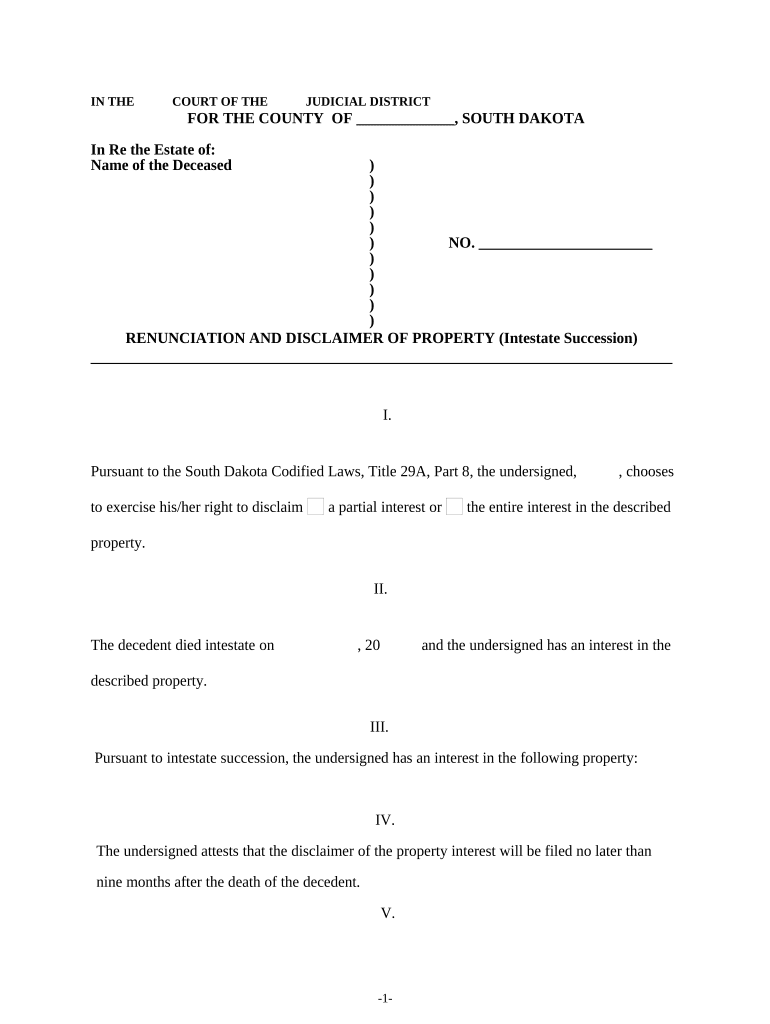

The Renunciation and Disclaimer of Property Received by Intestate Succession in South Dakota is a legal document that allows an individual to formally refuse property that they have inherited due to the intestate succession laws. Intestate succession occurs when a person passes away without a valid will, leading to the distribution of their estate according to state laws. By filing this document, an heir can relinquish their rights to the inherited property, which may be beneficial for various reasons, such as tax implications or personal circumstances.

Steps to Complete the Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

Completing the Renunciation and Disclaimer of Property Received by Intestate Succession in South Dakota involves several key steps:

- Identify the property you wish to disclaim.

- Ensure that the disclaimer is made within the legally required timeframe, typically nine months from the date of the decedent's death.

- Fill out the renunciation form accurately, providing all necessary information, including your name, the decedent's name, and details about the property.

- Sign the form in the presence of a notary public to validate the document.

- File the completed form with the appropriate court or authority overseeing the estate.

Legal Use of the Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

The legal use of the Renunciation and Disclaimer of Property Received by Intestate Succession in South Dakota is crucial for ensuring that the process of property transfer adheres to state laws. This document must be executed in accordance with South Dakota statutes to be legally binding. It serves to protect the rights of the disclaimant and ensures that the property can be passed on to the next eligible heir or according to the decedent's wishes, as determined by state law.

State-Specific Rules for the Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

In South Dakota, specific rules govern the renunciation and disclaimer process. These include:

- The disclaimer must be in writing and signed by the disclaimant.

- The disclaimer must be filed within nine months of the decedent's death.

- The disclaimant cannot accept any benefits from the property being disclaimed.

- The document must comply with the South Dakota Codified Laws to be considered valid.

How to Obtain the Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

To obtain the Renunciation and Disclaimer of Property Received by Intestate Succession in South Dakota, individuals can typically access the form through the South Dakota Unified Judicial System website or by visiting the local probate court. It is important to ensure that the correct version of the form is used, as variations may exist based on specific circumstances or updates to state law.

Examples of Using the Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

Examples of when to use the Renunciation and Disclaimer of Property Received by Intestate Succession include:

- An heir who is facing significant tax liabilities may choose to disclaim an inheritance to avoid additional financial burdens.

- Individuals who have personal reasons for not wanting to accept property, such as maintenance costs or emotional ties, may find this document useful.

- In cases where the property is not in line with the heir's financial goals or estate planning strategies, a disclaimer can be a prudent choice.

Quick guide on how to complete renunciation and disclaimer of property received by intestate succession south dakota

Prepare Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to amend and eSign Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota with ease

- Obtain Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota and click Get Form to begin.

- Utilize the available tools to submit your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota?

A Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota is a legal document that allows an heir to refuse their inheritance. By executing this document, an heir can formally decline any property or assets that may be passed down to them under intestate succession laws. This process is crucial for individuals who wish to avoid potential tax liabilities or other implications associated with inherited property.

-

How can airSlate SignNow assist with creating a Renunciation And Disclaimer Of Property in South Dakota?

airSlate SignNow offers a user-friendly platform to create, sign, and manage your Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota. With customizable templates and easy eSigning features, users can efficiently prepare their documents and ensure they are legally binding. This helps streamline the process for individuals who need to handle estate matters effectively.

-

Is airSlate SignNow cost-effective for managing legal documents like disclaimers?

Yes, airSlate SignNow provides a cost-effective solution for managing legal documents such as the Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota. With various pricing plans to cater to different needs, users can access essential features without breaking the bank. This affordability makes it an attractive option for individuals and businesses alike.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features designed to enhance document management, including customizable templates, eSignature capabilities, secure document storage, and real-time collaboration options. These features can signNowly simplify the process of handling documents like the Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota. Users can efficiently track and manage their documents from anywhere.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various applications and tools, allowing you to streamline workflows and enhance productivity. These integrations can enable seamless data transfer and collaboration, making it easier to manage your Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota alongside other important business processes.

-

What are the benefits of using airSlate SignNow for disclaimers?

Using airSlate SignNow for your Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's digital eSignature feature speeds up the signing process while ensuring that your documents are safe and compliant. Additionally, users benefit from the convenience of managing documents online, saving time and effort.

-

Is my information secure when using airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your information. The platform employs advanced encryption technologies and adheres to industry standards to protect your documents, including the Renunciation And Disclaimer Of Property Received By Intestate Succession in South Dakota. Users can confidently handle sensitive legal documents, knowing that their data is secure.

Get more for Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

- Severe financial hardship application form lesf super

- Contribution and loan repayment remittance bformb

- Backflow prevention assembly test city of kyle form

- Pony express district life to beagleb guide preparing for the bb gec bbsab gsm gec bsa form

- Colorado waste tire program colorado form

- Ui22 application illness benefits edomestic co form

- Key issue packet chapter 11 rubenstein 11th ed 1pdf form

- Event planning guide timeline checklist form for student activities tc3foundation

Find out other Renunciation And Disclaimer Of Property Received By Intestate Succession South Dakota

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy