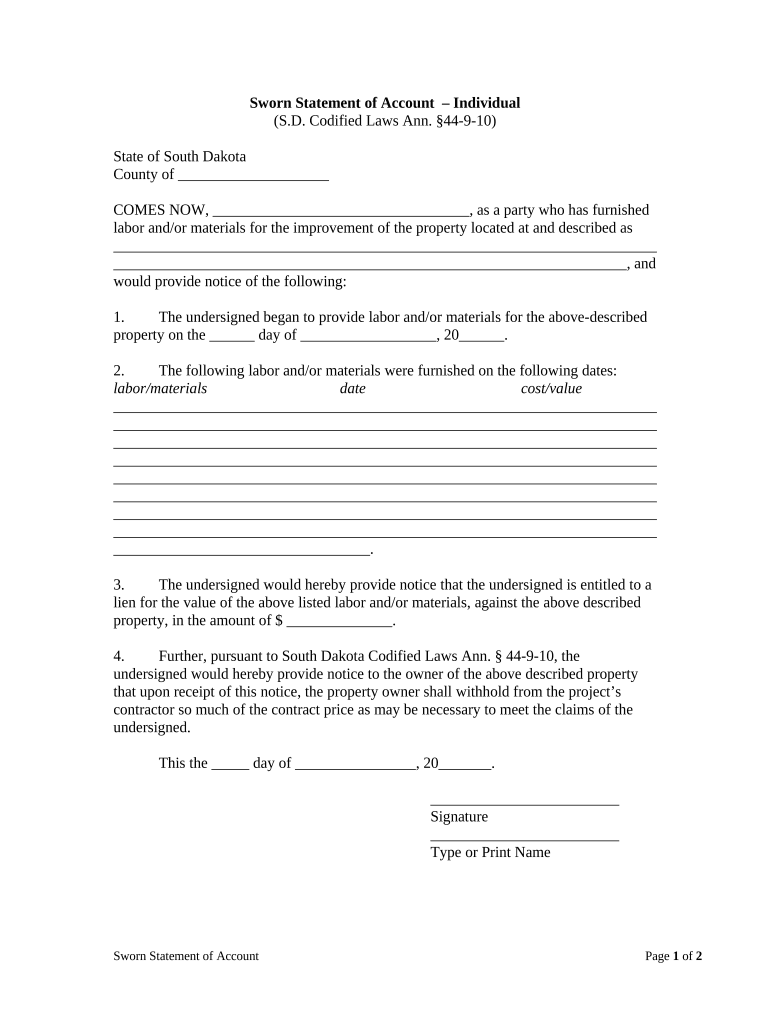

Statement of Account Individual South Dakota Form

What is the Statement Of Account Individual South Dakota

The Statement of Account Individual South Dakota is a financial document that provides a detailed summary of an individual's account activity within a specific period. This form is essential for tracking transactions, balances, and any outstanding amounts owed. It is commonly used by individuals to monitor their financial status, especially when dealing with financial institutions or government agencies. The statement includes various elements such as account number, transaction dates, descriptions, and amounts, making it a vital tool for personal financial management.

How to use the Statement Of Account Individual South Dakota

Using the Statement of Account Individual South Dakota involves several steps. First, individuals should gather all relevant transaction information that needs to be included in the statement. Next, they can input this data into the appropriate sections of the form, ensuring accuracy in amounts and descriptions. Once completed, the document can be printed or saved digitally for submission to the relevant authority or institution. This form can also be used to reconcile personal finances, making it easier to identify discrepancies or errors in account records.

Steps to complete the Statement Of Account Individual South Dakota

Completing the Statement of Account Individual South Dakota requires careful attention to detail. Follow these steps for successful completion:

- Gather all transaction records for the specified period.

- Fill in your personal information, including your name and account number.

- List each transaction, including the date, description, and amount.

- Review the information for accuracy to avoid errors.

- Sign and date the form, if required, to validate it.

Legal use of the Statement Of Account Individual South Dakota

The Statement of Account Individual South Dakota is legally recognized when completed accurately and submitted to the appropriate entities. It serves as a formal record of financial transactions and can be used in various legal contexts, such as disputes over account balances or verification of financial activity. To ensure its legal validity, it is important to comply with relevant regulations and include all necessary signatures or certifications as required by law.

Key elements of the Statement Of Account Individual South Dakota

Key elements of the Statement of Account Individual South Dakota include:

- Account Information: This includes the account holder's name, address, and account number.

- Transaction Details: Each transaction should be recorded with the date, description, and amount.

- Balance Summary: A summary of the account balance at the beginning and end of the reporting period.

- Signatures: Required signatures to validate the document, if applicable.

State-specific rules for the Statement Of Account Individual South Dakota

In South Dakota, specific rules govern the use and submission of the Statement of Account Individual. These may include requirements for how the form should be formatted, the time frame for submission, and any necessary accompanying documents. It is essential for individuals to familiarize themselves with these regulations to ensure compliance and avoid any potential penalties. Additionally, understanding state-specific guidelines can help streamline the process of obtaining and using this form effectively.

Quick guide on how to complete statement of account individual south dakota

Complete Statement Of Account Individual South Dakota effortlessly on any device

Web-based document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, enabling you to acquire the required form and securely retain it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Statement Of Account Individual South Dakota on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Statement Of Account Individual South Dakota with ease

- Obtain Statement Of Account Individual South Dakota and then select Get Form to begin.

- Employ the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you choose. Edit and eSign Statement Of Account Individual South Dakota and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Statement Of Account Individual South Dakota?

A Statement Of Account Individual South Dakota is a comprehensive document summarizing an individual's financial transactions within a specific period. It provides a detailed overview of credits, debits, and balances, helping individuals keep track of their financial activities. This document is crucial for personal finance management and can be easily generated through our platform.

-

How can I create a Statement Of Account Individual South Dakota using airSlate SignNow?

Creating a Statement Of Account Individual South Dakota with airSlate SignNow is simple and efficient. You can start by uploading the necessary documents, then use our e-signature tool to securely sign and manage your account statements electronically. Our user-friendly interface ensures you can generate documents quickly at your convenience.

-

Is there a cost associated with generating a Statement Of Account Individual South Dakota?

AirSlate SignNow offers flexible pricing plans designed to meet various user needs. For generating a Statement Of Account Individual South Dakota, you can take advantage of our free trial or choose a plan that best fits your business requirements. Our cost-effective solutions ensure you get value for your money.

-

What features does airSlate SignNow offer for managing Statement Of Account Individual South Dakota?

airSlate SignNow provides numerous features to enhance your experience, including e-signature capabilities, document templates, and online form creation. These tools will help streamline the process of generating a Statement Of Account Individual South Dakota, making it more efficient and less time-consuming.

-

How does airSlate SignNow ensure the security of my Statement Of Account Individual South Dakota?

We prioritize the security of your data at airSlate SignNow. All documents, including the Statement Of Account Individual South Dakota, are encrypted both in transit and at rest. Additionally, we comply with industry standards to safeguard your information, ensuring that your sensitive financial records remain confidential.

-

Can I integrate airSlate SignNow with other applications to manage my Statement Of Account Individual South Dakota?

Yes, airSlate SignNow offers a range of integrations with popular applications like Google Drive, Dropbox, and Salesforce. This means you can easily manage your Statement Of Account Individual South Dakota alongside other tools you use. Streamlining your workflow enhances efficiency and organization.

-

Are there any benefits to using airSlate SignNow for my Statement Of Account Individual South Dakota needs?

Using airSlate SignNow for your Statement Of Account Individual South Dakota offers several benefits, including reduced paper usage, faster processing times, and secure e-signatures. Our platform makes tracking and managing your financial documents straightforward, allowing you to focus on growing your business.

Get more for Statement Of Account Individual South Dakota

- Print form houston police department personal history statement this packet is essential to your application process

- Limited thirdparty trading authorization and indemnification form

- Form pt 3511 may 2005 fuel consumed in new york state by tax ny

- Chp 362 form

- Ibm iv18476 chfs command fails mistakenly reports chfs ky form

- Primerica life insurance company company legacybuilder form

- Tahun 3 bahasa melayu karangan form

- Anita m bock39s letterhead los angeles county file lacounty form

Find out other Statement Of Account Individual South Dakota

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document