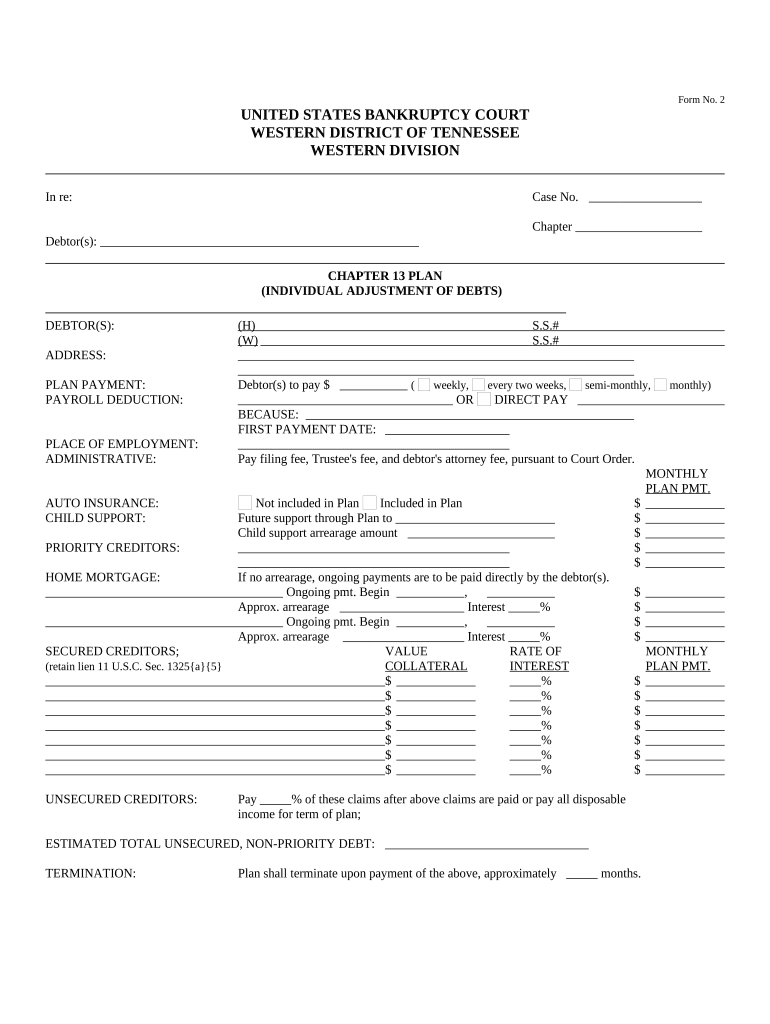

Chapter 13 Plan Tennessee Form

What is the Chapter 13 Plan Tennessee

The Chapter 13 Plan in Tennessee is a legal framework that allows individuals with a regular income to reorganize their debts and create a repayment plan. This plan is designed for those who are struggling to meet their financial obligations but want to avoid bankruptcy liquidation. Under this plan, debtors propose a repayment schedule to their creditors, typically spanning three to five years, during which they make regular payments to a trustee who distributes the funds to creditors. The goal is to provide a manageable way for individuals to pay off their debts while retaining their assets.

Steps to complete the Chapter 13 Plan Tennessee

Completing the Chapter 13 Plan involves several key steps:

- Gather financial information: Collect details about your income, expenses, debts, and assets.

- Consult with a bankruptcy attorney: Seek professional guidance to ensure compliance with legal requirements and to tailor the plan to your situation.

- Prepare the repayment plan: Outline how much you can afford to pay each month and how long the repayment period will last.

- File the plan with the court: Submit your Chapter 13 Plan along with the required documents to the appropriate bankruptcy court in Tennessee.

- Attend the confirmation hearing: Present your plan to the court and creditors, addressing any objections they may have.

- Make regular payments: Once approved, begin making payments to the trustee as outlined in your plan.

Key elements of the Chapter 13 Plan Tennessee

Several key elements define the structure and requirements of the Chapter 13 Plan in Tennessee:

- Payment Amount: The plan must specify the monthly payment amount that the debtor can afford.

- Duration: The repayment period typically lasts between three to five years, depending on the debtor's income.

- Debts Included: The plan must identify which debts will be repaid, including secured and unsecured debts.

- Trustee Role: A bankruptcy trustee is appointed to oversee the plan, collect payments, and distribute funds to creditors.

- Feasibility: The plan must be feasible, meaning the debtor must demonstrate the ability to make the proposed payments.

Legal use of the Chapter 13 Plan Tennessee

The legal use of the Chapter 13 Plan in Tennessee is governed by federal bankruptcy laws and local court rules. It is essential for debtors to adhere to these regulations to ensure the plan's approval and successful implementation. The plan must be filed in the appropriate bankruptcy court, and debtors are required to attend hearings and provide necessary documentation. Failure to comply with legal requirements can result in dismissal of the case or denial of the plan.

Required Documents for the Chapter 13 Plan Tennessee

When filing for a Chapter 13 Plan in Tennessee, several documents are required to support the application:

- Proof of income: Recent pay stubs or tax returns to verify income levels.

- List of debts: A comprehensive list of all creditors and the amounts owed.

- Asset documentation: Information regarding assets, including property and bank accounts.

- Monthly expenses: A detailed account of monthly living expenses to demonstrate financial need.

- Credit counseling certificate: Proof of completion of a credit counseling course, as required by law.

Eligibility Criteria for the Chapter 13 Plan Tennessee

To qualify for the Chapter 13 Plan in Tennessee, debtors must meet specific eligibility criteria:

- Regular income: Debtors must have a steady source of income, whether from employment or other means.

- Debt limits: Unsecured debts must be less than a specified amount, which is adjusted periodically.

- Credit counseling: Completion of a credit counseling course is mandatory before filing.

- Good faith: The debtor must demonstrate good faith in proposing a repayment plan that is feasible and fair to creditors.

Quick guide on how to complete chapter 13 plan tennessee 497326895

Prepare Chapter 13 Plan Tennessee effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Chapter 13 Plan Tennessee on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Chapter 13 Plan Tennessee with ease

- Locate Chapter 13 Plan Tennessee and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Chapter 13 Plan Tennessee while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chapter 13 Plan in Tennessee?

A Chapter 13 Plan in Tennessee is a legal framework that allows individuals to reorganize and repay their debts over a specified period, typically three to five years. This plan is designed to make debt repayment more manageable while allowing debtors to keep their property. It's a key part of the Chapter 13 bankruptcy process.

-

How does airSlate SignNow assist with the Chapter 13 Plan process in Tennessee?

airSlate SignNow simplifies the documentation process for your Chapter 13 Plan in Tennessee by enabling you to easily send, receive, and eSign important documents. This efficient workflow ensures that you meet all the required deadlines without the hassle of paper-based processes. Our platform is designed to keep your information secure and organized.

-

What features does airSlate SignNow offer for managing a Chapter 13 Plan in Tennessee?

With airSlate SignNow, you can access features like template creation, reminders, and the ability to track document statuses for your Chapter 13 Plan in Tennessee. These tools streamline communication with all parties involved, ensuring transparency and efficiency. You’ll also benefit from customizable workflows that fit your specific needs.

-

Is there a cost associated with using airSlate SignNow for my Chapter 13 Plan in Tennessee?

Yes, there are costs associated with using airSlate SignNow, but the pricing is designed to be cost-effective for individuals managing a Chapter 13 Plan in Tennessee. Depending on your needs, you can choose from several subscription models that best fit your budget. The investment often pays off by saving you time and reducing hassle.

-

Can airSlate SignNow integrate with other financial tools for my Chapter 13 Plan in Tennessee?

Absolutely! airSlate SignNow can seamlessly integrate with various financial tools and software you may be using to manage your Chapter 13 Plan in Tennessee. These integrations allow for a more coordinated approach to managing your debt, enabling you to keep all your financial information in one place.

-

What are the benefits of using airSlate SignNow for the Chapter 13 Plan in Tennessee?

Using airSlate SignNow for your Chapter 13 Plan in Tennessee provides you with a streamlined way to handle necessary documents while ensuring compliance with legal requirements. The platform enhances your efficiency, allowing you to focus on your financial recovery. Moreover, eSigning documents eliminates delays caused by postal services.

-

How secure is airSlate SignNow for handling my Chapter 13 Plan documents in Tennessee?

airSlate SignNow prioritizes security, implementing features like encryption and secure cloud storage for all your Chapter 13 Plan documents in Tennessee. We understand the sensitivity of your financial information and take measures to protect it from unauthorized access. You can trust that your documents remain confidential and secure.

Get more for Chapter 13 Plan Tennessee

Find out other Chapter 13 Plan Tennessee

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation