Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications 2015

What is the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123?

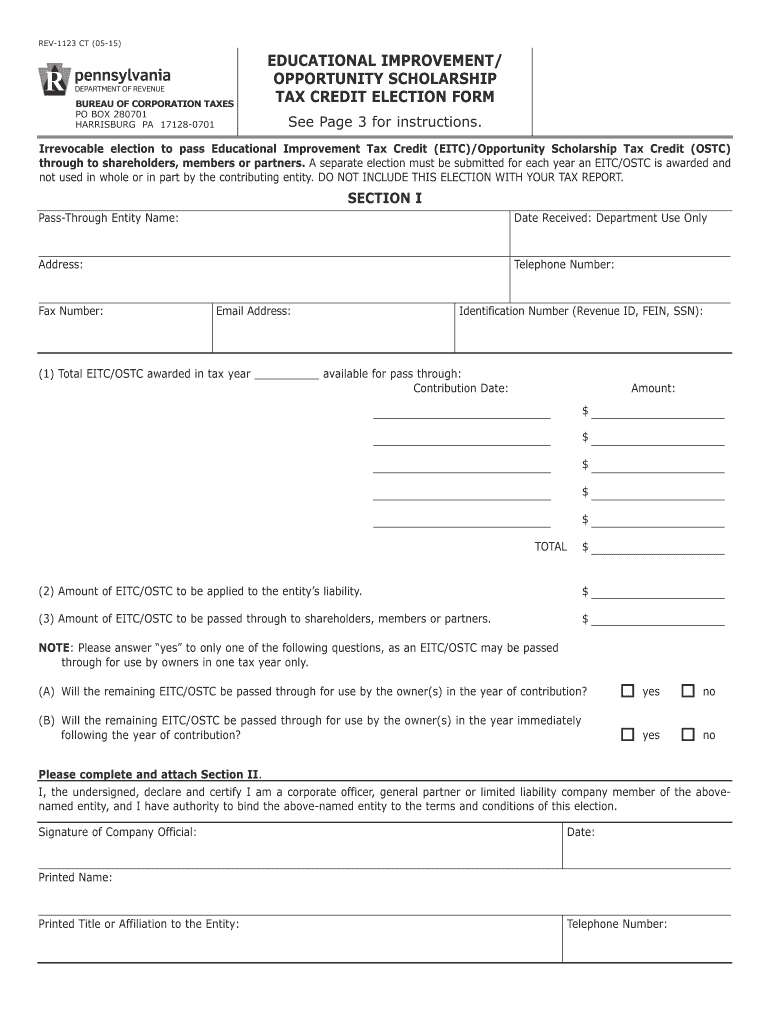

The Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123 is a specific document used in the United States to claim tax credits related to educational improvement initiatives. This form allows taxpayers to designate their contributions to scholarship organizations that provide educational opportunities for students. By completing this form, individuals can support educational programs while benefiting from potential tax reductions. It is essential for taxpayers to understand the purpose and implications of this form to ensure compliance with tax regulations.

How to Use the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123

Using the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123 involves several steps. First, taxpayers must gather necessary information, including their personal details and the amounts they wish to contribute to eligible scholarship organizations. Next, individuals should fill out the form accurately, ensuring all required fields are completed. After filling out the form, it is crucial to review it for any errors before submission. Once verified, the form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS.

Steps to Complete the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123

Completing the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation, including your tax identification number and details of the scholarship organization.

- Accurately fill in your personal information, ensuring that all data matches IRS records.

- Specify the amount you are contributing to the scholarship organization.

- Review the completed form for accuracy and completeness.

- Submit the form according to the guidelines provided by the IRS, either electronically or by mail.

Key Elements of the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123

Understanding the key elements of the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123 is vital for effective completion. Important components include:

- Taxpayer Information: This section requires personal details such as name, address, and tax identification number.

- Contribution Amount: Taxpayers must indicate the total amount they wish to contribute to the designated scholarship organization.

- Signature: A signature is required to validate the form and confirm the taxpayer's intent to claim the credit.

- Date: Including the date of submission is essential for record-keeping and compliance.

Eligibility Criteria for the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123

To qualify for the Educational Improvement Opportunity Scholarship Tax Credit, taxpayers must meet specific eligibility criteria. These criteria typically include:

- Being a resident of the state where the tax credit is applicable.

- Making a qualifying contribution to an approved scholarship organization.

- Filing a tax return in the relevant tax year.

It is important for taxpayers to verify their eligibility before submitting the form to ensure compliance with state and federal regulations.

Form Submission Methods for the Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123

The Educational Improvement Opportunity Scholarship Tax Credit Election Form REV 1123 can be submitted through various methods. Taxpayers may choose to:

- Submit Online: Many states offer electronic submission options for convenience and efficiency.

- Mail the Form: Taxpayers can print the completed form and send it via postal mail to the appropriate tax authority.

- In-Person Submission: Some individuals may prefer to deliver the form directly to their local tax office.

Choosing the right submission method can help ensure timely processing and compliance with submission deadlines.

Quick guide on how to complete educational improvementopportunity scholarship tax credit election form rev 1123 formspublications

Your assistance manual for preparing your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications

If you’re uncertain about how to create and submit your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications, here are some straightforward guidelines to simplify the tax declaration process.

To begin, all you need is to set up your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an intuitive and robust document solution that allows you to modify, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to update details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications in just a few minutes:

- Establish your account and start editing PDFs quickly.

- Utilize our library to locate any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications in our editor.

- Fill in the necessary fields with your information (text, numbers, check marks).

- Employ the Signature Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase return errors and delay refunds. It’s advisable to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct educational improvementopportunity scholarship tax credit election form rev 1123 formspublications

Create this form in 5 minutes!

How to create an eSignature for the educational improvementopportunity scholarship tax credit election form rev 1123 formspublications

How to make an eSignature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Formspublications online

How to make an electronic signature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Formspublications in Google Chrome

How to create an electronic signature for putting it on the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Formspublications in Gmail

How to generate an eSignature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Formspublications straight from your smartphone

How to make an electronic signature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Formspublications on iOS

How to create an electronic signature for the Educational Improvementopportunity Scholarship Tax Credit Election Form Rev 1123 Formspublications on Android OS

People also ask

-

What is the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications?

The Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications is a required document that allows taxpayers to apply for a tax credit when donating to student scholarship organizations. This form ensures that you can benefit from tax deductions while contributing to educational improvements.

-

How can I access the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications?

You can easily access the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications through our website. We provide a downloadable version that you can fill out electronically and submit, making the process seamless and efficient.

-

Are there any costs associated with filing the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications?

There are no specific costs related to filing the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications itself. However, if you choose to use professional services for assistance, those fees may apply. Utilizing airSlate SignNow can save you money and simplify document management.

-

What features does airSlate SignNow offer for managing the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications?

airSlate SignNow offers features such as electronic signature capabilities, document storage, and easy sharing options, specifically for managing the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications. These tools enhance efficiency and ensure that your forms are securely handled.

-

What are the benefits of using airSlate SignNow for the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications?

Using airSlate SignNow provides numerous benefits for the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications, including time savings, enhanced security, and improved document tracking. Our platform helps streamline your workflow, ensuring compliance and accuracy in your submissions.

-

Can I integrate airSlate SignNow with other applications for the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications?

Yes, airSlate SignNow can seamlessly integrate with various applications to facilitate the completion of the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications. This interoperability allows you to enhance your productivity and manage your documents more effectively within your existing systems.

-

Is it easy to collaborate on the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications with airSlate SignNow?

Absolutely! AirSlate SignNow allows for smooth collaboration on the Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications, enabling multiple users to access, edit, and sign the document in real time. This functionality helps ensure that all parties can contribute while maintaining document integrity.

Get more for Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications

- Form pt 102 1 107 diesel motor fuel receipts pt1021 tax ny

- Periodic table study guide form

- Vr 008 form

- Skin care survey court of achievers form

- Cobb county schools form

- Www sars gov zasouth african revenue serviceat your service form

- Application for private rental aboriginal assistance form

- Report and certification of loan disbursement form

Find out other Educational ImprovementOpportunity Scholarship Tax Credit Election Form REV 1123 FormsPublications

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form