Pa 1000 Form 2018

What is the PA 1000 Form

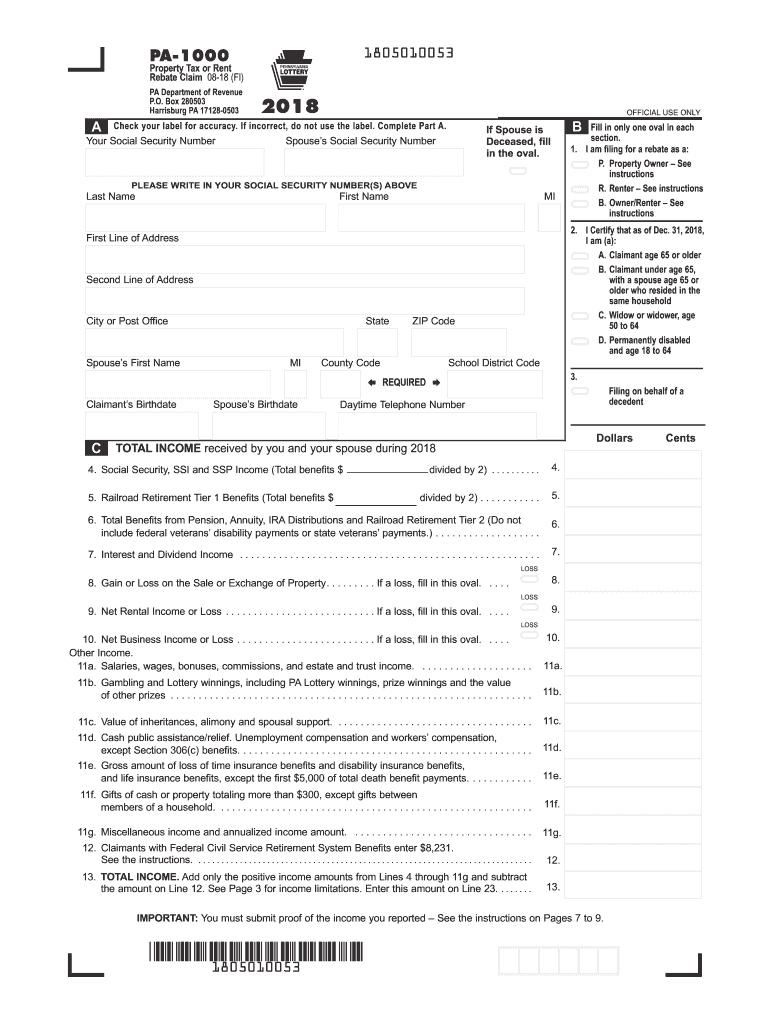

The PA 1000 form, also known as the Pennsylvania Property Tax Rebate Form, is designed to provide financial relief to eligible homeowners and renters in Pennsylvania. This form allows individuals to claim a rebate on property taxes or rent paid during the tax year. The rebate is intended for those who meet specific income criteria and can help alleviate the financial burden associated with property taxes.

How to use the PA 1000 Form

Using the PA 1000 form involves several steps to ensure accurate completion and submission. First, gather all necessary documents, including proof of income and property tax or rent payment records. Next, fill out the form with accurate information regarding your income, property, and the amount of taxes paid. After completing the form, review it for accuracy before signing. Finally, submit the form through the appropriate channels, either online, by mail, or in person, depending on your preference and local regulations.

Steps to complete the PA 1000 Form

Completing the PA 1000 form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the PA 1000 form.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your property taxes or rent payments, including the total amount paid.

- Report your total income from all sources, ensuring it aligns with the eligibility criteria.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Eligibility Criteria

To qualify for the rebate through the PA 1000 form, applicants must meet specific income limits set by the state. Generally, eligibility is determined by total income, which includes wages, pensions, and any other sources of revenue. Homeowners and renters aged sixty-five or older, or those with disabilities, may also qualify for additional considerations. It is essential to check the current income thresholds and other requirements to ensure eligibility before applying.

Form Submission Methods

The PA 1000 form can be submitted through various methods to accommodate different preferences. Individuals can complete the form online using designated state resources, ensuring a quick and efficient process. Alternatively, the form can be printed and mailed to the appropriate state office. For those who prefer in-person submissions, local tax offices may accept the completed form directly. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Key elements of the PA 1000 Form

The PA 1000 form contains several key elements that are crucial for accurate completion. These include:

- Personal identification information, such as name and address.

- Details regarding property taxes or rent payments.

- Total income information to determine eligibility.

- Signature and date fields to validate the submission.

Understanding these elements can help ensure that applicants provide all necessary information for a successful rebate claim.

Quick guide on how to complete property taxrent rebate program forms pa department of revenue

Your assistance manual on how to prepare your Pa 1000 Form

If you’re curious about how to finalize and submit your Pa 1000 Form, below are a few straightforward tips on how to streamline tax processing signNowly.

To get started, you simply need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, generate, and finish your income tax papers with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to adjust details when necessary. Simplify your tax administration with enhanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Pa 1000 Form in just a few minutes:

- Establish your account and start editing PDFs within minutes.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Pa 1000 Form in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to append your legally-recognized eSignature (if necessary).

- Examine your document and correct any inaccuracies.

- Preserve changes, print your copy, send it to your recipient, and save it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can lead to return errors and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct property taxrent rebate program forms pa department of revenue

FAQs

-

My parents owns a rental property, they put the house under my name, but they collect the rent all to themselves. What is the impact of this situation on my tax return and how do I get out?

Obviously you should consult a tax professional if you are concerned. It as I understand it, the home is deeded in your name. If that’s true, you own the home. I am assuming they transferred ownership through a quit claim deed and they have no ownership rights. Since you are not personally in the rental business you have no rental business to report to the IRS if in US. At the same time, you have given permission by default for your parents to use your house as a rental business. They might be filing a business tax return for their rental business. I am guessing that they pay the taxes, insurance and all expenses so they deserve the income. Since they don’t own the home, they likely can’t write off depreciation. Your taxes might get questionable if you try to deduct real estate taxes paid if you didn’t pay them. If all of this bothers you and depending on your relationship to your parents you could transfer ownership back to them via a quit claim deed and pay the required filing fees. There would be a potential liability issue of course to you if you continue as is. You are owner of record and could be sued if someone was hurt or damaged in the home. Not sure if your parents can book insurance since they are not the home owners. Sounds a bit shady.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the property taxrent rebate program forms pa department of revenue

How to make an eSignature for your Property Taxrent Rebate Program Forms Pa Department Of Revenue online

How to make an eSignature for the Property Taxrent Rebate Program Forms Pa Department Of Revenue in Google Chrome

How to create an eSignature for putting it on the Property Taxrent Rebate Program Forms Pa Department Of Revenue in Gmail

How to create an electronic signature for the Property Taxrent Rebate Program Forms Pa Department Of Revenue right from your smartphone

How to create an eSignature for the Property Taxrent Rebate Program Forms Pa Department Of Revenue on iOS

How to make an electronic signature for the Property Taxrent Rebate Program Forms Pa Department Of Revenue on Android

People also ask

-

What is the PA tax form PA1000?

The PA tax form PA1000 is a form used for Pennsylvania residents to claim a rebate on property taxes or rent paid. It is designed for low-income individuals and senior citizens, making it crucial for qualifying applicants to understand its requirements and benefits.

-

How can airSlate SignNow help with the PA tax form PA1000?

airSlate SignNow enables users to securely eSign and manage the PA tax form PA1000 online. With its easy-to-use interface, you can streamline the submission process, ensuring that your form is completed and sent quickly.

-

Are there any costs associated with using airSlate SignNow for the PA tax form PA1000?

Yes, while airSlate SignNow provides a cost-effective eSigning solution, there are subscription plans that may apply. However, using airSlate SignNow can save you time and resources in managing your PA tax form PA1000.

-

What features does airSlate SignNow offer for handling the PA tax form PA1000?

airSlate SignNow offers features such as eSigning, document sharing, and templates specifically for forms like the PA tax form PA1000. These features enhance user experience, making it easier to fill out and submit your tax documentation.

-

Is airSlate SignNow compliant with PA tax form PA1000 requirements?

Yes, airSlate SignNow is compliant with the necessary regulations for handling the PA tax form PA1000. Our platform ensures that electronic signatures and document formats meet the standards required by state tax authorities.

-

Can I save my PA tax form PA1000 templates in airSlate SignNow?

Absolutely! You can create and save templates for the PA tax form PA1000 in airSlate SignNow. This feature allows you to pre-fill common information for future submissions, making the process more efficient.

-

What integrations does airSlate SignNow offer to assist with the PA tax form PA1000?

airSlate SignNow integrates seamlessly with various apps that can assist in preparing the PA tax form PA1000. You can connect with CRMs, cloud storage services, and accounting software to streamline your tax filing process.

Get more for Pa 1000 Form

Find out other Pa 1000 Form

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement