Warranty Deed from Corporation to Husband and Wife Texas Form

What is the Warranty Deed From Corporation To Husband And Wife Texas

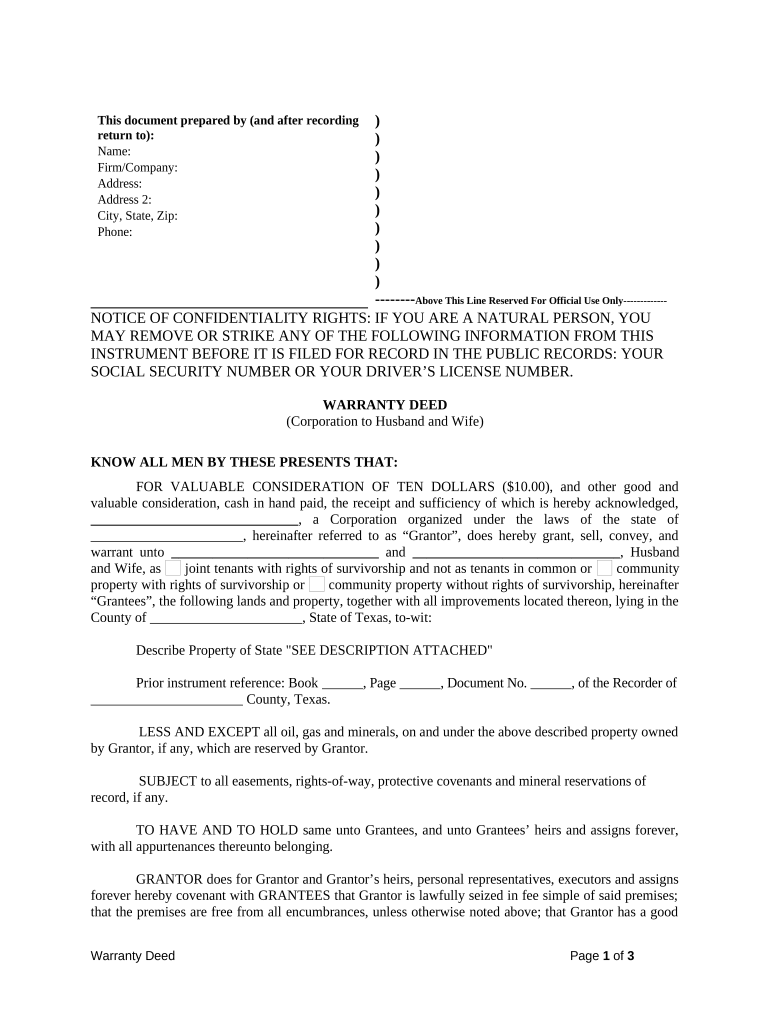

A warranty deed from a corporation to a husband and wife in Texas is a legal document that transfers ownership of property from a corporate entity to a married couple. This type of deed provides a guarantee that the corporation holds clear title to the property and has the right to convey it. It ensures that the couple will receive full ownership rights, free from any claims or encumbrances, except those explicitly stated in the deed. This form is essential in real estate transactions, as it protects the interests of the new owners and establishes their legal claim to the property.

Key Elements of the Warranty Deed From Corporation To Husband And Wife Texas

Several key elements must be included in a warranty deed to ensure its validity in Texas. These elements include:

- Grantor Information: The name of the corporation transferring the property.

- Grantee Information: The names of the husband and wife receiving the property.

- Property Description: A detailed description of the property being transferred, including its legal description.

- Consideration: The amount paid for the property, which may be nominal in some cases.

- Signature of the Grantor: The deed must be signed by an authorized representative of the corporation.

- Notarization: The deed must be notarized to verify the identities of the signers and the legitimacy of the transaction.

Steps to Complete the Warranty Deed From Corporation To Husband And Wife Texas

Completing a warranty deed from a corporation to a husband and wife involves several steps:

- Gather necessary information, including the names of the grantor and grantees, property description, and consideration.

- Draft the warranty deed, ensuring that all required elements are included.

- Have the authorized representative of the corporation sign the deed in the presence of a notary public.

- Obtain notarization to validate the signatures on the document.

- File the completed deed with the appropriate county clerk's office where the property is located.

Legal Use of the Warranty Deed From Corporation To Husband And Wife Texas

The warranty deed from a corporation to a husband and wife is legally binding and must comply with Texas property laws. This deed is used to formally transfer ownership and is essential for establishing the couple's legal rights to the property. It is important to ensure that the deed is executed correctly to avoid any future disputes regarding ownership. Additionally, the deed should be filed promptly with the county clerk to provide public notice of the transfer.

How to Obtain the Warranty Deed From Corporation To Husband And Wife Texas

To obtain a warranty deed from a corporation to a husband and wife in Texas, follow these steps:

- Contact the corporation to request the deed or obtain a template from a legal resource.

- Ensure that the deed is tailored to meet the specific requirements of the transaction.

- Consult with a real estate attorney if needed, to ensure compliance with local laws.

- Complete the deed with accurate information before proceeding with the signing and notarization process.

State-Specific Rules for the Warranty Deed From Corporation To Husband And Wife Texas

Texas has specific rules governing the execution and filing of warranty deeds. These rules include:

- The deed must be executed by an authorized officer of the corporation.

- Notarization is required to validate the document.

- The deed must be filed with the county clerk's office where the property is located to be effective against third parties.

- Texas law requires that the deed include a legal description of the property, not just a street address.

Quick guide on how to complete warranty deed from corporation to husband and wife texas

Complete Warranty Deed From Corporation To Husband And Wife Texas seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Warranty Deed From Corporation To Husband And Wife Texas on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Warranty Deed From Corporation To Husband And Wife Texas effortlessly

- Obtain Warranty Deed From Corporation To Husband And Wife Texas and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Warranty Deed From Corporation To Husband And Wife Texas to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Warranty Deed From Corporation To Husband And Wife Texas?

A Warranty Deed From Corporation To Husband And Wife Texas is a legal document that transfers property ownership from a corporation to a married couple, ensuring that the property is free from claims or liens. This type of deed provides the grantees with a guarantee of clear title, making it essential for real estate transactions in Texas.

-

How can airSlate SignNow assist with creating a Warranty Deed From Corporation To Husband And Wife Texas?

airSlate SignNow provides an easy-to-use platform for drafting and eSigning a Warranty Deed From Corporation To Husband And Wife Texas. With customizable templates, you can quickly generate the deed, ensuring that all necessary details are accurately captured, making the process simple and efficient.

-

What are the benefits of using airSlate SignNow for my Warranty Deed From Corporation To Husband And Wife Texas?

Using airSlate SignNow for your Warranty Deed From Corporation To Husband And Wife Texas streamlines document management with features like cloud storage, real-time collaboration, and secure eSigning. These benefits enhance efficiency and ensure that your real estate transaction is completed smoothly and securely.

-

Is there a cost associated with using airSlate SignNow for my Warranty Deed From Corporation To Husband And Wife Texas?

Yes, airSlate SignNow offers a variety of pricing plans designed to cater to different needs, including the creation of a Warranty Deed From Corporation To Husband And Wife Texas. Pricing typically reflects the level of features and user access required, providing a cost-effective solution for document signing and management.

-

Can I integrate airSlate SignNow with other platforms for managing my Warranty Deed From Corporation To Husband And Wife Texas?

Absolutely! airSlate SignNow allows for seamless integrations with various software and applications, enhancing your workflow. This means you can easily manage your Warranty Deed From Corporation To Husband And Wife Texas alongside your existing tools, ensuring a cohesive document management system.

-

What security measures does airSlate SignNow have in place for my Warranty Deed From Corporation To Husband And Wife Texas?

airSlate SignNow prioritizes security by offering end-to-end encryption, secure cloud storage, and compliant eSignature solutions. These measures ensure that your Warranty Deed From Corporation To Husband And Wife Texas remains confidential and legally binding while protecting it from unauthorized access.

-

How long does it take to complete a Warranty Deed From Corporation To Husband And Wife Texas using airSlate SignNow?

Completing a Warranty Deed From Corporation To Husband And Wife Texas with airSlate SignNow can be done in a matter of minutes. The platform's user-friendly interface allows you to fill out and eSign your document quickly, facilitating a swift and efficient process for your real estate transaction.

Get more for Warranty Deed From Corporation To Husband And Wife Texas

- California letter 2014 2018 form

- Lic 624b 2008 2019 form

- Medical statement to request special meals andor accommodations cnp 925 2017 2019 form

- Medical state special meals form

- Calpers retirement allowance estimate requesrt 2010 2019 form

- N of the health access programs family pact program client eligibility certification cec form 2016 2019

- State of ct qmb application 2016 2019 form

- Dadeschoolsnet records amp forms miami dade county public

Find out other Warranty Deed From Corporation To Husband And Wife Texas

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document