Tx Declaration Form

What is the Tx Declaration

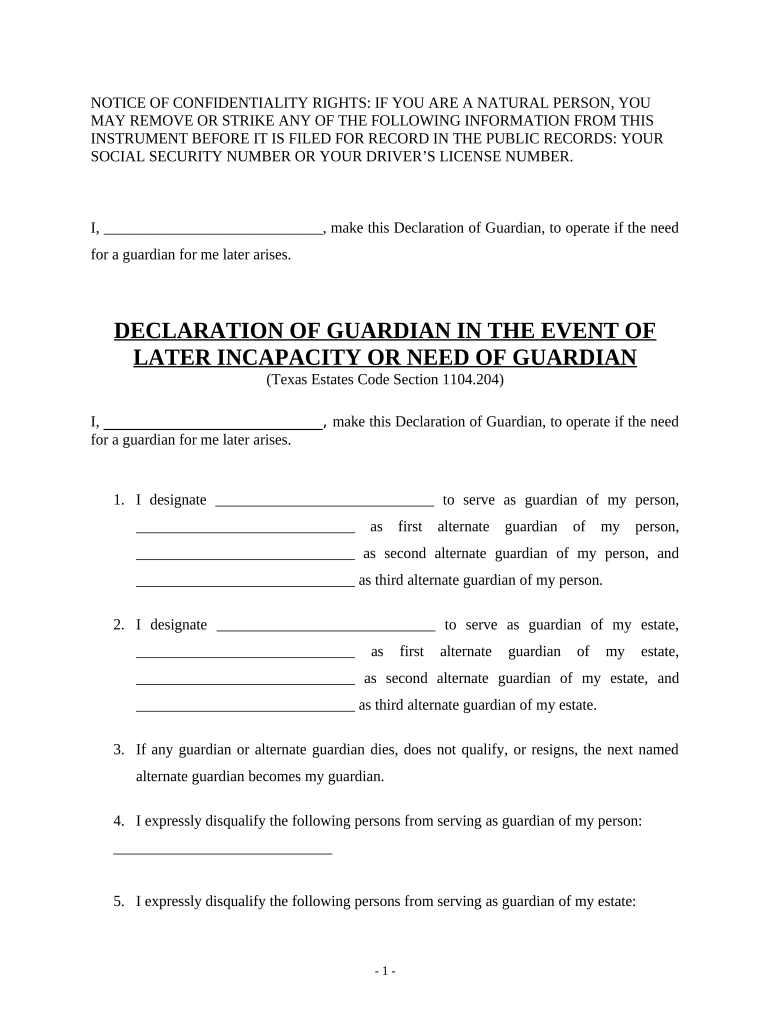

The Tx Declaration is a formal document used in Texas to declare specific information for legal or tax purposes. This form is essential for individuals and businesses to communicate their compliance with state regulations. It typically includes details such as the declarant's name, address, and the nature of the declaration being made. Understanding the Tx Declaration is crucial for ensuring that all information submitted is accurate and meets legal requirements.

How to use the Tx Declaration

Using the Tx Declaration involves several straightforward steps. First, ensure you have the correct form for your specific needs. Next, gather all necessary information, including personal or business details that need to be declared. After filling out the form, review it for accuracy before submission. The Tx Declaration can often be completed electronically, which simplifies the process and helps maintain a clear record of your submission.

Steps to complete the Tx Declaration

Completing the Tx Declaration requires careful attention to detail. Follow these steps to ensure proper completion:

- Obtain the correct version of the Tx Declaration form.

- Fill in your personal or business information accurately.

- Provide any required supporting documents, if applicable.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail, depending on the requirements.

Legal use of the Tx Declaration

The Tx Declaration serves a significant legal purpose. It is used to affirm compliance with various state laws and regulations. When filled out correctly, it can be used as evidence in legal proceedings or audits. It is important to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or legal complications.

Key elements of the Tx Declaration

Several key elements must be included in the Tx Declaration to ensure its validity:

- Declarant's Information: Full name and address of the person or entity making the declaration.

- Nature of the Declaration: A clear statement of what is being declared.

- Date of Declaration: The date when the declaration is made.

- Signature: The declarant's signature, which may be required to validate the document.

Filing Deadlines / Important Dates

Filing deadlines for the Tx Declaration can vary depending on the specific purpose of the declaration. It is essential to be aware of these deadlines to avoid penalties. Generally, deadlines may align with tax filing dates or other regulatory requirements. Keeping an organized calendar and setting reminders can help ensure timely submission.

Quick guide on how to complete tx declaration

Complete Tx Declaration effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage Tx Declaration on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Tx Declaration with ease

- Find Tx Declaration and then click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Confirm all information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tx Declaration and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tx declaration and how does it work?

A tx declaration is a legal document that outlines tax obligations. With airSlate SignNow, you can easily create, send, and eSign tx declarations, streamlining your tax processes. Our platform offers an intuitive interface that ensures you can complete your tx declaration swiftly and accurately.

-

How does airSlate SignNow help with tx declaration management?

airSlate SignNow assists in managing your tx declaration by providing a centralized platform for document storage and tracking. You can send your tx declarations for eSignature, monitor their status in real-time, and retrieve completed forms effortlessly. Our solution enhances organization and reduces the chances of errors in your tx declaration process.

-

Is there a cost associated with using airSlate SignNow for tx declarations?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, including options for handling tx declarations. Each plan is designed to provide value, giving you access to features that simplify the eSigning process. You can explore our website for detailed pricing information tailored to your usage of tx declarations.

-

Can I integrate airSlate SignNow with other software for tx declaration processes?

Absolutely! airSlate SignNow offers integrations with various software tools, facilitating seamless cooperation for your tx declaration processes. This means you can connect SignNow with platforms like CRM systems and bookkeeping software, enhancing the efficiency of your tx declaration management.

-

What security features does airSlate SignNow offer for tx declarations?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive tx declarations. Our platform is equipped with robust encryption methods, ensuring that your documents are protected during transmission and storage. Additionally, we comply with industry standards to safeguard your information related to tx declarations.

-

Can I customize my tx declaration templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize tx declaration templates to suit your specific needs. You can add your branding, modify fields, and set automation rules within your templates, making the tx declaration process faster and more personalized. This flexibility enhances your user experience and ensures compliance.

-

How can airSlate SignNow improve the efficiency of my tx declaration workflow?

By using airSlate SignNow, you can signNowly improve the efficiency of your tx declaration workflow through automated processes and electronic signatures. You can eliminate paper-based methods, reduce turnaround time for approvals, and minimize delays in getting your tx declaration finalized. Our platform helps streamline operations for businesses of all sizes.

Get more for Tx Declaration

Find out other Tx Declaration

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast