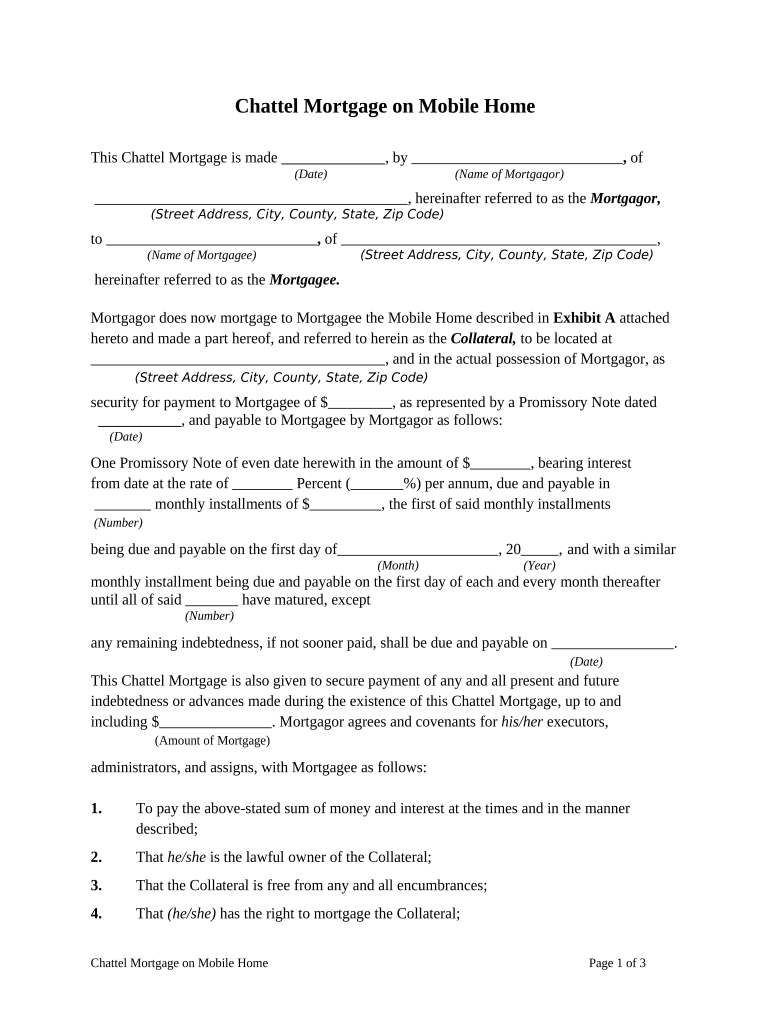

Chattel Mortgage on Mobile Home Form

What is the Chattel Mortgage On Mobile Home

A chattel mortgage on a mobile home is a type of loan specifically designed for financing mobile homes that are not classified as real estate. Unlike traditional mortgages, which apply to fixed property, a chattel mortgage allows the borrower to use the mobile home itself as collateral. This means that the lender has a legal claim to the mobile home until the loan is fully repaid. This financing option is particularly useful for individuals who wish to purchase a mobile home and need a flexible loan structure.

How to use the Chattel Mortgage On Mobile Home

Using a chattel mortgage on a mobile home involves several steps. First, you need to identify a lender that offers this type of financing. Once you have chosen a lender, you will need to provide information about the mobile home, including its make, model, and value. The lender will assess your creditworthiness and may require documentation such as proof of income and identification. After approval, you will sign the mortgage agreement, which outlines the terms of the loan, including interest rates and repayment schedules.

Steps to complete the Chattel Mortgage On Mobile Home

Completing a chattel mortgage on a mobile home involves the following steps:

- Research and select a lender that offers chattel mortgages.

- Gather necessary documentation, including income verification and identification.

- Provide details about the mobile home, such as its value and specifications.

- Submit your application and await approval from the lender.

- Review the mortgage agreement carefully before signing.

- Complete any additional requirements set by the lender, such as insurance.

Legal use of the Chattel Mortgage On Mobile Home

The legal use of a chattel mortgage on a mobile home is governed by specific laws and regulations. It is essential to ensure that the mortgage agreement complies with state and federal laws. This includes understanding the rights and responsibilities of both the borrower and lender. In many cases, the lender must provide clear terms regarding the loan and any potential penalties for default. Additionally, borrowers should be aware of their rights concerning repossession and the process involved if they fail to meet repayment obligations.

Key elements of the Chattel Mortgage On Mobile Home

Key elements of a chattel mortgage on a mobile home include:

- Loan Amount: The total amount borrowed to finance the mobile home.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: The schedule for repaying the loan, including the duration and frequency of payments.

- Collateral: The mobile home itself serves as security for the loan.

- Default Terms: Conditions under which the lender can take possession of the mobile home if payments are not made.

Eligibility Criteria

Eligibility for a chattel mortgage on a mobile home typically includes several factors. Lenders will assess your credit score, income level, and employment status. Additionally, the mobile home must meet specific criteria, such as age and condition, to qualify for financing. Some lenders may also consider the borrower's debt-to-income ratio to ensure that the borrower can manage the loan payments. Understanding these criteria can help potential borrowers prepare for the application process.

Quick guide on how to complete chattel mortgage on mobile home

Effortlessly prepare Chattel Mortgage On Mobile Home on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without hassles. Manage Chattel Mortgage On Mobile Home on any platform using the airSlate SignNow apps for Android or iOS, and enhance your document-oriented workflows today.

The easiest way to modify and eSign Chattel Mortgage On Mobile Home with ease

- Locate Chattel Mortgage On Mobile Home and then click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Chattel Mortgage On Mobile Home and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chattel Mortgage On Mobile Home?

A Chattel Mortgage On Mobile Home is a secured loan arrangement that allows you to finance the purchase of a mobile home. Unlike traditional mortgages, this type of financing allows you to secure the loan against the mobile home itself rather than real estate. This makes it a popular choice for mobile home buyers looking for flexible and accessible financing options.

-

How does a Chattel Mortgage On Mobile Home work?

When you choose a Chattel Mortgage On Mobile Home, the lender retains a security interest in the mobile home until the loan is paid off. You will make regular payments to the lender, and once you complete the payment term, you own the mobile home outright. This type of mortgage often has lower interest rates than unsecured loans, making it an attractive option.

-

What are the benefits of a Chattel Mortgage On Mobile Home?

The primary benefits of a Chattel Mortgage On Mobile Home include lower interest rates and flexible repayment terms. Additionally, this type of financing enables mobile home buyers to secure funding without needing substantial equity in the property. It makes homeownership accessible for many who might not qualify for traditional mortgages.

-

What is needed to qualify for a Chattel Mortgage On Mobile Home?

To qualify for a Chattel Mortgage On Mobile Home, lenders typically require proof of income, a good credit score, and evidence of low debt-to-income ratios. Additionally, the mobile home must meet certain standards set by the lender, such as being manufactured in recent years and being placed on a permanent foundation. Always check specific lender requirements for additional criteria.

-

Are there any fees associated with a Chattel Mortgage On Mobile Home?

Yes, obtaining a Chattel Mortgage On Mobile Home may involve some fees, such as application fees, appraisal fees, and closing costs. These fees can vary based on the lender and the specific loan terms. It's important to review all potential costs with your lender before committing to ensure you're fully aware of the financial implications.

-

Can I refinance a Chattel Mortgage On Mobile Home?

Yes, refinancing a Chattel Mortgage On Mobile Home is possible if you meet the lender's requirements and your financial situation has improved. Refinancing might allow you to lower your interest rate or adjust the loan term for better financial management. Always compare offers to find the best refinancing option.

-

What is the difference between a Chattel Mortgage On Mobile Home and a traditional mortgage?

The main difference between a Chattel Mortgage On Mobile Home and a traditional mortgage is that the former secures the loan against the mobile home rather than real estate. Traditional mortgages are often used for fixed properties and typically involve a more complex approval process. Chattel mortgages tend to be simpler and more accessible for mobile home financing.

Get more for Chattel Mortgage On Mobile Home

Find out other Chattel Mortgage On Mobile Home

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document