Obtain S Corporation Status Corporate Resolutions Forms

What is the Obtain S Corporation Status Corporate Resolutions Forms

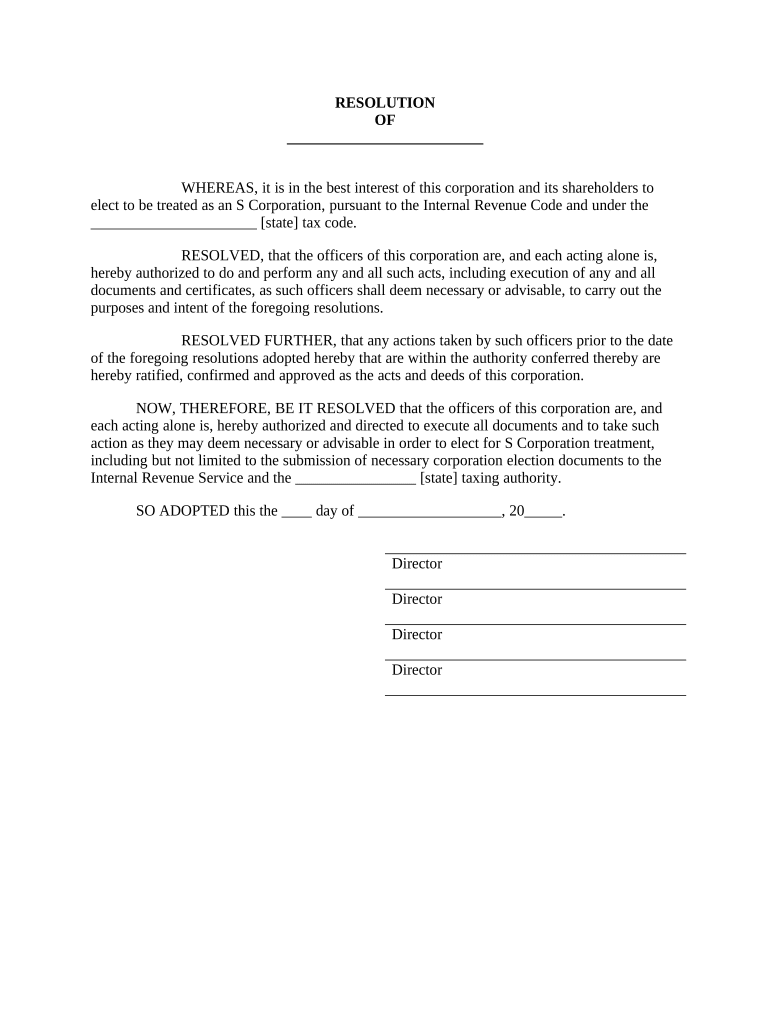

The Obtain S Corporation Status Corporate Resolutions Forms are essential documents that facilitate the election of S Corporation status for a business entity. This form is crucial for corporations that wish to be taxed under Subchapter S of the Internal Revenue Code. By completing this form, a corporation can enjoy the benefits of pass-through taxation, where income is reported on the shareholders' personal tax returns, avoiding double taxation at the corporate level. Understanding this form is vital for business owners aiming to optimize their tax obligations while maintaining limited liability protection.

How to Use the Obtain S Corporation Status Corporate Resolutions Forms

Using the Obtain S Corporation Status Corporate Resolutions Forms involves several straightforward steps. First, ensure that your business meets the eligibility criteria for S Corporation status, which includes having no more than one hundred shareholders and only one class of stock. Next, fill out the required information accurately, including the corporation's name, address, and details of the shareholders. Once completed, the form must be signed by an authorized officer of the corporation. Finally, submit the form to the IRS along with any necessary supporting documentation to formalize the election.

Steps to Complete the Obtain S Corporation Status Corporate Resolutions Forms

Completing the Obtain S Corporation Status Corporate Resolutions Forms requires careful attention to detail. Follow these steps:

- Verify your corporation's eligibility for S Corporation status.

- Gather necessary information about the corporation and its shareholders.

- Accurately fill out the form, ensuring all details are correct.

- Obtain the required signatures from authorized officers.

- Submit the completed form to the IRS within the designated timeframe.

Legal Use of the Obtain S Corporation Status Corporate Resolutions Forms

The legal use of the Obtain S Corporation Status Corporate Resolutions Forms is governed by IRS regulations. These forms must be filed within a specific timeframe to ensure that the S Corporation election is effective for the current tax year. Failure to comply with these regulations may result in the loss of S Corporation status, which can lead to unfavorable tax consequences. It is important to maintain accurate records and ensure that all corporate resolutions are documented properly to uphold the validity of the election.

Eligibility Criteria for S Corporation Status

To qualify for S Corporation status, a corporation must meet specific eligibility criteria set by the IRS. These criteria include:

- The corporation must be a domestic entity.

- It must have no more than one hundred shareholders.

- All shareholders must be individuals, certain trusts, or estates; partnerships and corporations cannot be shareholders.

- The corporation can only have one class of stock.

- The corporation must not be an ineligible corporation, such as certain financial institutions or insurance companies.

IRS Guidelines for Filing

The IRS provides clear guidelines for filing the Obtain S Corporation Status Corporate Resolutions Forms. It is essential to adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Filing the form within two months and fifteen days after the beginning of the tax year for which the election is to take effect.

- Providing all required information accurately and completely.

- Retaining copies of the filed form and any related documentation for your records.

Quick guide on how to complete obtain s corporation status corporate resolutions forms

Complete Obtain S Corporation Status Corporate Resolutions Forms effortlessly on any device

Web-based document management has become favored by enterprises and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly without hindrances. Manage Obtain S Corporation Status Corporate Resolutions Forms on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

The simplest way to alter and eSign Obtain S Corporation Status Corporate Resolutions Forms with ease

- Obtain Obtain S Corporation Status Corporate Resolutions Forms and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Sayonara to lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Alter and eSign Obtain S Corporation Status Corporate Resolutions Forms and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Corporate Resolutions Forms and why are they important for obtaining S Corporation status?

Corporate Resolutions Forms are documents that outline decisions made by a corporation's board of directors or shareholders. They are crucial for obtaining S Corporation status as they provide the necessary legal documentation to support the election of S Corporation tax treatment with the IRS.

-

How does airSlate SignNow help in obtaining S Corporation status?

airSlate SignNow streamlines the process of preparing and signing necessary documents, including Corporate Resolutions Forms. By using our easy-to-use platform, businesses can efficiently manage and eSign documents required for obtaining S Corporation status, ensuring compliance and accuracy.

-

Are there any costs associated with obtaining Corporate Resolutions Forms through airSlate SignNow?

Our pricing for obtaining S Corporation status and related Corporate Resolutions Forms is competitively structured to provide cost-effective solutions for businesses. You can review our pricing plans on our website to find the best option for your specific needs.

-

What features does airSlate SignNow offer for managing Corporate Resolutions Forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to help manage Corporate Resolutions Forms efficiently. These features simplify the process of obtaining S Corporation status and enhance organizational workflow.

-

Can I integrate airSlate SignNow with other software to assist in obtaining S Corporation status?

Yes, airSlate SignNow offers various integrations with popular business software to optimize your workflows. This capability allows you to streamline the preparation and management of Corporate Resolutions Forms needed to obtain S Corporation status seamlessly.

-

How can I ensure compliance while using Corporate Resolutions Forms with airSlate SignNow?

Using airSlate SignNow, you can ensure compliance with legal requirements by utilizing our template library, which includes accurately designed Corporate Resolutions Forms. Additionally, our platform provides audit trails and secure storage for compliance purposes when obtaining S Corporation status.

-

What is the typical time frame to obtain S Corporation status using airSlate SignNow?

The time frame to obtain S Corporation status can vary based on state processing times and document readiness; however, using airSlate SignNow can signNowly reduce administrative delays. Once your Corporate Resolutions Forms are completed and signed, we help you submit them promptly to the IRS.

Get more for Obtain S Corporation Status Corporate Resolutions Forms

- Card children s ministry program registration form fbcswan

- 3 d cell project rubric edwardsville high school ecusd7 form

- Kansas immunization program usd230 form

- Improving outcomes for australians with lung cancer form

- Face to name transition sheet form

- Amelia park arb application rev 01182016 ameliapark form

- Radi101 credit card authorization form sxswcom

- I 290b online form 2017 2019

Find out other Obtain S Corporation Status Corporate Resolutions Forms

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure