Debt Form

What is the Debt Form

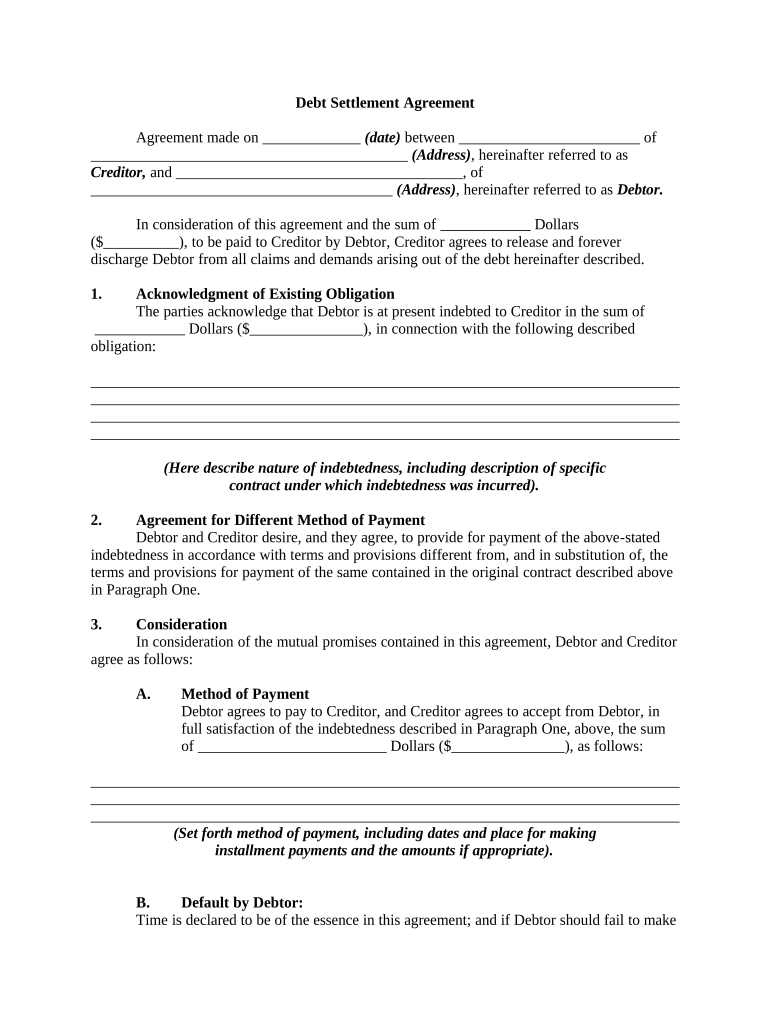

The debt form is a legal document used to outline the terms and conditions of a debt agreement between a borrower and a lender. This form typically includes essential details such as the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a written record of the agreement, ensuring that both parties are aware of their obligations and rights. In the United States, having a properly executed debt form can provide legal protection and clarity in financial transactions.

How to Use the Debt Form

Using the debt form involves several steps to ensure that it is completed accurately and legally. First, both parties should review the terms of the agreement to ensure mutual understanding. Next, fill out the form with all required information, including personal details, loan specifics, and any additional clauses relevant to the agreement. After completing the form, both parties should sign it, ideally in the presence of a witness or notary, to enhance its legal validity. Finally, retain copies of the signed document for future reference.

Steps to Complete the Debt Form

Completing the debt form requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by entering the full names and contact information of both the borrower and lender.

- Clearly state the total amount of the loan and the interest rate applicable.

- Outline the repayment schedule, including due dates and payment methods.

- Include any specific terms, such as late fees or penalties for non-payment.

- Provide a section for signatures and dates to finalize the agreement.

Legal Use of the Debt Form

The legal use of the debt form is crucial for ensuring that the agreement is enforceable in a court of law. To be considered legally binding, the form must meet specific criteria, including the clear identification of both parties, explicit terms of the agreement, and the inclusion of signatures from both the borrower and lender. Adhering to state-specific laws regarding debt agreements is also essential, as these can vary significantly across jurisdictions.

Key Elements of the Debt Form

Several key elements must be included in any debt form to ensure its effectiveness and legality:

- Borrower and Lender Information: Full names and contact details.

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the borrowed amount.

- Repayment Terms: Schedule and method of repayment.

- Signatures: Both parties must sign to validate the agreement.

Examples of Using the Debt Form

The debt form can be utilized in various scenarios, including personal loans between friends or family, business loans from financial institutions, and formal agreements for credit extensions. For instance, a small business owner may use the debt form to secure a loan from a bank, detailing the loan amount, repayment schedule, and interest rate. Similarly, an individual borrowing money from a relative can use the debt form to document the loan terms and avoid misunderstandings in the future.

Quick guide on how to complete debt form

Complete Debt Form seamlessly on any gadget

Managing documents online has gained traction with both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely maintain it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Debt Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Debt Form effortlessly

- Obtain Debt Form and click Get Form to initiate.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of distributing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Debt Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a debt form and how can it help my business?

A debt form is a customized document used to record and manage loan agreements. Using a debt form through airSlate SignNow simplifies the process of documenting debt relationships, ensuring clarity and legal compliance. It not only streamlines your workflow but also enhances communication between parties.

-

How much does it cost to use the debt form feature in airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Depending on your requirements, the cost for using the debt form feature can vary, but you can expect a competitive price point that provides excellent value. We encourage you to explore our pricing page for detailed information on subscription options.

-

Can I customize a debt form in airSlate SignNow?

Yes, you can fully customize your debt form in airSlate SignNow. The platform allows you to add fields, adjust formatting, and include specific clauses to suit your business needs. This flexibility ensures that your debt form meets all necessary legal and personal requirements.

-

Is it easy to eSign a debt form using airSlate SignNow?

Absolutely! eSigning a debt form with airSlate SignNow is quick and straightforward. Simply upload your document, send it to the required parties, and they can securely sign it from any device—saving time and ensuring accuracy in the process.

-

What are the benefits of using a debt form in airSlate SignNow?

Using a debt form in airSlate SignNow provides numerous benefits, including enhanced security for your documentation and improved efficiency in managing debt obligations. The automation features streamline the process, reducing the chance of errors, while also ensuring that all parties can access and complete the form conveniently.

-

Can I integrate my debt form with other applications?

Yes, airSlate SignNow supports various integrations that allow you to connect your debt form with other applications seamlessly. This capability helps you to automate workflows and synchronize information across different platforms, enhancing your overall document management process.

-

Is my data secure when using the debt form in airSlate SignNow?

Your data security is our top priority at airSlate SignNow. When using a debt form, robust encryption and security measures are enforced to protect your sensitive information. We adhere to strict compliance standards to ensure your documents remain safe throughout their lifecycle.

Get more for Debt Form

- Computershare forms

- Application for canadian form

- Cit 0002 form

- Louisiana student residency questionnaire form fill online

- Dbpr form co 6000 2 developercondominium filing statement

- Category ii non ache credits form

- Nims record number form

- 0115 application to proceed in district court without prepaying fees or costs long form

Find out other Debt Form

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple