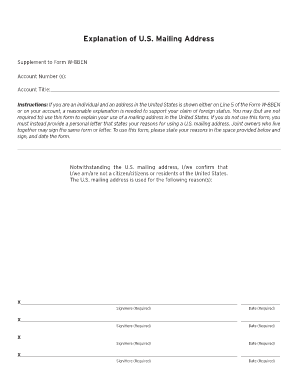

Supplement to Form W 8ben

What is the Supplement to Form W-8BEN?

The supplement to Form W-8BEN is a crucial document used by foreign individuals or entities to certify their foreign status for U.S. tax purposes. This form is essential for non-U.S. persons to claim a reduced rate of, or exemption from, withholding tax on certain types of income, such as dividends or interest. The supplement provides additional information that supports the primary W-8BEN form, ensuring compliance with U.S. tax regulations. Understanding the purpose and requirements of this supplement is vital for anyone engaging in financial transactions with U.S. entities.

How to Use the Supplement to Form W-8BEN

Using the supplement to Form W-8BEN involves completing the necessary sections accurately to reflect the taxpayer's information and intentions. This form should be submitted to the withholding agent or financial institution that requires it. It is important to fill out the supplement in conjunction with the main W-8BEN form, ensuring that all information aligns. This helps prevent delays in processing and ensures that the correct withholding rates are applied. Always keep a copy of the completed forms for your records.

Steps to Complete the Supplement to Form W-8BEN

Completing the supplement to Form W-8BEN requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Review the instructions provided with the form to understand specific requirements related to your situation.

- Fill out the supplement, ensuring that all fields are completed accurately.

- Sign and date the form, certifying that the information provided is true and correct.

- Submit the completed form to the appropriate withholding agent or financial institution.

Legal Use of the Supplement to Form W-8BEN

The legal use of the supplement to Form W-8BEN is governed by U.S. tax laws. This form must be completed and submitted correctly to ensure compliance and avoid penalties. It serves as a declaration of the foreign status of the individual or entity, which is necessary for tax withholding purposes. Failure to provide accurate information can lead to incorrect withholding rates and potential legal repercussions. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of the form.

IRS Guidelines for the Supplement to Form W-8BEN

The IRS provides specific guidelines for completing the supplement to Form W-8BEN, which include instructions on eligibility, required information, and submission procedures. Familiarizing yourself with these guidelines is essential to ensure compliance. The IRS emphasizes the importance of accuracy in the information provided, as discrepancies can lead to audits or penalties. It is recommended to refer to the IRS website or consult a tax advisor for the most current information regarding the form.

Filing Deadlines for the Supplement to Form W-8BEN

Filing deadlines for the supplement to Form W-8BEN can vary depending on the type of income and the requirements of the withholding agent. Generally, this form should be submitted before the payment of income to ensure that the correct withholding tax rate is applied. It is important to stay informed about any changes in deadlines, as these can affect tax obligations. Keeping track of these dates helps avoid unnecessary penalties and ensures compliance with U.S. tax laws.

Quick guide on how to complete supplement to form w 8ben

Complete Supplement To Form W 8ben seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage Supplement To Form W 8ben on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Supplement To Form W 8ben with ease

- Obtain Supplement To Form W 8ben and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of your documents or redact sensitive information using features that airSlate SignNow supplies for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Supplement To Form W 8ben and guarantee exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the supplement to form w 8ben

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a supplement to form w 8ben?

A supplement to form w 8ben is an additional document that helps foreign individuals or entities establish eligibility for tax treaty benefits. This form is crucial for non-residents receiving income from U.S. sources to clarify their tax status.

-

How can airSlate SignNow assist with the supplement to form w 8ben?

AirSlate SignNow provides an easy-to-use platform for electronically signing and sending the supplement to form w 8ben. With its intuitive interface, users can complete and submit the document quickly, ensuring compliance and accuracy.

-

What are the pricing options for using airSlate SignNow for the supplement to form w 8ben?

AirSlate SignNow offers various pricing plans tailored to different business needs, starting from a free tier for basic functionalities to premium subscriptions with advanced features. Users can choose a plan that best fits their requirements for managing the supplement to form w 8ben effortlessly.

-

Are there any features specifically designed for managing the supplement to form w 8ben?

Yes, airSlate SignNow includes features such as customizable templates, form field validation, and secure document storage specifically tailored for handling the supplement to form w 8ben. These tools streamline document preparation and ensure all necessary information is accurately captured.

-

What benefits does using airSlate SignNow bring for processing the supplement to form w 8ben?

Using airSlate SignNow for processing the supplement to form w 8ben enhances efficiency and accuracy. The platform minimizes errors during sign-off, saves time in document management, and provides a compliant way to handle sensitive tax information.

-

Can I integrate airSlate SignNow with other software to manage the supplement to form w 8ben?

Yes, airSlate SignNow offers seamless integrations with various applications like CRMs, accounting software, and document management systems. This connectivity allows users to easily manage and automate the workflow for the supplement to form w 8ben.

-

Is airSlate SignNow secure for handling the supplement to form w 8ben?

Absolutely, airSlate SignNow employs advanced security measures to protect sensitive data associated with the supplement to form w 8ben. Features such as encryption, secure access, and detailed audit trails ensure that your documents are safe and compliant.

Get more for Supplement To Form W 8ben

Find out other Supplement To Form W 8ben

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online