Addendum Fha Va Loan Form

What is the Addendum FHA VA Loan

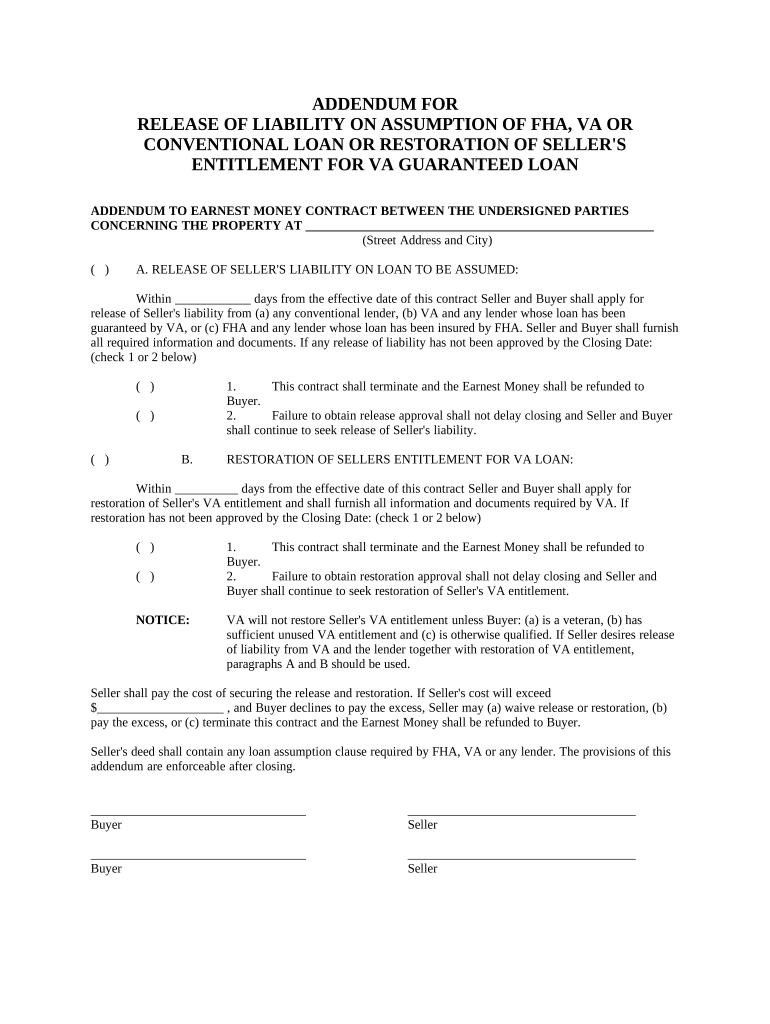

The Addendum FHA VA Loan is a supplementary document that provides additional terms and conditions related to Federal Housing Administration (FHA) and Veterans Affairs (VA) loans. This addendum is essential for borrowers who are utilizing these specific loan programs, as it outlines the responsibilities and obligations of both the borrower and the lender. It ensures that all parties are aware of the unique aspects of these loans, including eligibility criteria, funding fees, and any specific requirements that must be met for the loan to be approved.

How to Use the Addendum FHA VA Loan

Using the Addendum FHA VA Loan involves several steps to ensure compliance with the terms set forth by the FHA and VA. Borrowers should carefully review the addendum to understand their responsibilities. It typically includes sections that detail the loan amount, interest rate, and repayment terms. After reviewing, borrowers must sign the document to indicate their agreement. This signed addendum is then submitted along with the primary loan application to the lender for processing.

Steps to Complete the Addendum FHA VA Loan

Completing the Addendum FHA VA Loan requires attention to detail. Here are the steps to follow:

- Obtain the addendum from your lender or mortgage broker.

- Read through the document thoroughly to understand all terms and conditions.

- Fill in any required personal and financial information accurately.

- Sign and date the addendum in the designated areas.

- Submit the completed addendum along with your loan application to your lender.

Legal Use of the Addendum FHA VA Loan

The legal use of the Addendum FHA VA Loan is governed by federal regulations that apply to FHA and VA loans. It is crucial for both lenders and borrowers to comply with these regulations to ensure the validity of the loan agreement. The addendum must be executed properly, with all necessary signatures obtained, to be considered legally binding. Additionally, it must align with the requirements set forth by the FHA and VA to avoid any potential legal issues during the loan process.

Key Elements of the Addendum FHA VA Loan

Key elements of the Addendum FHA VA Loan include:

- Loan amount and terms

- Interest rate and payment schedule

- Borrower eligibility criteria

- Funding fees and costs associated with the loan

- Conditions for loan approval and disbursement

Required Documents

To complete the Addendum FHA VA Loan, several documents are typically required. These may include:

- Proof of income (pay stubs, tax returns)

- Credit report

- Identification (driver's license, Social Security card)

- Property information (purchase agreement, appraisal)

- Any additional documentation requested by the lender

Quick guide on how to complete addendum fha va loan

Complete Addendum Fha Va Loan easily on any device

Digital document management has become favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your papers swiftly without delays. Handle Addendum Fha Va Loan on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and electronically sign Addendum Fha Va Loan effortlessly

- Find Addendum Fha Va Loan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your preference. Edit and electronically sign Addendum Fha Va Loan to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an addendum FHA VA loan?

An addendum FHA VA loan is a supplemental document that provides additional terms or agreements related to an existing FHA or VA loan. This addendum is particularly useful for borrowers looking to clarify or modify certain aspects of their loan agreement. Understanding how to use an addendum can enhance your mortgage experience.

-

How can airSlate SignNow help with addendum FHA VA loan processing?

airSlate SignNow streamlines the process of sending and eSigning documents associated with addendum FHA VA loans. Our user-friendly platform simplifies the document management process, making it easy to create, send, and track your loan addendums. This can save you time and reduce paperwork hassle.

-

What are the benefits of using airSlate SignNow for addendum FHA VA loans?

Using airSlate SignNow for addendum FHA VA loans offers several benefits, including quick document turnaround, secure eSigning, and easy collaboration with all parties involved. Our platform ensures that your documents are stored securely and are easily accessible whenever needed. Additionally, our service is cost-effective, providing excellent value to users.

-

Is airSlate SignNow compatible with other loan types?

Yes, airSlate SignNow is versatile and can be used for various loan types, including conventional, FHA, and VA loans. Whether you're dealing with an addendum FHA VA loan or other forms of agreements, our solution simplifies the document signing process universally. This makes it easier for you to manage different types of loans seamlessly.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers competitive pricing plans to fit the needs of different users, whether you are an individual or a business. Our pricing is designed to be cost-effective, especially for those who frequently deal with documents like addendum FHA VA loans. Visit our website for detailed pricing information and to find a plan that suits you.

-

Can airSlate SignNow be integrated with other tools and platforms?

Absolutely! airSlate SignNow supports integration with a variety of third-party applications, enhancing your workflow for managing addendum FHA VA loans. Integrations with tools like CRMs and document management systems are easy to set up, allowing seamless transitions between platforms for a more efficient process.

-

How secure is airSlate SignNow for handling sensitive loan documents?

Security is a top priority at airSlate SignNow. We utilize state-of-the-art encryption and security protocols to protect sensitive information, including documents related to addendum FHA VA loans. You can trust that your data is secure as we maintain compliance with industry standards.

Get more for Addendum Fha Va Loan

- Publication 1769 en sp rev 11 2014 irs english and spanish bookmark form

- Publication 5435 en sp 8 2020 need to pay your taxes in cash there are ways to pay form

- State income tax return deadlines and other state hampampr block form

- Govcumbredeseguridad form

- Publication 6961 a rev 8 2019 calendar year projections of information and withholding documents for the united states and irs

- Form 886 h dep sp rev 10 2019 supporting documents for dependency exemptions spanish version

- Publication 4473 rev 5 2015 irs computer loan program welcome package irs form

- Form 14039 b sp rev 8 2020 business identity theft affidavit spanish version

Find out other Addendum Fha Va Loan

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple