How to Handle Tax Returns If You're Divorced or Separated 2022-2026

Understanding Tax Returns After Divorce or Separation

Handling tax returns can be complex for individuals who are divorced or separated. The IRS allows for specific considerations when filing, especially regarding dependents. It is essential to understand how your marital status impacts your filing options, such as whether to file jointly or separately. Those who share custody of children must determine who claims the child as a dependent, which can affect tax credits and deductions.

Steps to Complete Tax Returns Post-Divorce

To effectively complete your tax returns after a divorce or separation, follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and any divorce agreements.

- Determine your filing status based on your current marital situation.

- Identify which parent will claim any children as dependents, if applicable.

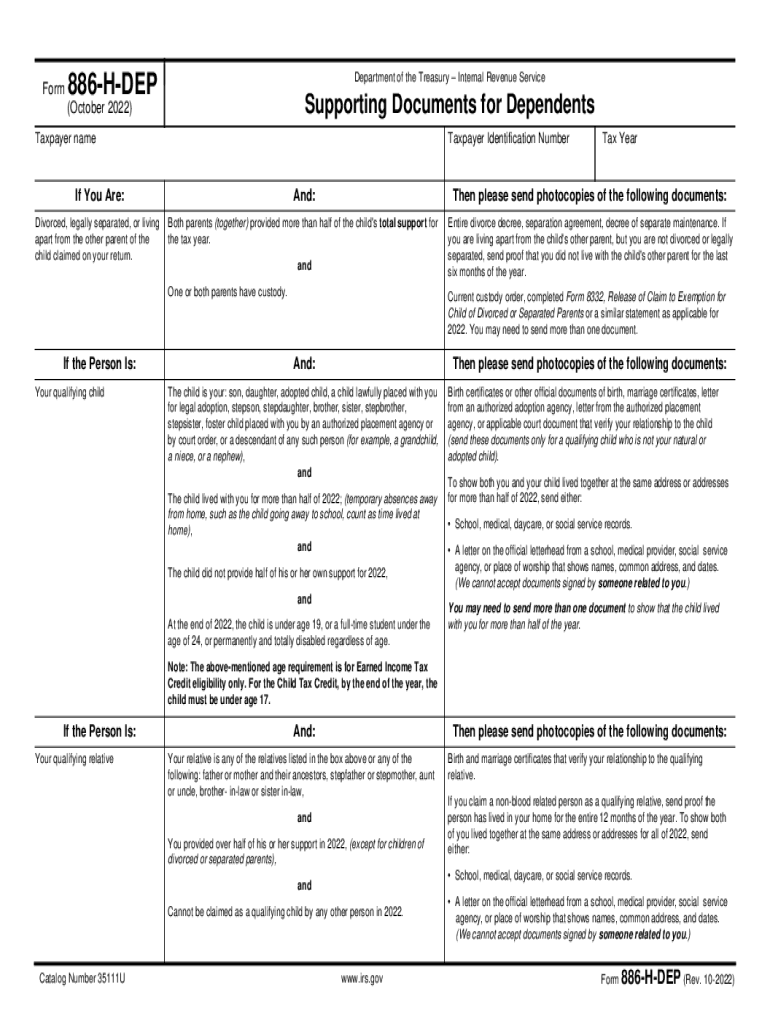

- Complete IRS Form 886 H DEP if claiming dependents, ensuring all information is accurate.

- Review any applicable tax credits, such as the Earned Income Credit (EIC), which can be influenced by your filing status and dependent claims.

- File your tax return electronically or by mail, ensuring you meet all deadlines.

Required Documents for Filing

When preparing to file your taxes post-divorce, ensure you have the following documents:

- All relevant income documents (W-2s, 1099s).

- Divorce decree or separation agreement, outlining financial responsibilities.

- Form 886 H DEP if claiming dependents.

- Any documentation supporting claims for tax credits, such as daycare expenses.

IRS Guidelines for Dependents

The IRS has specific guidelines regarding who can claim dependents, which is crucial for divorced or separated individuals. Generally, the custodial parent has the right to claim the child unless a written agreement states otherwise. Understanding these guidelines can help you maximize your tax benefits and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Filing inaccurately or failing to comply with IRS regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits. It is vital to ensure that all information is correct, especially regarding dependents, to avoid complications with the IRS.

Eligibility Criteria for Claiming Dependents

To claim a dependent on your tax return, certain eligibility criteria must be met. The dependent must be a qualifying child or relative, and you must provide more than half of their financial support during the year. Additionally, they must live with you for more than half of the year, unless specific exceptions apply. Understanding these criteria is essential for accurate tax filing.

Quick guide on how to complete how to handle tax returns if youre divorced or separated

Prepare How To Handle Tax Returns If You're Divorced Or Separated effortlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without hassles. Manage How To Handle Tax Returns If You're Divorced Or Separated on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Effortlessly modify and eSign How To Handle Tax Returns If You're Divorced Or Separated

- Find How To Handle Tax Returns If You're Divorced Or Separated and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Edit and eSign How To Handle Tax Returns If You're Divorced Or Separated and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to handle tax returns if youre divorced or separated

Create this form in 5 minutes!

How to create an eSignature for the how to handle tax returns if youre divorced or separated

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 886 h dep and how can airSlate SignNow help?

Form 886 h dep is a tax form used for claiming a refundable credit for certain dependents. airSlate SignNow streamlines the process of gathering signatures and sending this form securely, making it easy for businesses to handle important documents efficiently.

-

Is there a cost associated with using airSlate SignNow for form 886 h dep?

Yes, airSlate SignNow offers multiple pricing plans tailored to fit various business needs. These plans provide access to features that simplify the signing and management of documents like form 886 h dep, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for handling form 886 h dep?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage. These tools help users manage form 886 h dep efficiently, reducing turnaround time and enhancing document security.

-

Can I integrate airSlate SignNow with other software for managing form 886 h dep?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as CRM systems and cloud storage services. This ensures that the management of form 886 h dep aligns perfectly with your existing workflow.

-

How does airSlate SignNow ensure the security of form 886 h dep?

airSlate SignNow employs advanced encryption and security protocols to protect sensitive data, including form 886 h dep. This commitment to security gives users peace of mind when sending and receiving important documents.

-

How can I track the status of my form 886 h dep using airSlate SignNow?

With airSlate SignNow, users can easily track the status of their sent documents, including form 886 h dep. Real-time notifications and status updates keep you informed about when the document is viewed and signed.

-

What customer support options does airSlate SignNow provide for form 886 h dep?

airSlate SignNow offers robust customer support options, including live chat, email, and a comprehensive help center. This ensures you receive assistance with any queries related to form 886 h dep at any time.

Get more for How To Handle Tax Returns If You're Divorced Or Separated

Find out other How To Handle Tax Returns If You're Divorced Or Separated

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy