Form 12203 Rev 8 Request for Appeals Review 2022-2026

What is the Form 12203 Rev 8 Request For Appeals Review

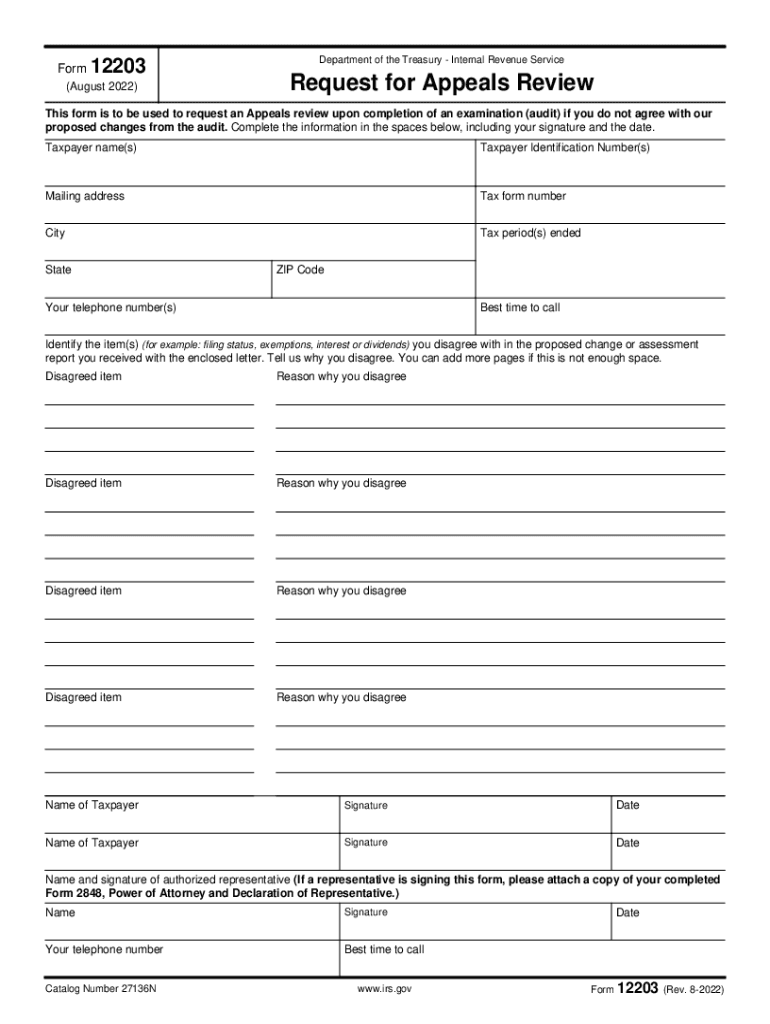

The Form 12203 Rev 8 is a crucial document used by taxpayers to formally request a review of a tax dispute with the Internal Revenue Service (IRS). This form is specifically designed for individuals who disagree with the IRS's determination regarding their tax obligations. By submitting this form, taxpayers can initiate the appeals process, allowing them to present their case and seek a resolution. Understanding the purpose and function of this form is essential for anyone facing a tax dispute.

Steps to complete the Form 12203 Rev 8 Request For Appeals Review

Completing the Form 12203 Rev 8 requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your tax identification number and details about the tax dispute.

- Clearly state the reasons for your disagreement with the IRS's decision in the appropriate section of the form.

- Attach any supporting documentation that substantiates your claims, such as previous correspondence with the IRS or relevant financial records.

- Review the completed form for accuracy and completeness before submission.

- Submit the form according to the instructions provided, either online, by mail, or in person.

Legal use of the Form 12203 Rev 8 Request For Appeals Review

The legal use of the Form 12203 Rev 8 is governed by IRS regulations, which stipulate that taxpayers have the right to appeal decisions made by the agency. This form serves as a formal request for an appeals review, ensuring that the taxpayer's voice is heard in the dispute resolution process. It is important to follow all legal requirements and guidelines when completing and submitting the form to ensure its validity.

IRS Guidelines

The IRS provides specific guidelines for the submission and processing of the Form 12203 Rev 8. These guidelines outline the eligibility criteria for filing an appeal, the necessary documentation to include, and the timelines for submission. Familiarizing yourself with these guidelines can help streamline the appeals process and increase the chances of a favorable outcome.

Filing Deadlines / Important Dates

Timeliness is critical when submitting the Form 12203 Rev 8. Taxpayers must adhere to specific deadlines to ensure their appeal is considered. Generally, the form must be filed within thirty days of receiving the IRS's notice of determination. Missing this deadline may result in the loss of the right to appeal. Keeping track of important dates related to your tax dispute is essential for a successful resolution.

Required Documents

When submitting the Form 12203 Rev 8, certain documents are required to support your appeal. These may include:

- Copies of any relevant correspondence with the IRS.

- Financial statements that pertain to the dispute.

- Any other documentation that provides evidence for your claims.

Providing comprehensive supporting documentation can strengthen your case and facilitate a smoother review process.

Quick guide on how to complete form 12203 rev 8 2022 request for appeals review

Complete Form 12203 Rev 8 Request For Appeals Review effortlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can locate the correct template and securely save it online. airSlate SignNow supplies you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Form 12203 Rev 8 Request For Appeals Review on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 12203 Rev 8 Request For Appeals Review with ease

- Obtain Form 12203 Rev 8 Request For Appeals Review and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about missing or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 12203 Rev 8 Request For Appeals Review and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 12203 rev 8 2022 request for appeals review

Create this form in 5 minutes!

How to create an eSignature for the form 12203 rev 8 2022 request for appeals review

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax dispute, and how can airSlate SignNow help?

A tax dispute refers to a disagreement between a taxpayer and a tax authority regarding the amount of tax owed or the interpretation of tax laws. airSlate SignNow simplifies the resolution process by enabling users to easily sign and submit necessary documents, ensuring that all agreements are securely executed and legally binding.

-

How can airSlate SignNow assist in documenting tax disputes?

With airSlate SignNow, businesses can quickly create, sign, and share critical documents related to tax disputes. The platform allows users to maintain a clear record of agreements and communications, which is crucial when addressing complex tax issues with authorities.

-

What pricing options does airSlate SignNow offer for businesses dealing with tax disputes?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses managing tax disputes. Users can choose from individual, small business, or enterprise plans, ensuring they access the necessary features at a cost-effective rate that aligns with their resolution efforts.

-

Does airSlate SignNow offer features specifically beneficial for resolving tax disputes?

Yes, airSlate SignNow includes features like customizable templates, reminders, and a secure eSignature process that streamline the management of tax disputes. These tools allow businesses to expedite documentation and communication, reducing the time spent on administrative tasks.

-

Can airSlate SignNow integrate with accounting software to assist with tax disputes?

Absolutely! airSlate SignNow integrates seamlessly with several popular accounting software solutions, making it easier to manage documents related to tax disputes. This integration allows users to import data directly, simplifying the process of documenting and resolving financial disagreements.

-

Is airSlate SignNow secure for handling sensitive tax dispute documents?

Yes, airSlate SignNow is designed with security in mind. All documents related to tax disputes are encrypted, and the platform complies with industry standards, ensuring that sensitive information remains protected throughout the eSigning process.

-

How quickly can I resolve a tax dispute using airSlate SignNow?

airSlate SignNow accelerates the resolution of tax disputes by streamlining document preparation and signing. With features like instant notifications and the ability to send documents electronically, users can expect quicker turnarounds when dealing with tax authorities.

Get more for Form 12203 Rev 8 Request For Appeals Review

- Car club registration form

- Sba form 3511

- Lifesteps wellness incentive preventive physical examination form

- Cl 200 056 15 revised service prior to membership service credit request form calpers ca

- Agency affiliated counselor application packet this packet is for an applicant to obtain a credential in washington state as an form

- Agency affiliated counselorwashington state department form

- Electronic payments wvsao gov form

- Facts direct deposit change west virginia state auditor39s office wvsao form

Find out other Form 12203 Rev 8 Request For Appeals Review

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF