Demand Creditor Form

What is the Demand Creditor

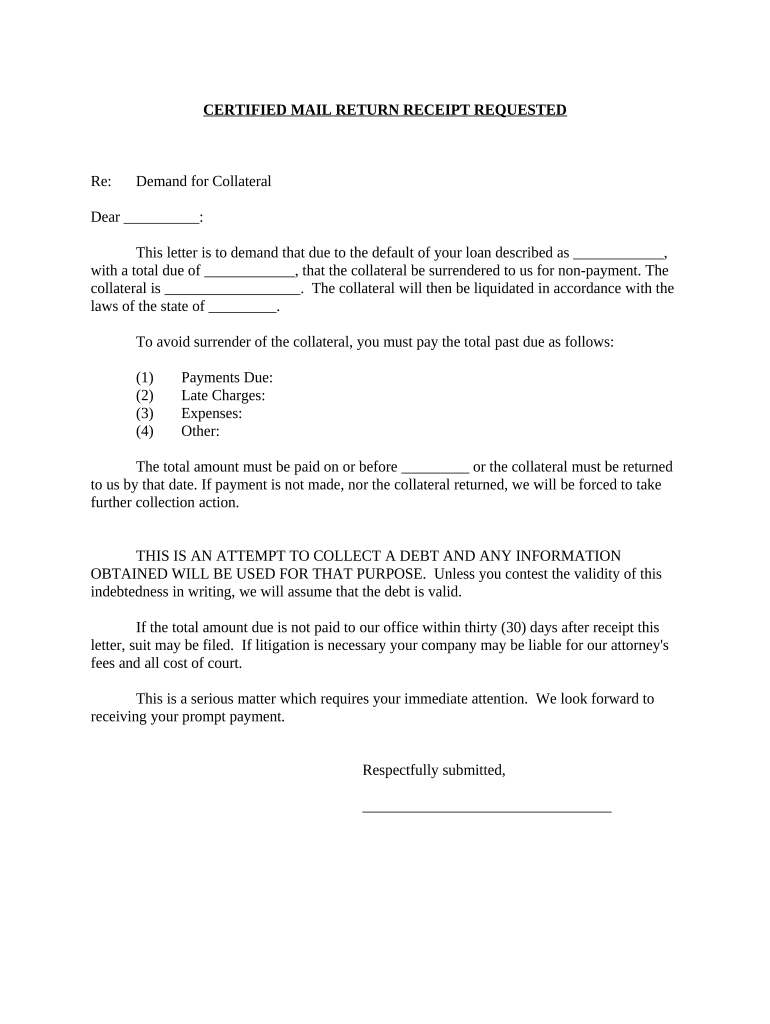

The demand creditor form is a legal document used by individuals or entities to formally request payment of a debt. This form serves as a notification to the debtor, outlining the amount owed and the terms of repayment. It is essential in the context of debt collection, as it establishes a clear record of the creditor's claim and the debtor's obligations. Understanding the specifics of this form can help ensure that both parties are aware of their rights and responsibilities.

How to Use the Demand Creditor

Using the demand creditor form involves several key steps. First, the creditor must accurately fill out the form with relevant details, including the debtor's name, contact information, and the amount owed. It is important to specify the due date for payment and any applicable interest or fees. Once completed, the form should be sent to the debtor, either through certified mail or electronically, to ensure there is a record of delivery. Keeping a copy of the sent form is crucial for future reference.

Steps to Complete the Demand Creditor

Completing the demand creditor form requires careful attention to detail. Follow these steps:

- Gather necessary information about the debtor, including their full name and address.

- Clearly state the total amount owed, including any interest or fees.

- Include a due date for payment to create urgency.

- Provide your contact information for any questions or clarifications.

- Sign and date the form to validate it.

- Send the form using a method that provides proof of delivery.

Legal Use of the Demand Creditor

The legal use of the demand creditor form is governed by various regulations that ensure its validity. For the form to be legally binding, it must be executed in compliance with state laws regarding debt collection. This includes providing accurate information and adhering to any specific requirements set forth by local jurisdictions. Additionally, the form should be retained as part of the creditor's records to support any future legal actions if necessary.

Key Elements of the Demand Creditor

Several key elements must be included in the demand creditor form to ensure its effectiveness:

- Creditor Information: Full name and contact details of the creditor.

- Debtor Information: Full name and address of the debtor.

- Amount Owed: Clear statement of the total amount due.

- Payment Terms: Details regarding payment deadlines and any applicable interest rates.

- Signature: The creditor's signature to validate the document.

Examples of Using the Demand Creditor

Examples of using the demand creditor form can vary widely depending on the situation. For instance, a small business owner may use the form to collect outstanding invoices from clients. Similarly, an individual may issue a demand creditor form to a friend or family member who has failed to repay a loan. Each scenario highlights the form's versatility in facilitating clear communication regarding debts.

Quick guide on how to complete demand creditor

Prepare Demand Creditor effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly option to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without any holdups. Manage Demand Creditor on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to adjust and electronically sign Demand Creditor without hassle

- Find Demand Creditor and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Demand Creditor to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a demand creditor?

A demand creditor is an individual or entity that has the right to demand payment from a debtor. Understanding your role as a demand creditor can help in ensuring timely payments and managing financial relationships effectively.

-

How can airSlate SignNow benefit demand creditors?

airSlate SignNow provides demand creditors with a streamlined solution to send, sign, and track important documents. This allows for quick communications and efficient management of debt agreements, ensuring that documents are legally binding and easily accessible.

-

What features does airSlate SignNow offer for demand creditors?

airSlate SignNow includes features such as customizable templates, document tracking, and secure eSigning. These features empower demand creditors to create efficient workflows, reducing the time and effort required for document management.

-

Is airSlate SignNow user-friendly for demand creditors?

Yes, airSlate SignNow is designed with user experience in mind, allowing demand creditors to navigate the platform easily. The intuitive interface simplifies the process of sending and signing documents, even for those with no prior experience in digital tools.

-

What is the pricing of airSlate SignNow for demand creditors?

airSlate SignNow offers competitive pricing plans suitable for demand creditors of all sizes. These plans provide access to essential features at a cost-effective rate, ensuring that even small businesses can afford this vital tool for managing their financial operations.

-

Can demand creditors integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing the workflow for demand creditors. This interoperability allows you to connect with tools such as CRMs and cloud storage systems for improved efficiency.

-

What are the compliance benefits for demand creditors using airSlate SignNow?

Using airSlate SignNow helps demand creditors maintain compliance with legal standards for electronic signatures. The platform adheres to regulations like ESIGN and UETA, ensuring that your documents are legally valid and protected.

Get more for Demand Creditor

- Aadhar gazetted officer form

- Pers subscriber monitoring agreement emergency24com form

- Pediatric center forms

- 3111 citizens way p form

- Pdf application for firearm control card for proprietary security personnel form

- Georgia security deed assignment form 3745 single family fannie mae uniform instrument

- Links to state incorporation websites irsgov form

- Important please enter all dates in mmddyyyy format

Find out other Demand Creditor

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online