Corporate Guaranty Form

What is the Corporate Guaranty

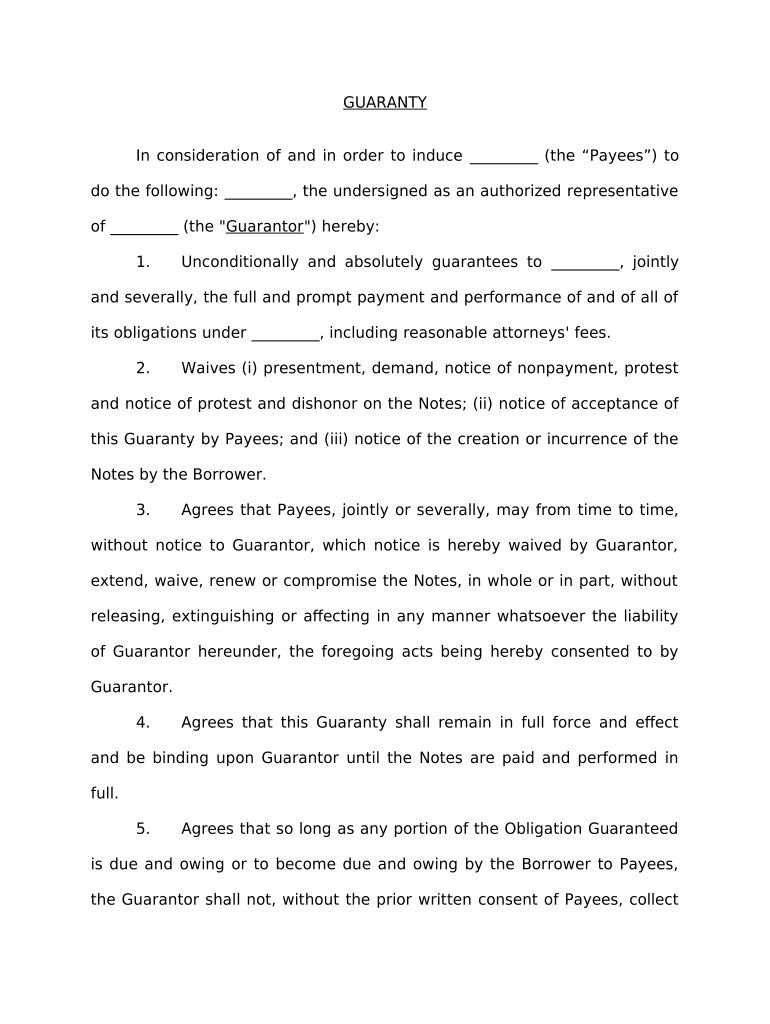

A corporate guaranty is a legal commitment made by a corporation to assume responsibility for the obligations of another party, typically a subsidiary or a partner. This instrument is often utilized in various financial transactions, including loans and leases, to provide assurance to creditors that they will be repaid even if the primary borrower defaults. By signing a corporate guaranty, the corporation pledges its assets to cover the debts or obligations of the other entity, enhancing the credibility of the transaction.

Key elements of the Corporate Guaranty

Understanding the key elements of a corporate guaranty is essential for ensuring its effectiveness. These elements typically include:

- Identification of Parties: Clearly define the guarantor (the corporation) and the party whose obligations are being guaranteed.

- Scope of Guarantee: Specify the extent of the obligations covered, including any limitations or exclusions.

- Duration: Indicate the time period during which the guaranty is valid.

- Conditions: Outline any conditions under which the guaranty may be invoked.

Each of these components plays a crucial role in the enforceability and clarity of the corporate guaranty.

Steps to complete the Corporate Guaranty

Completing a corporate guaranty involves several important steps to ensure its validity and effectiveness. These steps include:

- Drafting the Document: Begin by drafting the guaranty, ensuring all key elements are included.

- Review by Legal Counsel: Have the document reviewed by legal professionals to confirm compliance with applicable laws.

- Signature of Authorized Representatives: Obtain signatures from individuals who have the authority to bind the corporation.

- Distribution: Provide copies of the signed guaranty to all relevant parties involved in the transaction.

Following these steps can help prevent disputes and ensure that the guaranty is legally binding.

Legal use of the Corporate Guaranty

The legal use of a corporate guaranty is governed by various laws and regulations. It is important for corporations to ensure that their guaranties comply with state and federal laws to avoid potential legal issues. A properly executed corporate guaranty can be enforced in court, provided it meets the necessary legal requirements. This includes having clear terms, being signed by authorized individuals, and being supported by adequate consideration.

Examples of using the Corporate Guaranty

Corporate guaranties are commonly used in various scenarios, such as:

- Loan Agreements: A corporation may guarantee a loan taken out by a subsidiary to secure favorable loan terms.

- Lease Agreements: Corporations often guarantee lease obligations for their subsidiaries to enhance their creditworthiness.

- Partnerships: In joint ventures, a corporate guaranty can provide assurance to investors regarding financial commitments.

These examples illustrate how corporate guaranties serve as a vital tool for facilitating business transactions and securing financial arrangements.

Eligibility Criteria

Eligibility criteria for a corporate guaranty typically include:

- Corporate Status: The guarantor must be a legally recognized corporation in good standing.

- Financial Stability: The corporation should demonstrate sufficient financial health to fulfill the obligations if required.

- Authorization: The individuals signing the guaranty must have the authority to bind the corporation legally.

Meeting these criteria is essential for the guaranty to be enforceable and effective.

Quick guide on how to complete corporate guaranty 497328556

Complete Corporate Guaranty effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Corporate Guaranty on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Corporate Guaranty with ease

- Obtain Corporate Guaranty and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Corporate Guaranty and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a corporate guaranty, and how does it work?

A corporate guaranty is a legal commitment made by a corporation to fulfill the obligations of another party in the event of a default. With airSlate SignNow, you can easily create and manage corporate guaranty agreements, ensuring all parties are protected and informed throughout the signing process.

-

Why should my business use airSlate SignNow for corporate guaranties?

Using airSlate SignNow for corporate guaranties streamlines the document signing process, offering security, efficiency, and ease of use. Our platform allows you to sign, send, and manage your guaranty agreements digitally, saving time and reducing paperwork.

-

How much does airSlate SignNow cost for managing corporate guaranties?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The cost of using our platform for corporate guaranties is extremely competitive, providing signNow savings compared to traditional paper-based methods.

-

What features does airSlate SignNow provide for corporate guaranty management?

Our platform offers various features for corporate guaranty management, including customizable templates, automated reminders, and secure cloud storage. Additionally, airSlate SignNow ensures compliance with eSignature laws, making your corporate guaranty documents legally binding.

-

Can I integrate airSlate SignNow with other software for corporate guaranty workflow?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your corporate guaranty workflow. Whether you need CRM, project management, or cloud storage solutions, you can easily connect them with our platform for optimal efficiency.

-

Is airSlate SignNow secure for handling sensitive corporate guaranties?

Absolutely! airSlate SignNow employs top-notch security measures, including data encryption and multi-factor authentication, to safeguard your corporate guaranties. Your sensitive documents are stored securely, ensuring peace of mind for your business.

-

How does airSlate SignNow improve the speed of corporate guaranty processing?

airSlate SignNow improves the speed of corporate guaranty processing by facilitating instant electronic signatures and automated workflows. This means that once your document is created, it can be signed and sent out for approvals in just minutes, expediting the entire process.

Get more for Corporate Guaranty

Find out other Corporate Guaranty

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors