Multistate Note Fixed Rate Form

What is the Multistate Note Fixed Rate

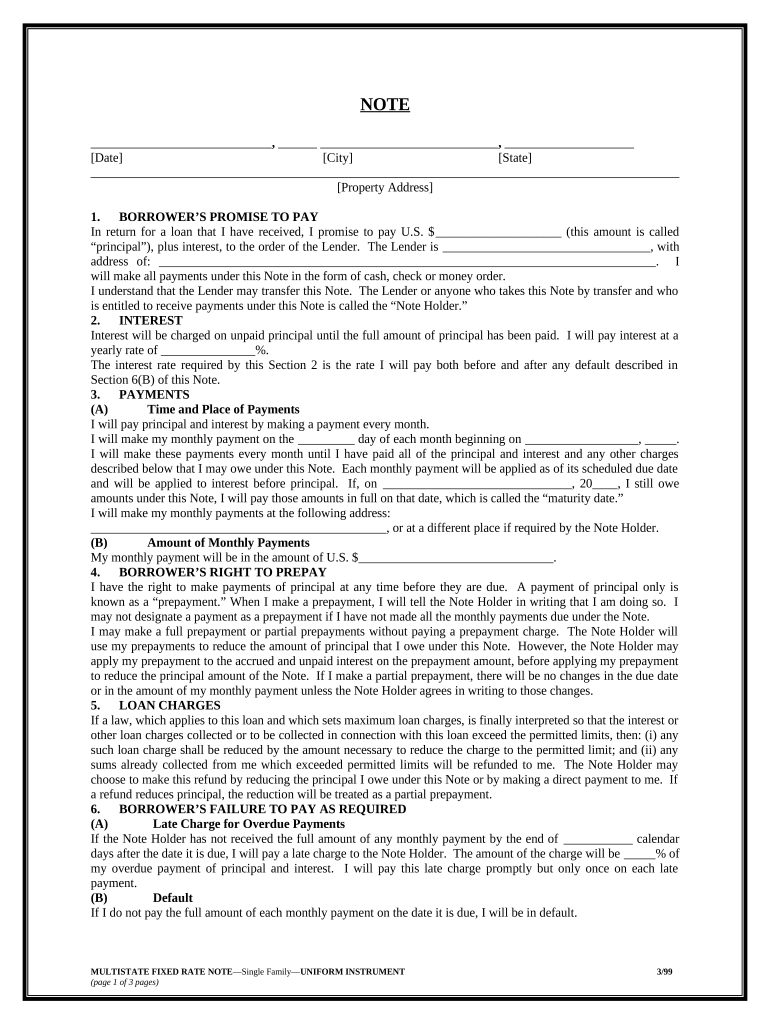

The multistate note fixed rate is a financial instrument used primarily in real estate transactions across multiple states. It serves as a secured note that outlines the terms of a loan, including the interest rate, payment schedule, and the obligations of the borrower. This type of note is particularly useful for lenders who operate in various jurisdictions, as it provides a standardized approach to securing loans while accommodating state-specific regulations.

How to Use the Multistate Note Fixed Rate

Using the multistate note fixed rate involves several key steps. First, both the lender and borrower should review the terms outlined in the document to ensure mutual understanding and agreement. Next, the borrower must provide necessary personal and financial information to complete the form accurately. Once filled out, both parties should sign the document electronically or in person, depending on their preference and the legal requirements of their respective states. It is essential to retain a copy of the signed note for future reference.

Steps to Complete the Multistate Note Fixed Rate

Completing the multistate note fixed rate requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary information, including borrower details and loan specifics.

- Fill out the form accurately, ensuring all fields are completed.

- Review the document for any errors or omissions.

- Sign the document electronically using a secure eSignature platform, or print it for manual signing.

- Distribute copies to all parties involved for their records.

Legal Use of the Multistate Note Fixed Rate

The legal use of the multistate note fixed rate is governed by various state laws and regulations. To ensure that the note is enforceable, it must comply with the Uniform Commercial Code (UCC) and any specific state requirements. This includes proper execution, adherence to interest rate limits, and clear terms regarding default and remedies. It is advisable to consult with a legal professional to confirm compliance with applicable laws.

State-Specific Rules for the Multistate Note Fixed Rate

Each state may have unique rules that affect the use and enforceability of the multistate note fixed rate. These rules can include specific disclosure requirements, limitations on interest rates, and procedures for foreclosure in case of default. It is crucial for both lenders and borrowers to familiarize themselves with the regulations in their respective states to avoid potential legal issues.

Examples of Using the Multistate Note Fixed Rate

Examples of the multistate note fixed rate in action include scenarios such as a lender providing a loan for a property that spans multiple states or a borrower seeking financing for a business with operations in different jurisdictions. In these cases, the multistate note fixed rate offers a streamlined approach to securing the loan while ensuring compliance with the relevant laws in each state.

Quick guide on how to complete multistate note fixed rate

Prepare Multistate Note Fixed Rate effortlessly on any gadget

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct template and securely preserve it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without unnecessary delays. Manage Multistate Note Fixed Rate on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Multistate Note Fixed Rate seamlessly

- Locate Multistate Note Fixed Rate and click on Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would prefer to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Multistate Note Fixed Rate while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a multistate note fixed rate?

A multistate note fixed rate is a type of financial instrument used for securing loans across multiple states at a predetermined interest rate. This can provide borrowers with stability and predictability in their loan payments. Utilizing tools like airSlate SignNow can streamline the process of signing and managing these documents efficiently.

-

How does airSlate SignNow handle multistate note fixed rate documents?

airSlate SignNow allows users to easily create, send, and eSign multistate note fixed rate documents online. Our platform ensures that all legal requirements are met, making document management simple and efficient. Users can track the status of their documents in real-time, ensuring a smooth signing process.

-

What are the pricing options for using airSlate SignNow for multistate note fixed rate projects?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes that need to manage multistate note fixed rate documents. Our competitive pricing structures ensure you get the best value while using our powerful eSignature solution. You can select the plan that best fits your needs and start managing your documents today.

-

What features does airSlate SignNow provide for managing multistate note fixed rate documents?

airSlate SignNow offers a range of features designed specifically for multistate note fixed rate document management, including customizable templates, secure eSignature capabilities, and document tracking. These features help ensure compliance and make it easy to collaborate with multiple signers across different states. With our intuitive interface, you can manage your documents effortlessly.

-

What are the benefits of using airSlate SignNow for multistate note fixed rate transactions?

Using airSlate SignNow for multistate note fixed rate transactions offers numerous benefits, including increased efficiency, reduced paperwork, and cost savings. Our solution enhances the signing experience by allowing all parties to sign digitally, reducing the time spent on manual processes. This ultimately leads to faster transactions and improved customer satisfaction.

-

Can airSlate SignNow integrate with other tools for multistate note fixed rate services?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, making it easy to manage multistate note fixed rate services alongside your existing workflows. Whether you need CRM, payment processing, or document management tools, our platform can connect with them to optimize your operations. This integration ensures a smooth user experience across all your processes.

-

Is it secure to use airSlate SignNow for multistate note fixed rate documents?

Absolutely, airSlate SignNow prioritizes the security of your multistate note fixed rate documents by employing bank-level encryption and ensuring compliance with industry standards. Our platform features multi-factor authentication and secure data storage to protect sensitive information. You can trust us to keep your documents secure throughout the signing process.

Get more for Multistate Note Fixed Rate

- Chase loan modification number 2018 2019 form

- 107453aeschet 0119 page 1 of 12 form

- Direction of signature evantage equity trust company form

- Ira distribution request form wells fargo asset management

- Tsp 17 2015 2019 form

- Entrust group inc 2018 2019 form

- Trust certification form edward jones 2014 2019

- 403b transaction authorization form bay bridge administrators

Find out other Multistate Note Fixed Rate

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document