Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft Form

What is the Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

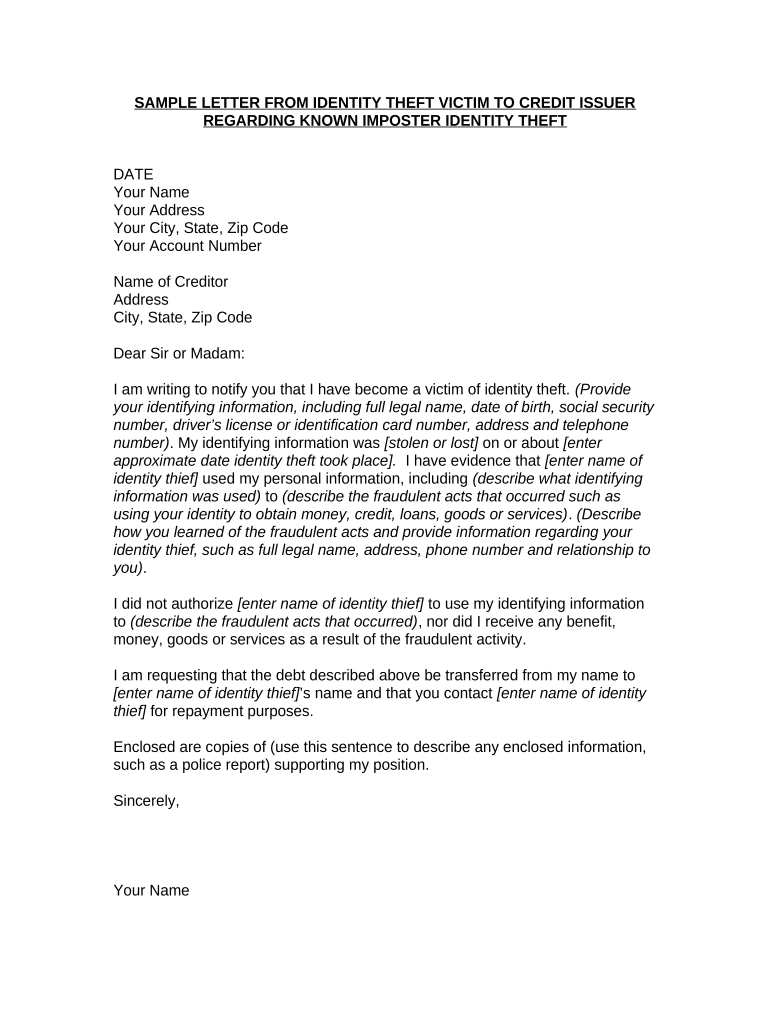

The letter from an identity theft victim to a credit issuer regarding known imposter identity theft serves as a formal notification to the credit issuer about fraudulent activity linked to the victim's identity. This letter is essential for disputing unauthorized charges and protecting the victim's credit history. It outlines the specifics of the identity theft incident, including the nature of the fraudulent transactions and any relevant account details. By submitting this letter, the victim seeks to inform the credit issuer of the situation and request corrective actions to mitigate the impact of the identity theft.

Key Elements of the Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

When drafting this letter, it is important to include several key elements to ensure clarity and effectiveness. The letter should contain:

- Victim's Information: Full name, address, and contact details.

- Credit Issuer's Information: Name of the credit issuer and relevant address.

- Subject Line: A clear subject line indicating the purpose of the letter.

- Description of Identity Theft: A detailed account of the identity theft incident, including dates and types of fraudulent activity.

- Request for Action: A specific request for the credit issuer to investigate and rectify the fraudulent charges.

- Supporting Documentation: Mention of any attached documents that support the claim, such as police reports or identity theft affidavits.

- Signature: A signature to authenticate the letter.

Steps to Complete the Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

Completing the letter involves several straightforward steps to ensure it is effective and comprehensive:

- Gather all necessary personal information and documentation related to the identity theft.

- Clearly outline the fraudulent transactions and any relevant details in the letter.

- Draft the letter using a professional tone, ensuring all key elements are included.

- Review the letter for accuracy and completeness before sending.

- Send the letter via a secure method, such as certified mail, to ensure it is received.

Legal Use of the Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

This letter is a legally recognized document that serves to protect the victim's rights under various consumer protection laws. It is crucial for initiating the process of disputing fraudulent charges and can be used as evidence in case of further legal action. By documenting the identity theft and notifying the credit issuer, the victim establishes a formal record that may be necessary for legal proceedings or credit repair efforts.

How to Use the Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

Using the letter effectively involves several steps. First, ensure that all relevant information is accurately presented. Next, send the letter to the correct department of the credit issuer, typically the fraud department. It is advisable to keep copies of the letter and any correspondence for personal records. Following up with the credit issuer after a reasonable time frame can help ensure that the matter is being addressed. Additionally, monitoring credit reports for changes is important to track the resolution of the identity theft issue.

Examples of Using the Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

Examples of scenarios where this letter is useful include:

- A victim discovers unauthorized charges on their credit card statement.

- A person receives a notice from a credit issuer about an account opened in their name without their consent.

- Individuals who have experienced identity theft and have filed a police report can use this letter to formally notify their credit issuers.

Quick guide on how to complete letter from identity theft victim to credit issuer regarding known imposter identity theft

Effortlessly complete Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft with ease

- Obtain Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your edits.

- Select your preferred method for sending your form, be it email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors necessitating new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

A Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft is a formal document used by individuals who have been a victim of identity theft. This letter notifies the credit issuer about the fraudulent activities and requests the correction of any inaccurate information on their credit report. Using this letter can help victims reclaim their identity and restore their credit standing.

-

How can airSlate SignNow help in creating this letter?

airSlate SignNow provides templates that simplify the process of drafting a Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft. The platform allows users to quickly fill in necessary details and customize the letter according to their needs. This saves time and ensures the letter meets all required standards for effective communication with credit issuers.

-

Is there a cost associated with using airSlate SignNow for creating documents?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different business needs. Each plan includes access to features that enable users to create, sign, and send documents, including a Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft. The pricing is designed to be cost-effective, making it accessible for individuals and businesses alike.

-

What features does airSlate SignNow offer for document eSigning?

airSlate SignNow includes features such as customizable templates, multi-party signing, and mobile compatibility, enhancing user experience. For a Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft, these features can streamline the signing process and provide added convenience. Additionally, real-time notifications ensure you stay updated on document status.

-

What benefits does airSlate SignNow offer for businesses dealing with identity theft documentation?

Using airSlate SignNow to prepare a Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft offers numerous benefits, such as enhanced security and compliance. The platform’s encrypted storage protects sensitive information, while audit trails provide transparency and accountability for all signed documents. This leads to improved trust and credibility with clients.

-

Can I integrate airSlate SignNow with other software solutions?

Absolutely! airSlate SignNow supports various integrations with popular software solutions such as CRM systems, cloud storage, and productivity tools. This allows users to access and send their Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft seamlessly across different platforms. Such integrations can streamline workflows and improve efficiency in business operations.

-

How does airSlate SignNow ensure the security of documents?

airSlate SignNow prioritizes document security by utilizing advanced encryption methods and secure data centers. When creating a Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft, users can rest assured that their information is safe from unauthorized access. Additionally, features like two-factor authentication add extra layers of protection for sensitive documents.

Get more for Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

Find out other Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors