Trusts Children Form

What is the Trusts Children

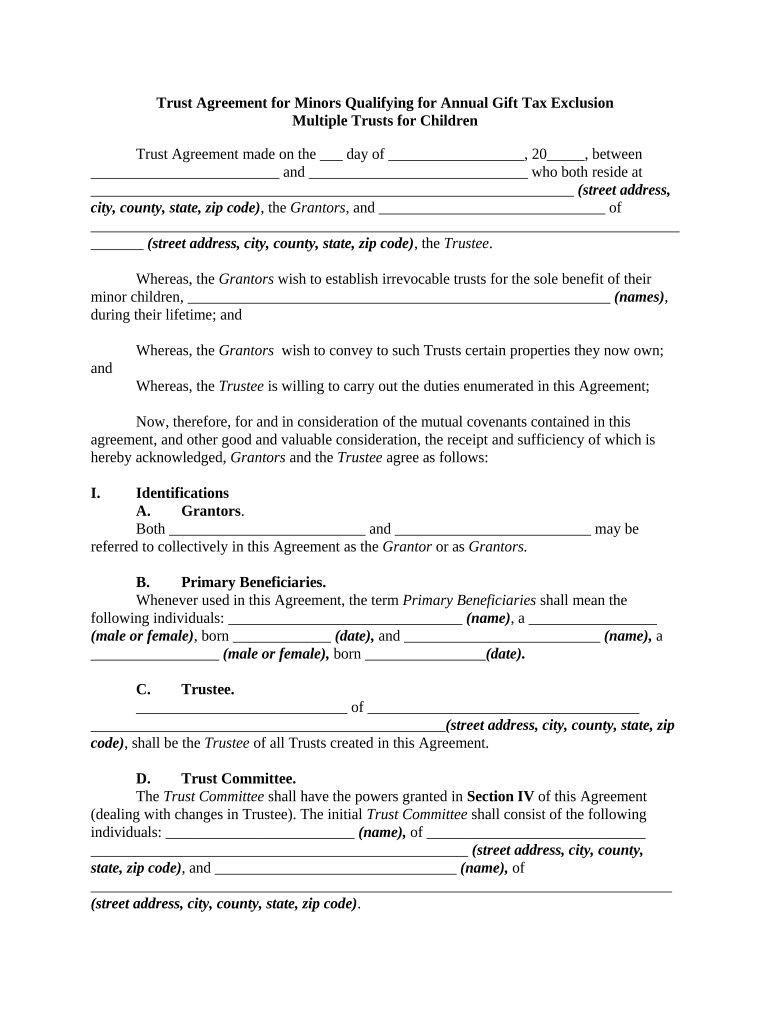

The trusts children form is a legal document designed to establish a trust for the benefit of minors. This form allows individuals to designate assets and resources that will be managed by a trustee until the children reach a specified age or meet certain conditions. Trusts can be used for various purposes, including education, healthcare, and general support, ensuring that the children's needs are met even in the absence of their guardians. This legal framework helps protect the interests of minors, providing a structured approach to asset management.

How to use the Trusts Children

Using the trusts children form involves several key steps to ensure its effectiveness and legality. First, the individual creating the trust must gather all necessary information about the beneficiaries, including their names, dates of birth, and any specific needs or requirements. Next, the individual must choose a reliable trustee who will manage the trust assets responsibly. Once the form is completed, it should be signed and dated by the creator and the trustee, and it may need to be notarized to enhance its legal standing. Finally, it's important to keep the document in a safe place and inform the trustee of its location.

Steps to complete the Trusts Children

Completing the trusts children form requires careful attention to detail. Here are the steps to follow:

- Identify the beneficiaries: List all children who will benefit from the trust.

- Determine the assets: Specify what assets will be placed in the trust, such as cash, property, or investments.

- Select a trustee: Choose a trustworthy individual or institution to manage the trust.

- Fill out the form: Provide all required information accurately, including the terms of the trust.

- Sign and date the form: Ensure that all parties involved sign the document, and consider notarization for added validity.

- Store the document securely: Keep the completed form in a safe location and inform the trustee of its whereabouts.

Legal use of the Trusts Children

The trusts children form must comply with specific legal requirements to be considered valid. This includes adherence to state laws regarding trusts, which can vary significantly. The form should clearly outline the terms of the trust, including how and when the assets will be distributed to the beneficiaries. Additionally, the document must be executed properly, with signatures from the creator and trustee, and may require notarization. Understanding these legal aspects is crucial to ensure the trust operates as intended and provides the necessary protections for the children involved.

Key elements of the Trusts Children

Several key elements are essential for the trusts children form to function effectively:

- Beneficiaries: Clearly identify the children who will benefit from the trust.

- Trustee: Designate a responsible individual or organization to manage the trust.

- Assets: Specify the assets included in the trust and their intended use.

- Distribution terms: Outline how and when the assets will be distributed to the beneficiaries.

- Legal compliance: Ensure that the trust adheres to state laws and regulations.

Examples of using the Trusts Children

There are various scenarios in which the trusts children form can be beneficial. For instance, a parent may establish a trust to fund their child's education, ensuring that the necessary resources are available when the child reaches college age. Another example is a grandparent who wants to set aside funds for their grandchildren's future needs, such as buying a home or starting a business. These examples illustrate how trusts can provide financial security and support for children in a structured manner, tailored to their specific needs and circumstances.

Quick guide on how to complete trusts children

Prepare Trusts Children effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate template and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without hindrances. Manage Trusts Children on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Trusts Children effortlessly

- Find Trusts Children and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Modify and eSign Trusts Children and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are trusts children, and how can they benefit my family?

Trusts children refer to legal arrangements that allow you to manage and distribute assets to your children, ensuring their financial security. By creating a trust, you can control when and how your children access funds, helping them to be responsible with money. Utilizing trusts for children helps in providing peace of mind and safeguarding their future.

-

How does airSlate SignNow facilitate the creation of trusts for children?

airSlate SignNow simplifies the process of creating and signing documents related to trusts children through its intuitive eSigning platform. With just a few clicks, you can upload, edit, and send trust documents to relevant parties for quick electronic signing. This convenience ensures that your estate planning documents are executed efficiently.

-

What features does airSlate SignNow offer for managing trusts for children?

AirSlate SignNow provides features such as customizable templates for trust documents, secure storage, and tracking capabilities. These tools allow you to create professional and legally binding documents specifically for trusts children, making the management process seamless for you and your beneficiaries.

-

Are there specific pricing plans for handling trusts children with airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to both individual users and businesses needing to manage trusts for children. Pricing is transparent, and you can choose a plan based on the volume of documents you plan to eSign or manage. This cost-effective solution ensures you find the right fit for your legal needs.

-

What are the benefits of using airSlate SignNow for trusts children documentation?

By utilizing airSlate SignNow for trusts children, you benefit from a streamlined documentation process that saves time and reduces the complexities of traditional paper signing. Enhanced security measures protect sensitive information, ensuring your children’s trusts are handled with the utmost care. Additionally, the platform’s user-friendly interface makes it accessible for all users.

-

Can airSlate SignNow integrate with other tools for managing trusts children?

Yes, airSlate SignNow offers various integrations with tools frequently used in financial and legal domains, allowing seamless management of trusts children. Whether you use accounting software, cloud storage, or customer relationship management systems, integrating with airSlate SignNow can enhance your workflow. This interoperability supports effective management of trust documentation.

-

Is it safe to use airSlate SignNow for important trusts children documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, including trusts children, through encryption and strict access controls. All signed documents are securely stored and backed up, protecting them from unauthorized access. You can trust airSlate SignNow to safeguard your sensitive information while you focus on your family's future.

Get more for Trusts Children

- Printable client intake form for zoning appeal development application

- Anthem mediblue hmo national united brokers nub form

- Clinic yes form

- Please click here to download adobe acrobat form

- For official use only rush university medical center rush form

- Controlling tuberculosis in the united states form

- Screening questionnaire and consent form cair

- How to file a claimamerican family insurance form

Find out other Trusts Children

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free