Agreement Credit Form

What is the Agreement Credit

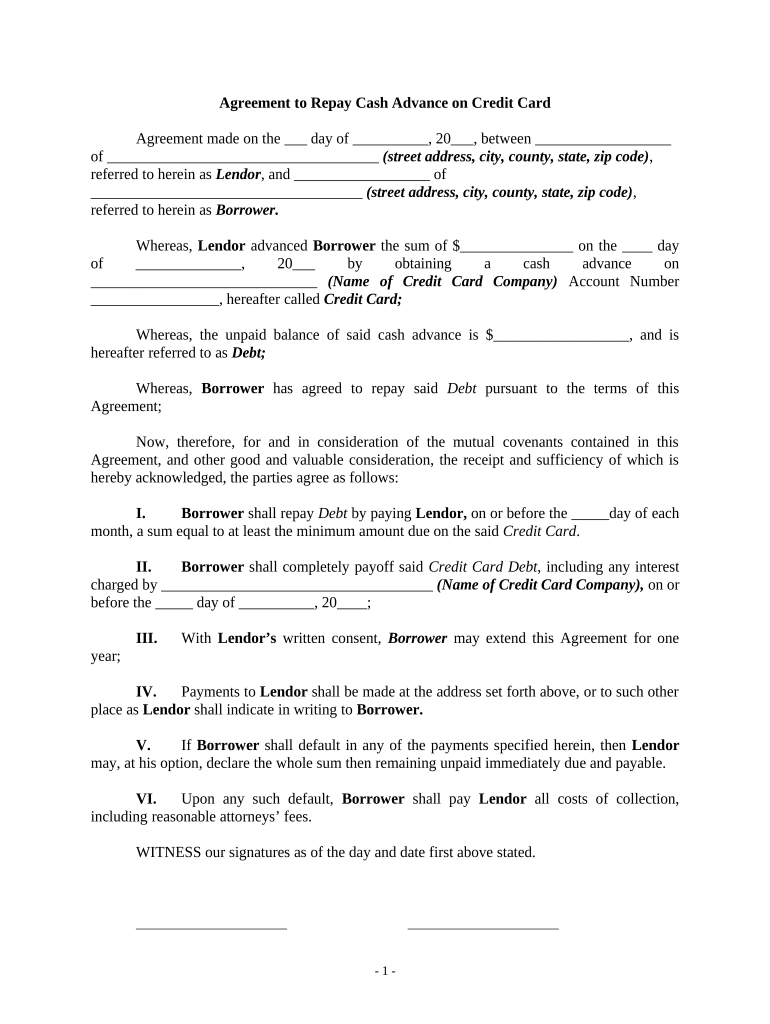

The agreement credit is a financial arrangement that allows individuals or businesses to receive funds based on a mutual understanding of repayment terms. This credit is often used for various purposes, such as funding projects, managing cash flow, or covering unexpected expenses. It serves as a formal acknowledgment of the borrower's obligation to repay the amount borrowed, typically within a specified timeframe.

Steps to complete the Agreement Credit

Completing the agreement credit involves several key steps to ensure clarity and legal compliance. First, both parties should clearly outline the terms of the credit, including the principal amount, interest rate, repayment schedule, and any penalties for late payments. Next, the agreement should be documented in writing, with both parties signing the document to validate it. Using a reliable eSignature solution can streamline this process, ensuring that all signatures are securely captured and stored. Finally, it is essential to keep a copy of the signed agreement for future reference.

Legal use of the Agreement Credit

The legal validity of the agreement credit hinges on compliance with applicable laws and regulations. In the United States, this means adhering to the Uniform Commercial Code (UCC) and relevant state laws governing loans and credit agreements. For the agreement to be enforceable, it must include essential elements such as offer, acceptance, consideration, and mutual consent. Utilizing a trustworthy platform for signing and storing the agreement can enhance its legal standing by providing a clear audit trail and compliance with eSignature regulations.

Key elements of the Agreement Credit

Several key elements define the structure of an agreement credit. These include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount, if applicable.

- Repayment Terms: Specific details regarding when and how the borrower will repay the loan.

- Default Clauses: Conditions under which the borrower may default on the agreement and the consequences thereof.

- Signatures: Both parties must sign the agreement to indicate acceptance of the terms.

How to use the Agreement Credit

Using the agreement credit effectively requires understanding its terms and managing repayments responsibly. Borrowers should familiarize themselves with the repayment schedule, ensuring they make payments on time to avoid penalties. It is also advisable to maintain open communication with the lender, especially if financial difficulties arise. By doing so, borrowers can negotiate potential adjustments to the repayment plan, fostering a positive relationship with the lender.

Who Issues the Form

The agreement credit form is typically issued by the lender, which can be a financial institution, a private lender, or even a peer-to-peer lending platform. The issuer is responsible for providing the necessary documentation that outlines the terms of the credit. It is important for borrowers to review the form carefully to ensure that all details are accurate and reflect the agreed-upon terms before signing.

Quick guide on how to complete agreement credit

Complete Agreement Credit effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without downtime. Manage Agreement Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Agreement Credit seamlessly

- Obtain Agreement Credit and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize signNow parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Agreement Credit and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the agreement repay feature in airSlate SignNow?

The agreement repay feature in airSlate SignNow allows users to create and manage repayment agreements efficiently. This feature simplifies the process of drafting, sending, and signing documents related to repayment terms while ensuring compliance and security.

-

How does airSlate SignNow facilitate the agreement repay process?

airSlate SignNow streamlines the agreement repay process by providing a user-friendly platform for electronic signatures and document management. Users can easily customize repayment agreements and send them directly to clients for quick signing, ensuring a fast turnaround.

-

What are the pricing options for using airSlate SignNow for agreement repay?

airSlate SignNow offers various pricing tiers to accommodate different business needs, including specific plans for users focusing on agreement repay. These plans come with a range of features, allowing businesses to choose the best fit based on their volume of transactions and required functionalities.

-

Are there any integrations available for agreement repay with airSlate SignNow?

Yes, airSlate SignNow provides several integrations that enhance the agreement repay experience. You can connect with popular CRM software, payment gateways, and other tools to streamline the repayment process and maintain seamless operational workflows.

-

What are the benefits of using airSlate SignNow for my agreement repay needs?

Using airSlate SignNow for your agreement repay needs offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved customer experience. The platform's electronic signature capabilities also help accelerate the process, allowing for quicker execution and better cash flow.

-

Is airSlate SignNow secure for managing agreement repay documentation?

Absolutely, airSlate SignNow prioritizes the security of your documents. It employs robust encryption protocols and follows industry standards to ensure that all agreement repay documents remain confidential and protected from unauthorized access.

-

Can I customize my agreement repay templates in airSlate SignNow?

Yes, airSlate SignNow allows users to fully customize their agreement repay templates. You can add specific clauses, terms, and branding to ensure that your repayment agreements meet your unique business requirements while maintaining a professional appearance.

Get more for Agreement Credit

- 3 communications information processing and data storage

- Chapter 826 rcw relocation assistancereal form

- Optional form 1012 travel voucher

- Merit promotion referral form

- Certificate of inspection of pressure vessels form

- Standard form 1035 public voucher for purchases and

- Sec 169a60 mn statutes form

- Do you know about cut off timings in mutual funds the form

Find out other Agreement Credit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors