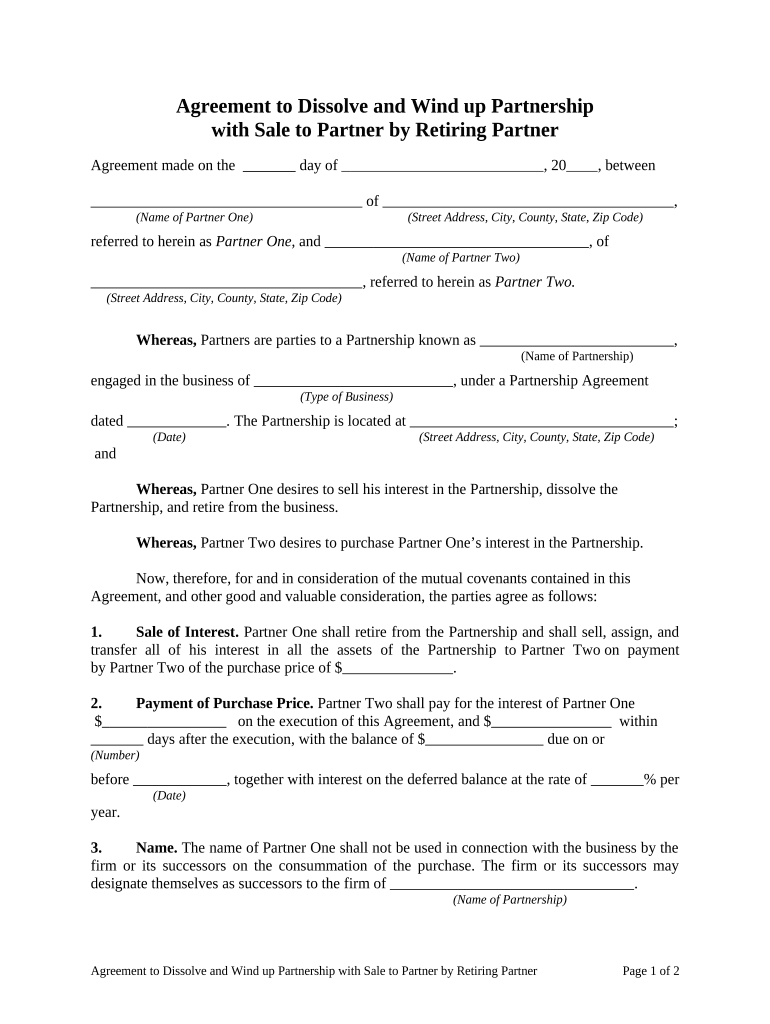

Dissolve Wind Up Form

What is the dissolve wind up?

The dissolve wind up refers to the formal process through which a business entity, such as a corporation or limited liability company (LLC), legally ceases its operations and dissolves its existence. This procedure involves several steps to ensure compliance with state laws and regulations. It is essential for business owners to understand the implications of this process, as it affects the entity's legal status, tax obligations, and liability issues.

Steps to complete the dissolve wind up

Completing the dissolve wind up involves a series of structured steps that must be followed to ensure legal compliance. Here are the key steps:

- Board Resolution: If applicable, the board of directors must pass a resolution to dissolve the business.

- Notify Stakeholders: Inform all stakeholders, including employees, creditors, and shareholders, about the decision to dissolve.

- Settle Debts: Pay off any outstanding debts and obligations to creditors before proceeding with the dissolution.

- File Articles of Dissolution: Submit the necessary dissolution paperwork to the appropriate state agency, often the Secretary of State.

- Cancel Licenses and Permits: Ensure that all business licenses and permits are canceled to prevent future liabilities.

Legal use of the dissolve wind up

The legal use of the dissolve wind up is crucial for ensuring that the business is officially recognized as dissolved by the state. This process protects the owners from future liabilities associated with the business. It is important to follow the specific legal requirements set forth by the state in which the business operates, as these can vary significantly. Failure to properly dissolve a business can lead to ongoing tax obligations and legal issues.

Key elements of the dissolve wind up

Several key elements must be addressed during the dissolve wind up process to ensure a smooth and compliant dissolution:

- Final Tax Returns: Submit final tax returns to the IRS and state tax authorities, indicating that the business is no longer active.

- Distribution of Assets: Distribute any remaining assets to shareholders or members after all debts have been settled.

- Documentation: Maintain thorough documentation of all steps taken during the dissolution process for future reference.

State-specific rules for the dissolve wind up

Each state has its own rules and regulations governing the dissolve wind up process. It is essential for business owners to familiarize themselves with the specific requirements in their state, as these can include different forms, fees, and timelines. Consulting with a legal professional or accountant can provide valuable guidance to ensure compliance with state laws.

Form Submission Methods

The dissolve wind up form can typically be submitted through various methods, depending on the state requirements. Common submission methods include:

- Online Submission: Many states offer online portals for submitting dissolution forms, providing a quick and efficient way to complete the process.

- Mail: Forms can often be printed and mailed to the appropriate state agency.

- In-Person: Some states allow for in-person submissions at designated offices, which can be useful for immediate assistance and confirmation.

Quick guide on how to complete dissolve wind up 497329150

Complete Dissolve Wind Up effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Dissolve Wind Up on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Dissolve Wind Up with ease

- Locate Dissolve Wind Up and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or mask sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Dissolve Wind Up and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to dissolve wind up in a business context?

To dissolve wind up refers to the legal process of terminating a company’s operations, settling its debts, and distributing any remaining assets to shareholders. This process can vary depending on the jurisdiction and involves certain legal requirements that must be met to ensure a smooth closure.

-

How can airSlate SignNow assist in the dissolve wind up process?

airSlate SignNow provides a seamless electronic signature solution that can help businesses streamline their document signing during the dissolve wind up process. With automated workflows and secure cloud storage, companies can easily manage necessary paperwork, ensuring compliance and efficient communication among all parties involved.

-

What is the pricing structure for using airSlate SignNow during a dissolve wind up?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes, including those looking to dissolve wind up their operations. Each plan includes features that support secure document handling, making it an affordable solution for companies needing to finalize their legal obligations.

-

Are there any special features in airSlate SignNow designed for businesses that need to dissolve wind up?

Yes, airSlate SignNow includes features specifically designed to facilitate document management during the dissolve wind up process. Users can leverage templates, automated reminders, and audit trails to ensure that all necessary documents are signed and filed appropriately.

-

What benefits does airSlate SignNow offer for businesses undergoing dissolve wind up?

Using airSlate SignNow during a dissolve wind up can save time and reduce stress by eliminating the need for printing, scanning, and mailing physical documents. The platform enhances collaboration, allows for real-time tracking of signatures, and ensures that all documents are securely stored for future reference.

-

Can airSlate SignNow integrate with other tools while managing a dissolve wind up?

Absolutely! airSlate SignNow offers integrations with a variety of business applications, allowing users to manage their dissolve wind up more effectively. By connecting with tools like CRMs, accounting software, and project management platforms, businesses can ensure a streamlined process.

-

Is it easy to migrate existing documents to airSlate SignNow for a dissolve wind up?

Yes, migrating existing documents to airSlate SignNow is a straightforward process. Users can upload a variety of document formats and start utilizing the platform’s features immediately, making it convenient for businesses looking to dissolve wind up efficiently.

Get more for Dissolve Wind Up

- A sample of a completed usaid form 0412

- Undergraduate and visiting students form

- Il license fill out paper packet or send through ncees form

- Room numbers in the hospital form

- Fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out fill out 416850860 form

- Maryland cds 2012 2019 form

- Cms 20031 transfer of appeal rights transfer of appeal rights cms 20031 acceptence of appeal rights form

- Peachcare application form

Find out other Dissolve Wind Up

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free