Agreement for Purchase of Business Assets from a Corporation Form

What is the Agreement For Purchase Of Business Assets From A Corporation

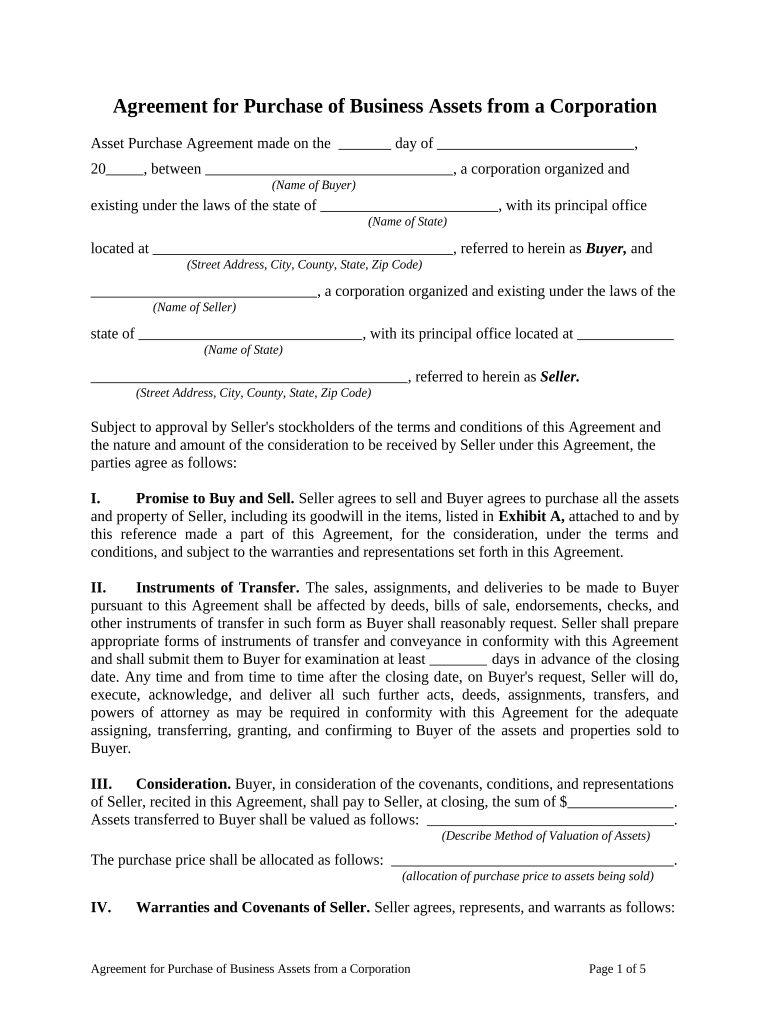

The Agreement For Purchase Of Business Assets From A Corporation is a legal document that outlines the terms and conditions under which a buyer acquires specific assets from a corporation. This type of agreement is crucial in ensuring that both parties understand their rights and obligations regarding the transaction. It typically includes details such as the description of the assets being sold, the purchase price, payment terms, and any warranties or representations made by the seller. This agreement helps facilitate a smooth transfer of ownership and protects both the buyer and seller by clearly defining the terms of the sale.

Key elements of the Agreement For Purchase Of Business Assets From A Corporation

Several key elements are essential for a comprehensive Agreement For Purchase Of Business Assets From A Corporation. These include:

- Asset Description: A detailed list of the assets being purchased, including physical property, equipment, and intellectual property.

- Purchase Price: The total amount to be paid for the assets, along with payment terms and conditions.

- Warranties and Representations: Statements made by the seller regarding the condition and ownership of the assets.

- Closing Conditions: Requirements that must be met before the transaction can be finalized.

- Indemnification: Provisions outlining responsibilities for any claims or liabilities that may arise post-transaction.

Steps to complete the Agreement For Purchase Of Business Assets From A Corporation

Completing the Agreement For Purchase Of Business Assets From A Corporation involves several steps to ensure accuracy and compliance. Here are the general steps to follow:

- Identify the Parties: Clearly state the names and addresses of the buyer and seller.

- List the Assets: Provide a detailed description of the assets being sold.

- Determine the Purchase Price: Specify the total cost and any payment terms.

- Include Warranties: Outline any warranties or representations made by the seller.

- Review and Sign: Both parties should review the agreement carefully before signing to ensure all terms are understood and agreed upon.

Legal use of the Agreement For Purchase Of Business Assets From A Corporation

The Agreement For Purchase Of Business Assets From A Corporation is legally binding once signed by both parties, provided it meets all legal requirements. To ensure its enforceability, the agreement should comply with relevant state laws and regulations. It is advisable to consult with a legal professional to confirm that the agreement adheres to all necessary legal standards and adequately protects the interests of both the buyer and seller.

How to use the Agreement For Purchase Of Business Assets From A Corporation

Using the Agreement For Purchase Of Business Assets From A Corporation involves several practical steps. First, ensure that both parties have a clear understanding of the assets being sold and the terms of the sale. Next, fill out the agreement with accurate information regarding the buyer, seller, and asset details. Once completed, both parties should sign the document, ideally in the presence of a witness or notary to enhance its legal standing. After signing, each party should retain a copy of the agreement for their records.

Digital vs. Paper Version

The Agreement For Purchase Of Business Assets From A Corporation can be executed in both digital and paper formats. Digital versions offer advantages such as ease of storage, quick access, and the ability to eSign documents securely. Electronic signatures are recognized legally under the ESIGN Act and UETA, making them a valid option for executing this agreement. Conversely, paper versions may be preferred in situations requiring physical signatures or where parties are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all legal requirements are met for the agreement to be enforceable.

Quick guide on how to complete agreement for purchase of business assets from a corporation

Complete Agreement For Purchase Of Business Assets From A Corporation effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Agreement For Purchase Of Business Assets From A Corporation on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Agreement For Purchase Of Business Assets From A Corporation with ease

- Locate Agreement For Purchase Of Business Assets From A Corporation and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or downloading it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and eSign Agreement For Purchase Of Business Assets From A Corporation and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Agreement For Purchase Of Business Assets From A Corporation?

An Agreement For Purchase Of Business Assets From A Corporation is a legal document outlining the terms under which a buyer purchases assets from a corporation. This agreement details the specific assets included in the sale, payment terms, and any liabilities being assumed by the buyer. Understanding this agreement is crucial for both parties to ensure a smooth transaction.

-

How can airSlate SignNow assist with creating an Agreement For Purchase Of Business Assets From A Corporation?

airSlate SignNow simplifies the process of creating an Agreement For Purchase Of Business Assets From A Corporation by offering customizable templates. Users can easily fill in the necessary information and securely eSign the document. This streamlines the paperwork, making it more efficient and saving time.

-

What are the pricing options for using airSlate SignNow for agreements?

airSlate SignNow offers several pricing plans to accommodate different business needs, including packages suitable for startups and large corporations. You can choose a plan that fits your budget and usage requirements for creating and managing documents like an Agreement For Purchase Of Business Assets From A Corporation. Additionally, there are no hidden fees, ensuring you get transparent pricing.

-

Are there any special features for managing agreements with airSlate SignNow?

Absolutely! airSlate SignNow provides features such as template creation, real-time document tracking, and automated reminders for signatures. These features enhance the management of your Agreement For Purchase Of Business Assets From A Corporation, ensuring both parties stay informed and engaged throughout the signing process.

-

What benefits does eSigning provide for business asset agreements?

eSigning your Agreement For Purchase Of Business Assets From A Corporation accelerates the approval process and reduces paperwork inefficiencies. It provides instant access to documentation and offers enhanced security and compliance. This modern approach guarantees that both parties can finalize transactions remotely and securely.

-

Can airSlate SignNow integrate with other software for better document management?

Yes, airSlate SignNow seamlessly integrates with various business applications, including CRM systems and cloud storage services. This compatibility allows you to manage your Agreement For Purchase Of Business Assets From A Corporation alongside existing workflows, enhancing productivity and organization within your business processes.

-

Is airSlate SignNow suitable for both small and large businesses?

Definitely! airSlate SignNow is designed to cater to both small and large businesses with scalable solutions. Whether you're drafting an Agreement For Purchase Of Business Assets From A Corporation for a single asset transaction or multiple agreements, the platform can adapt to your specific requirements.

Get more for Agreement For Purchase Of Business Assets From A Corporation

- People first application fillable 2013 form

- Duval county public schools websites form

- Appointment of campaign treasurer dsde9 form

- Four point inspection form

- Florida voter registration application ds de 39 form

- Anger scale pdf form

- Aqs 278 2005 form

- Fillable online how do i find my sites performance profile

Find out other Agreement For Purchase Of Business Assets From A Corporation

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy