Purchase Money Mortgage Form

What is the Purchase Money Mortgage Form

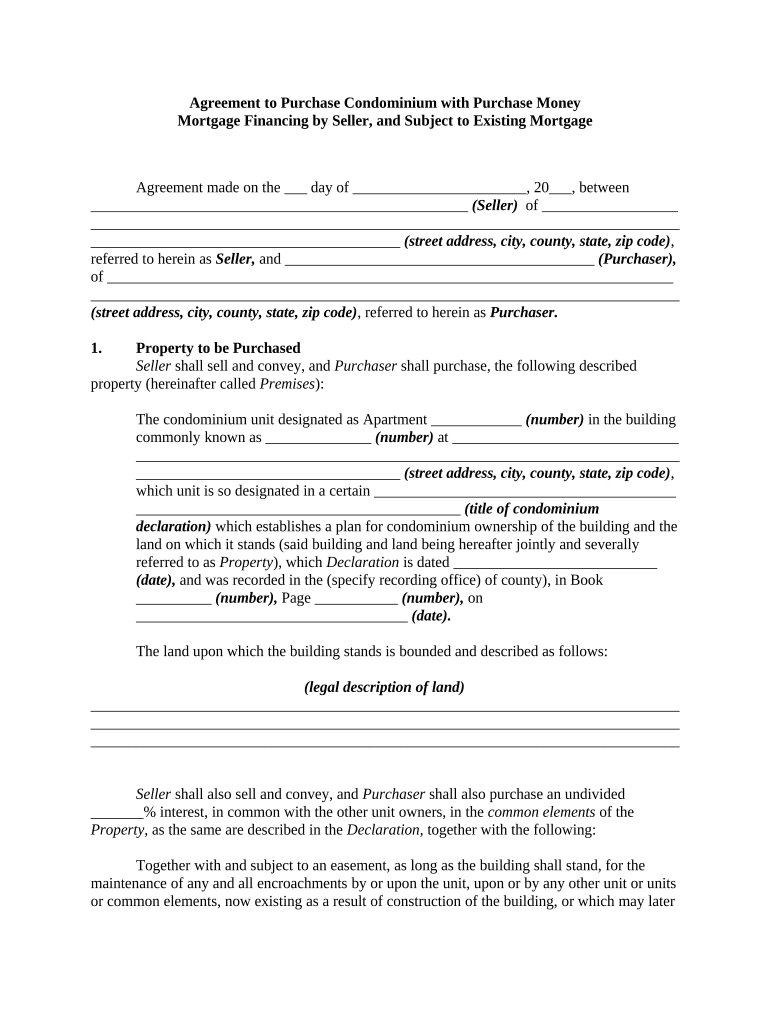

The Purchase Money Mortgage Form is a legal document used in real estate transactions where the seller provides financing to the buyer. This form outlines the terms and conditions of the mortgage, including the loan amount, interest rate, repayment schedule, and any contingencies. It is essential for both parties to understand the obligations and rights defined in this agreement, as it serves as the foundation for the financial arrangement between the buyer and the seller.

How to use the Purchase Money Mortgage Form

Using the Purchase Money Mortgage Form involves several steps. First, both the buyer and seller must agree on the terms of the mortgage, which should be clearly stated in the form. Once agreed upon, both parties need to fill out the document accurately, ensuring that all necessary details are included. After completing the form, both parties should sign it. It is advisable to retain copies for personal records and consult with a legal professional to ensure compliance with local laws.

Steps to complete the Purchase Money Mortgage Form

Completing the Purchase Money Mortgage Form requires careful attention to detail. Follow these steps:

- Gather necessary information, including the buyer's and seller's names, property details, and financial terms.

- Fill in the loan amount, interest rate, and repayment terms.

- Include any contingencies or special provisions that apply to the agreement.

- Review the form for accuracy and completeness.

- Both parties should sign and date the form in the designated areas.

Legal use of the Purchase Money Mortgage Form

The legal use of the Purchase Money Mortgage Form is governed by state and federal laws. For the form to be legally binding, it must meet specific requirements, including proper signatures and adherence to local regulations. It is crucial for both parties to ensure that the form complies with the relevant laws to avoid potential disputes or legal challenges in the future. Consulting with a legal expert can provide additional assurance of compliance.

Key elements of the Purchase Money Mortgage Form

Several key elements must be included in the Purchase Money Mortgage Form to ensure its effectiveness:

- Borrower and Lender Information: Names and contact details of both parties.

- Property Description: A detailed description of the property being financed.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: Schedule detailing how and when payments will be made.

- Signatures: Required signatures of both parties to validate the agreement.

Examples of using the Purchase Money Mortgage Form

Examples of using the Purchase Money Mortgage Form include situations where a seller agrees to finance a portion of the purchase price for a buyer. For instance, if a buyer cannot secure traditional financing, the seller may offer a Purchase Money Mortgage to facilitate the sale. This arrangement can benefit both parties, as the seller can receive interest on the financed amount while the buyer gains access to the property without needing full upfront payment.

Quick guide on how to complete purchase money mortgage form

Complete Purchase Money Mortgage Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, adjust, and eSign your documents quickly and seamlessly. Manage Purchase Money Mortgage Form on any device utilizing airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Purchase Money Mortgage Form without hassle

- Obtain Purchase Money Mortgage Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Purchase Money Mortgage Form and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit mortgage sellers?

airSlate SignNow is an eSignature platform that simplifies the document signing process for mortgage sellers. It offers a user-friendly interface that enables quick and secure signing of mortgage documents, reducing turnaround times and enhancing the overall customer experience.

-

How does airSlate SignNow ensure the security of documents for mortgage sellers?

Security is a top priority for airSlate SignNow, especially for mortgage sellers who handle sensitive information. The platform employs industry-leading security measures, including encryption and secure cloud storage, to protect all documents and signatures from unauthorized access.

-

What pricing plans are available for airSlate SignNow for mortgage sellers?

airSlate SignNow offers competitive pricing plans tailored for mortgage sellers, ensuring access to essential features without breaking the bank. Our flexible subscription options allow you to choose the best plan according to your business needs, with transparent pricing and no hidden fees.

-

Can airSlate SignNow integrate with other tools commonly used by mortgage sellers?

Yes, airSlate SignNow seamlessly integrates with popular CRM and financial platforms commonly used by mortgage sellers. This integration capability allows for a streamlined workflow, ensuring that you can easily manage documents and customer relationships within one ecosystem.

-

What features make airSlate SignNow ideal for mortgage sellers?

airSlate SignNow provides a range of features specifically beneficial for mortgage sellers, including customizable templates, automated reminders, and tracking capabilities. These features help mortgage sellers save time and enhance productivity by simplifying document management.

-

How easy is it to use airSlate SignNow for new mortgage sellers?

New mortgage sellers will find airSlate SignNow incredibly user-friendly. With an intuitive interface designed for ease of use, you can quickly create, send, and sign documents, making it easy to onboard new users and accelerate the signing process.

-

Does airSlate SignNow offer mobile access for mortgage sellers?

Absolutely! airSlate SignNow provides a mobile-friendly solution that allows mortgage sellers to access and manage documents on-the-go. This flexibility ensures that you can send and sign important mortgage documents anytime, anywhere, supporting your mobile workforce.

Get more for Purchase Money Mortgage Form

- Phone 315 448 4848 fax 315 448 4851 form

- Fillable online optumrx has partnered with covermymeds to form

- And controlled release professionals optumrx form

- Form affidavitofresidence 20160405docx

- Make checks payable to rysa pay when ordering form

- Form 440 emo 2015

- Provider recredentialing 2014 form

- Veterans clearance form

Find out other Purchase Money Mortgage Form

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple