Continuing Guaranty of Business Indebtedness by Corporate Stockholders Form

What is the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

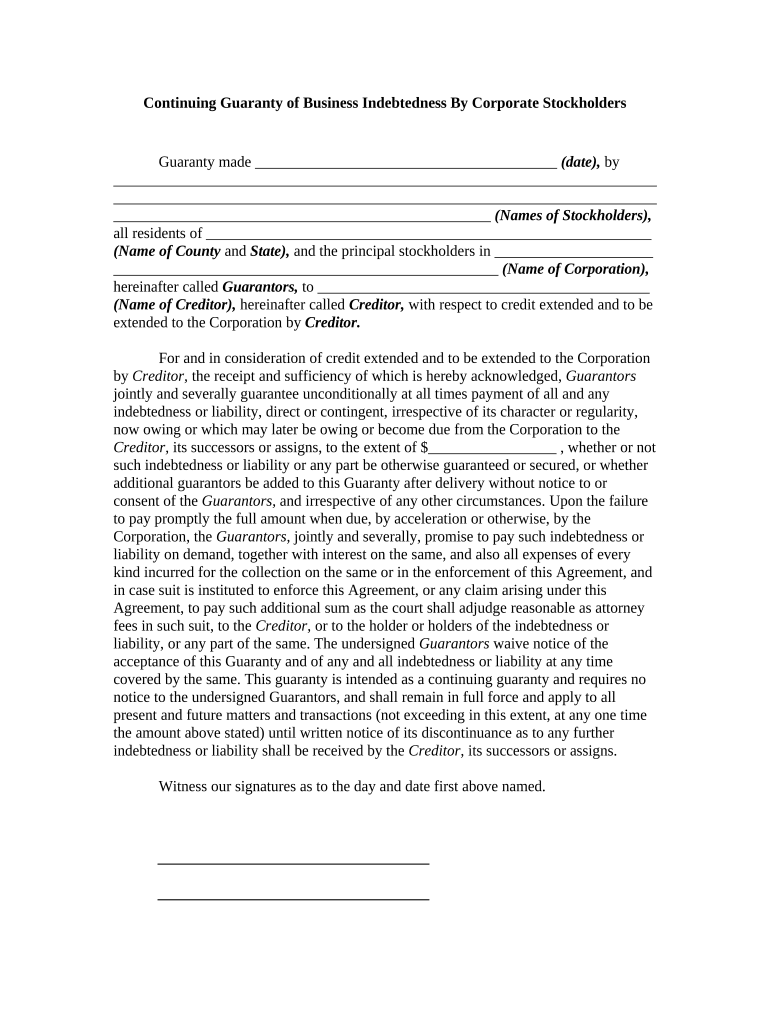

The Continuing Guaranty of Business Indebtedness by Corporate Stockholders is a legal document that allows corporate stockholders to guarantee the debts of their corporation. This form is essential for businesses seeking loans or credit, as it provides lenders with an assurance that the stockholders will be responsible for the company's obligations. The guaranty remains in effect until it is revoked or the debt is fully satisfied, offering ongoing support for the business's financial commitments.

How to use the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

Using the Continuing Guaranty of Business Indebtedness by Corporate Stockholders involves several steps. First, stockholders must review the document to understand their obligations. Next, they should fill out the form accurately, including all required information about the corporation and the nature of the debts being guaranteed. Once completed, the form must be signed by all relevant parties, ensuring that the document is legally binding. Utilizing electronic signature tools can streamline this process, making it easier to execute and store the document securely.

Steps to complete the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

Completing the Continuing Guaranty of Business Indebtedness by Corporate Stockholders involves a systematic approach:

- Review the form to understand the terms and conditions.

- Gather necessary information, including details about the corporation and the specific debts.

- Complete the form, ensuring all fields are filled out accurately.

- Have all stockholders sign the document, either physically or electronically.

- Store the completed form in a secure location for future reference.

Legal use of the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

The legal use of the Continuing Guaranty of Business Indebtedness by Corporate Stockholders is governed by state laws and regulations. For the guaranty to be enforceable, it must meet specific legal requirements, such as being in writing and signed by the guarantors. Additionally, the terms must be clear and unambiguous to avoid disputes. Compliance with relevant legal frameworks ensures that the document holds up in court if necessary.

Key elements of the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

Key elements of the Continuing Guaranty of Business Indebtedness by Corporate Stockholders include:

- Identification of parties: Clearly state the names of the stockholders and the corporation.

- Description of debts: Specify the nature and amount of the indebtedness being guaranteed.

- Duration of the guaranty: Indicate whether the guaranty is ongoing or for a specific period.

- Signatures: Ensure all stockholders sign the document to validate the agreement.

Examples of using the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

Examples of using the Continuing Guaranty of Business Indebtedness by Corporate Stockholders include scenarios where a corporation seeks a loan for expansion or operational expenses. In such cases, stockholders may provide a guaranty to reassure lenders of repayment. Another example is when a corporation needs to secure a line of credit; the guaranty can help facilitate the approval process by demonstrating the commitment of stockholders to the corporation's financial health.

Quick guide on how to complete continuing guaranty of business indebtedness by corporate stockholders

Manage Continuing Guaranty Of Business Indebtedness By Corporate Stockholders seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Handle Continuing Guaranty Of Business Indebtedness By Corporate Stockholders on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Continuing Guaranty Of Business Indebtedness By Corporate Stockholders effortlessly

- Locate Continuing Guaranty Of Business Indebtedness By Corporate Stockholders and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from your preferred device. Modify and eSign Continuing Guaranty Of Business Indebtedness By Corporate Stockholders and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

A Continuing Guaranty Of Business Indebtedness By Corporate Stockholders is a legal agreement where corporate stockholders guarantee the business's debts and obligations. This ensures lenders have recourse to the stockholders' personal assets if the business fails to meet its debts. It's an important tool for risk management in corporate finance.

-

How can airSlate SignNow facilitate the execution of the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning legal documents, including a Continuing Guaranty Of Business Indebtedness By Corporate Stockholders. With easy-to-use templates and secure electronic signature options, businesses can execute these agreements efficiently and with confidence.

-

What are the pricing options for using airSlate SignNow for the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, whether you're a small business or a larger enterprise needing to handle Continuing Guaranty Of Business Indebtedness By Corporate Stockholders at scale. Plans are designed to be budget-friendly and scalable as your business grows, providing excellent value for important legal documents.

-

What features does airSlate SignNow offer for managing Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

With airSlate SignNow, businesses benefit from features like customizable legal templates, automated reminders, and real-time tracking of document status, which are essential when managing Continuing Guaranty Of Business Indebtedness By Corporate Stockholders. These features enhance efficiency and ensure that all parties are kept informed throughout the signing process.

-

Are there any integrations available with airSlate SignNow for Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

Yes, airSlate SignNow seamlessly integrates with various CRM systems, accounting software, and cloud storage solutions, simplifying the management of Continuing Guaranty Of Business Indebtedness By Corporate Stockholders. This connectivity allows users to automate workflows and streamline the document process, making it easier to keep track of important agreements.

-

What are the benefits of using airSlate SignNow for eSigning a Continuing Guaranty Of Business Indebtedness By Corporate Stockholders?

Utilizing airSlate SignNow for eSigning a Continuing Guaranty Of Business Indebtedness By Corporate Stockholders offers several key benefits, like increased security, rapid turnaround times, and the ability to easily manage multiple signatories. Signing electronically reduces the need for physical documents, saving time and resources while ensuring legal compliance.

-

Can I customize the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the Continuing Guaranty Of Business Indebtedness By Corporate Stockholders template to suit your specific business needs. You can add fields, logos, and clauses, ensuring that your document reflects your corporate identity while still being legally sound.

Get more for Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

Find out other Continuing Guaranty Of Business Indebtedness By Corporate Stockholders

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast