Unconditional Guaranty Form

What is the Unconditional Guaranty

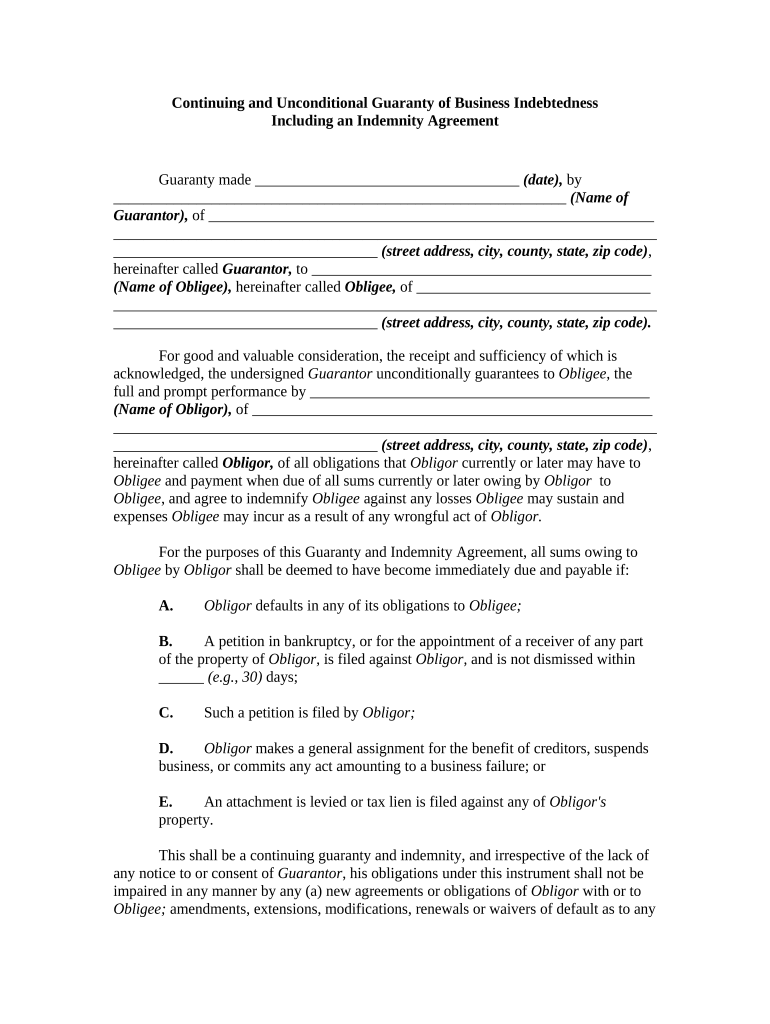

An unconditional guaranty is a legal agreement in which one party agrees to be responsible for the debt or obligation of another party, without any conditions or limitations. This type of guaranty provides a strong assurance to the creditor that they will receive payment or fulfillment of the obligation, regardless of the circumstances surrounding the primary debtor. It is often used in business transactions, such as loans or leases, where the creditor requires additional security to mitigate risk.

Key Elements of the Unconditional Guaranty

Understanding the key elements of an unconditional guaranty is crucial for both parties involved. The main components include:

- Parties Involved: The guarantor, who provides the guaranty, and the creditor, who benefits from it.

- Obligation Details: A clear description of the obligation being guaranteed, including the amount and terms.

- Duration: The period during which the guaranty is valid, often tied to the underlying obligation.

- Signatures: The document must be signed by the guarantor to be legally binding.

Steps to Complete the Unconditional Guaranty

Completing an unconditional guaranty involves several straightforward steps:

- Gather Necessary Information: Collect details about the primary debtor and the obligation being guaranteed.

- Draft the Document: Use a template or create a document that includes all key elements.

- Review the Terms: Ensure all parties understand and agree to the terms outlined in the guaranty.

- Sign the Document: The guarantor must sign the document, and it may require notarization depending on state laws.

- Distribute Copies: Provide copies of the signed guaranty to all parties involved for their records.

Legal Use of the Unconditional Guaranty

The unconditional guaranty must comply with applicable laws to be enforceable. In the United States, it is essential to adhere to the Uniform Commercial Code (UCC) and any relevant state laws. This ensures that the guaranty is recognized in court and can be enforced if the primary debtor defaults. Legal counsel may be advisable to ensure that the document meets all legal requirements and adequately protects the interests of the guarantor and creditor.

Examples of Using the Unconditional Guaranty

Unconditional guaranties are commonly used in various business scenarios. Some examples include:

- A landlord requiring a personal guaranty from a business owner to secure a lease.

- A bank requesting an unconditional guaranty from a business owner when approving a loan.

- A supplier asking for a guaranty from a business owner to ensure payment for goods delivered on credit.

Required Documents

When preparing an unconditional guaranty, certain documents may be required to support the agreement. These can include:

- Financial statements of the primary debtor.

- Credit reports to assess the risk involved.

- Any existing contracts related to the obligation being guaranteed.

Quick guide on how to complete unconditional guaranty

Complete Unconditional Guaranty seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It provides an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents swiftly without interruptions. Manage Unconditional Guaranty on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to modify and eSign Unconditional Guaranty effortlessly

- Find Unconditional Guaranty and select Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Unconditional Guaranty to ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an unconditional guaranty in the context of airSlate SignNow?

An unconditional guaranty within airSlate SignNow refers to a commitment that ensures your documents are securely signed and authorized without any conditions. This enhances the reliability of your agreements and provides peace of mind when executing important transactions.

-

How does airSlate SignNow ensure the security of documents with an unconditional guaranty?

airSlate SignNow employs advanced encryption and authentication methods to provide an unconditional guaranty of document security. Our platform ensures that all signed documents are tamper-proof, maintaining their integrity throughout the signing process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet various business needs while providing an unconditional guaranty of value. Pricing is competitive, and we offer customizable packages that ensure you only pay for the features crucial to your organization.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow provides seamless integrations with various platforms such as Google Drive, Salesforce, and more. This integration capability, paired with our unconditional guaranty, allows for efficient workflows and document management.

-

What are the primary benefits of using airSlate SignNow's unconditional guaranty?

The primary benefits of choosing airSlate SignNow include enhanced document security, ease of use, and increased efficiency. With our unconditional guaranty, users can confidently complete transactions, knowing their documents are handled with the utmost care.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is tailored to accommodate businesses of all sizes, including small businesses seeking an unconditional guaranty for their document signing needs. Our cost-effective solutions help streamline operations without compromising on quality or security.

-

How can I get support if I encounter issues with airSlate SignNow?

If you experience any issues with airSlate SignNow, our dedicated support team is readily available to assist you. We guarantee a prompt response to inquiries, ensuring that your experience remains smooth under the unconditional guaranty of our customer service.

Get more for Unconditional Guaranty

Find out other Unconditional Guaranty

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors