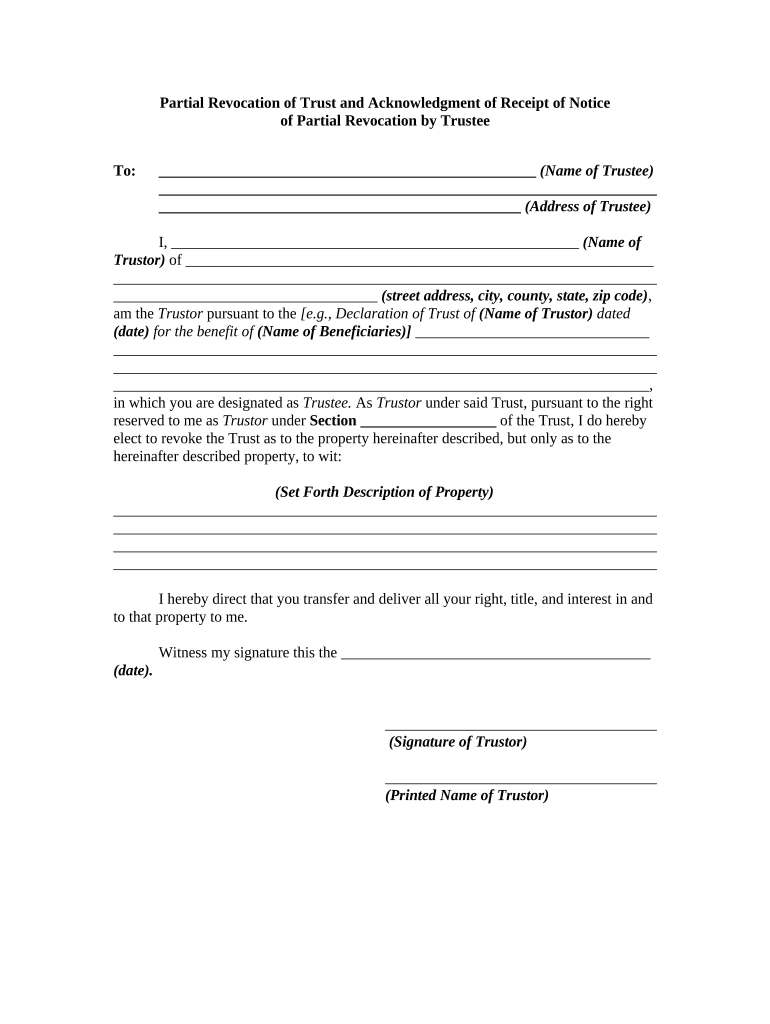

Revocation Trust Form

What is the revocation trust?

A revocation trust is a legal arrangement that allows an individual, known as the grantor, to transfer assets into a trust while retaining the ability to modify or revoke the trust at any time during their lifetime. This type of trust is commonly used for estate planning purposes, as it provides flexibility and control over the assets held within it. The grantor can manage the trust assets, specify beneficiaries, and outline instructions for asset distribution after their passing. Importantly, a revocation trust can help avoid probate, making the transfer of assets smoother and more private.

How to use the revocation trust

Using a revocation trust involves several steps. First, the grantor must create the trust document, which outlines the terms of the trust, including the management of assets and the designation of beneficiaries. Next, the grantor transfers ownership of their assets into the trust, which may include real estate, bank accounts, and investments. Throughout their lifetime, the grantor can amend or revoke the trust as needed. Upon the grantor's death, the trust assets are distributed according to the trust's terms, bypassing the probate process.

Steps to complete the revocation trust

Completing a revocation trust involves a series of organized steps:

- Draft the trust document: Work with an attorney or use a trusted template to create a legally binding trust document.

- Transfer assets: Change the title of assets from personal ownership to the name of the trust.

- Designate a trustee: Appoint a reliable individual or institution to manage the trust.

- Review and amend: Regularly review the trust to ensure it reflects current wishes and circumstances.

- Communicate with beneficiaries: Inform beneficiaries about the trust and its terms to avoid confusion later.

Legal use of the revocation trust

The legal use of a revocation trust is primarily governed by state laws, which can vary significantly. Generally, a revocation trust must comply with state requirements for validity, including proper execution and witnessing. It is essential for the grantor to ensure that the trust document adheres to these laws to avoid challenges in the future. Additionally, the trust must be properly funded with assets to be effective. Legal advice is often recommended to navigate these requirements and ensure the trust serves its intended purpose.

Key elements of the revocation trust

Several key elements define a revocation trust:

- Grantor: The individual who creates the trust and retains control over it.

- Trustee: The person or entity responsible for managing the trust assets.

- Beneficiaries: Individuals or entities designated to receive assets from the trust.

- Trust document: The legal document that outlines the terms of the trust, including asset management and distribution instructions.

- Revocation clause: A provision that allows the grantor to modify or revoke the trust at any time.

Examples of using the revocation trust

Revocation trusts can be utilized in various scenarios. For instance, a married couple may establish a revocation trust to manage their joint assets and ensure a smooth transfer to their children upon their passing. Another example includes an individual who wishes to maintain control over their assets while providing for a disabled family member. By using a revocation trust, the grantor can specify how the assets should be managed for the beneficiary's benefit, ensuring their needs are met without court intervention.

Quick guide on how to complete revocation trust

Complete Revocation Trust effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly without any holdups. Handle Revocation Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Revocation Trust with ease

- Obtain Revocation Trust and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Revocation Trust and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revocation trust?

A revocation trust is a type of estate planning tool that allows you to manage your assets during your lifetime and provides a way to revoke or change its terms whenever necessary. This flexibility is essential for individuals who want control over their trust assets. With airSlate SignNow, you can easily eSign documents related to your revocation trust and manage them efficiently.

-

How does a revocation trust differ from an irrevocable trust?

Unlike an irrevocable trust, which cannot be changed after creation, a revocation trust allows you to modify or dissolve it at any time. This adaptability is particularly beneficial for people whose financial situations or personal wishes may change. airSlate SignNow helps you manage the documents associated with your revocation trust seamlessly.

-

What are the benefits of setting up a revocation trust?

The primary benefits of a revocation trust include flexibility, privacy, and avoiding probate. It allows you to retain control over your assets while ensuring that your wishes are honored after your passing. Using airSlate SignNow, you can efficiently execute and maintain documents related to your revocation trust, providing peace of mind.

-

Can I integrate airSlate SignNow with my revocation trust planning?

Yes, airSlate SignNow can seamlessly integrate into your revocation trust planning, enabling you to manage all related documents digitally. Our platform streamlines the signing process, making it easier to collaborate with legal advisors and family members. This ensures that your revocation trust is always up-to-date and accessible.

-

Is there a cost associated with creating a revocation trust using airSlate SignNow?

Creating a revocation trust with airSlate SignNow is a cost-effective solution, especially when compared to traditional legal services. Our pricing plans are designed to fit various budgets, ensuring that you have access to the tools necessary for effective estate planning. You can start with a free trial to see how our platform can assist with your revocation trust.

-

How can I modify my revocation trust once it’s created?

Modifying your revocation trust is straightforward as long as you keep track of the necessary documents. With airSlate SignNow, you can easily make adjustments, eSign modifications, and ensure that all changes are documented properly. This flexibility is one of the key features of a revocation trust that airSlate SignNow enhances.

-

Who needs a revocation trust?

Individuals who wish to retain control over their assets while planning for the future benefit signNowly from a revocation trust. It is especially useful for those with fluctuating financial circumstances or changes in family dynamics. Utilizing airSlate SignNow simplifies the process of establishing and managing your revocation trust.

Get more for Revocation Trust

Find out other Revocation Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors