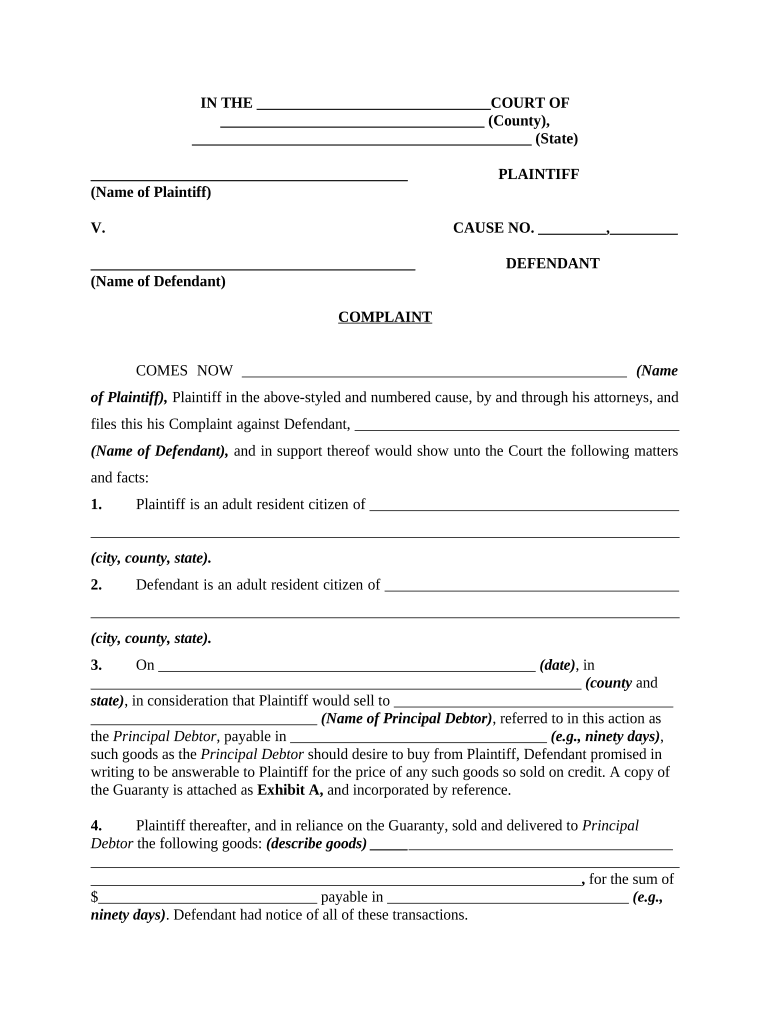

Credit Transactions Form

What is the Credit Transactions

The term "credit transactions" refers to financial exchanges where goods, services, or funds are provided with the expectation of future payment. These transactions can occur in various contexts, including retail purchases, loans, and business agreements. Understanding credit transactions is essential for individuals and businesses alike, as they can impact credit scores, financial planning, and legal obligations.

How to use the Credit Transactions

Utilizing credit transactions involves several steps to ensure accuracy and compliance. First, identify the type of transaction you are engaging in, whether it be a purchase, loan, or service agreement. Next, gather all necessary documentation, such as contracts or invoices. When completing the transaction, ensure that all parties involved understand the terms, including payment schedules and interest rates. Finally, maintain records of the transaction for future reference and to support any potential disputes.

Steps to complete the Credit Transactions

Completing credit transactions involves a systematic approach to ensure everything is handled correctly. Here are the essential steps:

- Determine the nature of the credit transaction.

- Gather required documentation, including identification and financial statements.

- Review the terms and conditions associated with the transaction.

- Complete the necessary forms accurately, ensuring all information is correct.

- Submit the forms through the appropriate channels, whether online or in person.

- Keep copies of all submitted documents for your records.

Legal use of the Credit Transactions

Credit transactions must adhere to various legal standards to be considered valid. In the United States, laws such as the Fair Credit Reporting Act and the Truth in Lending Act govern how credit transactions should be conducted. These regulations ensure transparency and protect consumers from unfair practices. It is crucial for businesses and individuals to understand these laws to avoid legal complications and ensure compliance.

Key elements of the Credit Transactions

Several key elements define credit transactions, including:

- Parties involved: Identifies the lender and borrower or seller and buyer.

- Terms of agreement: Outlines payment schedules, interest rates, and penalties for late payments.

- Documentation: Includes contracts, invoices, and any other relevant paperwork.

- Compliance: Adherence to applicable laws and regulations.

Examples of using the Credit Transactions

Credit transactions can take many forms. Common examples include:

- Credit card purchases at retail stores.

- Loans taken out for personal or business purposes.

- Leases for vehicles or equipment.

- Service agreements where payment is made after the service is rendered.

Quick guide on how to complete credit transactions 497329798

Manage Credit Transactions seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Credit Transactions on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Credit Transactions with ease

- Locate Credit Transactions and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Credit Transactions to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are credit transactions in the context of airSlate SignNow?

Credit transactions refer to the digital exchanges where businesses utilize airSlate SignNow to send and eSign critical documents. This process ensures secure and efficient handling of contracts, agreements, and other essential papers, minimizing delays and increasing productivity.

-

How does airSlate SignNow manage credit transactions?

airSlate SignNow streamlines credit transactions by offering a user-friendly platform that allows for electronic signatures and document tracking. Businesses can quickly process multiple credit transactions while maintaining compliance and security through robust encryption technologies.

-

Is there a cost associated with credit transactions on airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model that includes pricing tiers based on the volume of credit transactions and features required. By selecting the right plan, businesses can efficiently manage their credit transactions at an affordable rate.

-

What features enhance credit transactions in airSlate SignNow?

airSlate SignNow includes features such as templates, bulk sending, and audit trails that enhance credit transactions. These functionalities provide efficiency and security, allowing businesses to handle high volumes of credit transactions seamlessly.

-

Can I integrate airSlate SignNow with other applications for better management of credit transactions?

Absolutely! airSlate SignNow supports integrations with numerous applications, enabling you to manage credit transactions alongside other business processes seamlessly. This connectivity helps enhance workflow efficiency and keeps all relevant tools in sync.

-

What are the benefits of using airSlate SignNow for credit transactions?

By using airSlate SignNow for credit transactions, businesses benefit from increased speed, reduced paper clutter, and improved compliance. These advantages help organizations operate more smoothly and effectively while minimizing overhead costs associated with traditional document handling.

-

How secure are credit transactions with airSlate SignNow?

Security is a top priority for airSlate SignNow, particularly for credit transactions. The platform employs advanced encryption methods, secure data storage, and strict compliance with industry regulations to ensure that all credit transactions are protected against unauthorized access.

Get more for Credit Transactions

- Ga sample final contractors affidavits virtual underwriter form

- Affidavit by an attorney in fact in the capacity of an administrator of an estate form

- Maryland notaries public maryland secretary of state form

- Corporation was held on 20 immediately following form

- Connecticut acknowledgmentsindividualus legal forms

- Conservation easement agreement the state of texas form

- 27 printable state of texas gift deed forms and templates fillable

- Oregon rn test observer agreementform 1505or

Find out other Credit Transactions

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form