Agreement Promissory Note Form

What is the Agreement Promissory Note

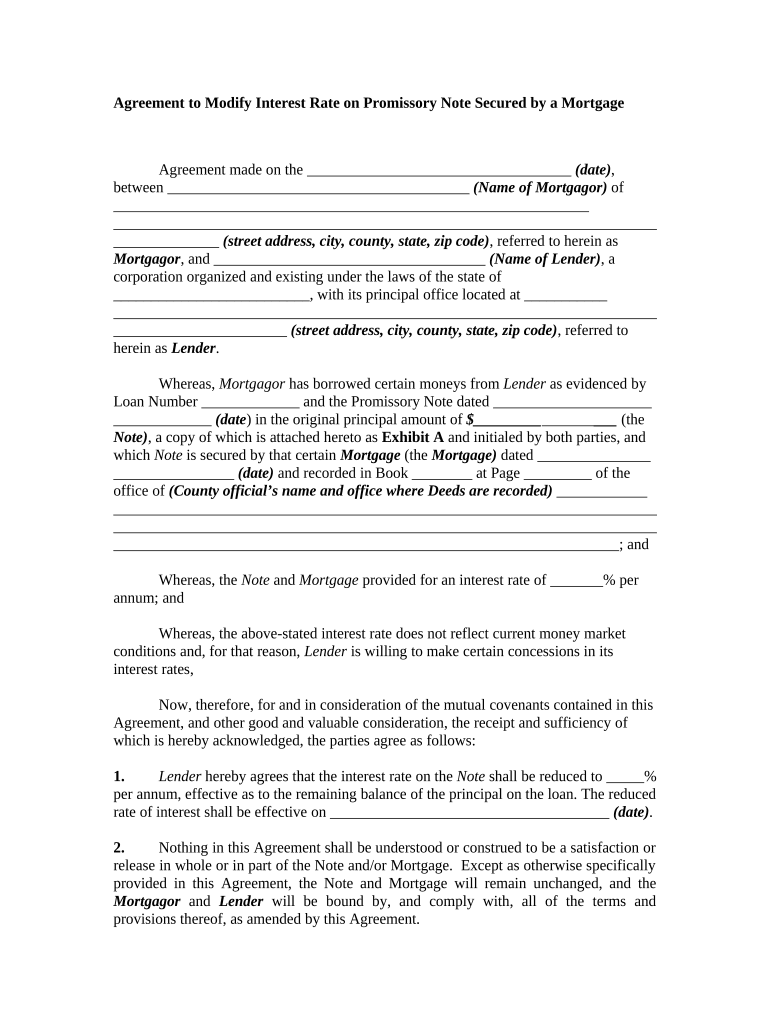

The agreement promissory note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This document serves as a written acknowledgment of a debt and includes critical details such as the loan amount, interest rate, repayment schedule, and any collateral securing the loan. In the context of real estate, a promissory note mortgage specifically refers to a loan secured by the property itself, providing the lender with a claim to the property should the borrower default.

Key Elements of the Agreement Promissory Note

Understanding the key elements of an agreement promissory note is essential for both borrowers and lenders. The primary components include:

- Borrower and Lender Information: Names and contact details of both parties involved.

- Loan Amount: The total amount borrowed, clearly stated.

- Interest Rate: The percentage charged on the borrowed amount, which can be fixed or variable.

- Repayment Terms: A detailed schedule outlining when payments are due and the total duration of the loan.

- Default Clauses: Conditions under which the borrower may be considered in default and the lender's rights in such cases.

- Signature Lines: Spaces for both parties to sign, indicating their agreement to the terms.

Steps to Complete the Agreement Promissory Note

Completing an agreement promissory note involves several straightforward steps. Begin by gathering all necessary information, including personal details and financial data. Follow these steps:

- Identify the Parties: Clearly state the names and addresses of the borrower and lender.

- Specify the Loan Amount: Enter the total amount being borrowed.

- Set the Interest Rate: Determine and write down the applicable interest rate.

- Outline Repayment Terms: Define how and when repayments will be made.

- Include Default Terms: Specify what constitutes default and the consequences.

- Sign the Document: Both parties should sign and date the note to make it legally binding.

Legal Use of the Agreement Promissory Note

The legal use of an agreement promissory note is governed by state laws and regulations. It is crucial for the document to meet specific legal requirements to be enforceable in court. This includes ensuring that the note is in writing, signed by the borrower, and contains all essential terms. Additionally, the note should comply with federal regulations regarding lending practices, particularly if the loan amount exceeds certain thresholds.

Digital vs. Paper Version

In today's digital age, borrowers and lenders can choose between a digital or paper version of the agreement promissory note. A digital version offers advantages such as ease of storage, quick sharing, and the ability to use electronic signatures, which are legally recognized under the ESIGN and UETA acts. Conversely, a paper version may be preferred by those who value traditional documentation. Regardless of the format, it is essential to ensure that the note is properly executed and stored securely.

How to Obtain the Agreement Promissory Note

Obtaining an agreement promissory note can be done through various means. Many lenders provide templates or forms that can be customized to fit specific loan agreements. Additionally, legal websites and document preparation services offer downloadable templates that comply with state laws. It is advisable to consult with a legal professional to ensure that the note meets all necessary legal requirements and adequately protects both parties' interests.

Quick guide on how to complete agreement promissory note

Prepare Agreement Promissory Note effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can locate the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage Agreement Promissory Note on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign Agreement Promissory Note with ease

- Obtain Agreement Promissory Note and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and hit the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Agreement Promissory Note and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a promissory note mortgage?

A promissory note mortgage is a written, legally binding agreement in which a borrower promises to repay a loan secured by a property. It outlines the terms of the loan, including interest rates and payment schedule, making it essential for real estate transactions. Understanding this document is crucial for both lenders and borrowers.

-

How does airSlate SignNow facilitate the signing of a promissory note mortgage?

airSlate SignNow provides a simple and efficient platform for electronic signatures, allowing users to sign promissory note mortgages securely. By using our service, you can send documents for eSigning from anywhere, signNowly speeding up the lending process. Our user-friendly interface ensures that signing remains hassle-free.

-

What are the key features of airSlate SignNow for managing promissory note mortgages?

airSlate SignNow offers features like customizable templates, bulk sending, and advanced security options for handling promissory note mortgages. With these tools, you can streamline document management, maintain compliance, and ensure a smooth transaction process. Additionally, real-time tracking allows you to monitor document statuses effortlessly.

-

Is airSlate SignNow cost-effective for managing promissory note mortgages?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing promissory note mortgages. Our flexible pricing plans accommodate businesses of all sizes, ensuring you only pay for the features you need. Transitioning to eSigning can also save on paper and storage costs over time.

-

Can airSlate SignNow integrate with other tools for managing promissory note mortgages?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, such as CRM systems and document storage services, to enhance your workflow for managing promissory note mortgages. These integrations simplify data transfer and improve overall efficiency in handling lending documents.

-

What are the benefits of using airSlate SignNow for promissory note mortgages?

Using airSlate SignNow for promissory note mortgages offers multiple benefits, including enhanced security, reduced turnaround times, and improved compliance. As clients can sign documents from anywhere, it enhances convenience for both parties. This results in faster processing of loans and overall increased satisfaction.

-

How does eSigning a promissory note mortgage ensure security?

eSigning a promissory note mortgage through airSlate SignNow employs advanced encryption and secure authentication methods to protect your documents. Each eSignature is unique, which helps verify the identity of signers and ensures that the signed document remains tamper-proof. This level of security is crucial for sensitive financial agreements.

Get more for Agreement Promissory Note

- Job information sheet

- F1 employment information waiver internationallamaredu international lamar

- Where can i got to print out paperwork needing to be signed form

- Employment application servatron inc form

- Pre task safety form

- Tool release form

- Previous dot employer inquiry form hartfordtransit

- Wc offer of temporary modified duty form

Find out other Agreement Promissory Note

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP