Irrevocable Trust Form

What is the irrevocable trust form?

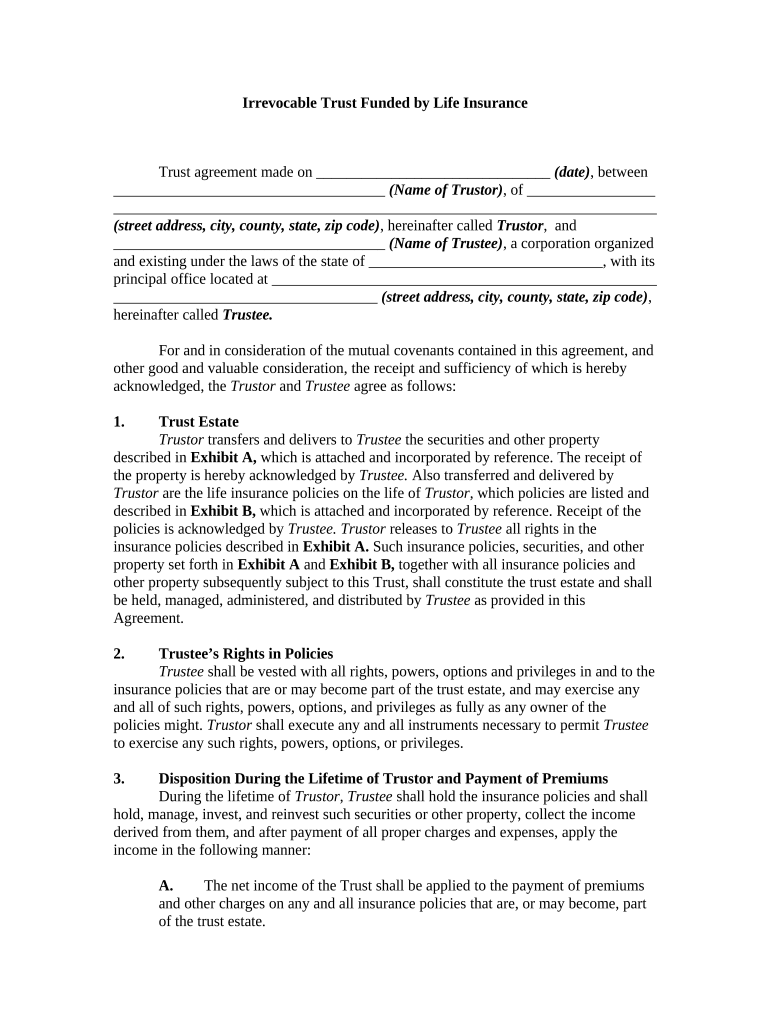

The irrevocable trust form is a legal document used to establish an irrevocable trust, which cannot be modified or terminated without the consent of the beneficiaries. This type of trust is often utilized for estate planning purposes, allowing individuals to transfer assets out of their estate while retaining certain benefits. Once the trust is created, the assets placed within it are no longer considered part of the grantor's estate, which can help reduce estate taxes and protect assets from creditors.

How to use the irrevocable trust form

Using the irrevocable trust form involves several key steps. First, gather all necessary information about the assets you wish to place in the trust, including property deeds, bank account details, and investment information. Next, complete the form with accurate details regarding the grantor, trustee, and beneficiaries. It is essential to ensure that all parties involved understand their roles and responsibilities. Once the form is filled out, it must be signed in the presence of a notary public to ensure its legal validity.

Steps to complete the irrevocable trust form

Completing the irrevocable trust form requires careful attention to detail. Here are the steps to follow:

- Identify the grantor, who creates the trust.

- Designate a trustee responsible for managing the trust assets.

- List all beneficiaries who will receive benefits from the trust.

- Detail the assets being transferred into the trust.

- Specify any terms or conditions related to the trust's management and distribution of assets.

- Review the completed form for accuracy and completeness.

- Sign the form in the presence of a notary public.

Legal use of the irrevocable trust form

The irrevocable trust form serves several legal purposes. It establishes a legally binding agreement that outlines how assets will be managed and distributed. This form is recognized by courts and financial institutions, provided it meets state-specific requirements. Additionally, it can protect assets from creditors and may help in qualifying for certain government benefits, such as Medicaid, by removing assets from the grantor's ownership.

Key elements of the irrevocable trust form

Key elements of the irrevocable trust form include:

- Grantor Information: Details about the individual creating the trust.

- Trustee Information: Identification of the person or entity managing the trust.

- Beneficiary Designation: Names and details of those who will benefit from the trust.

- Asset Description: A comprehensive list of assets included in the trust.

- Terms and Conditions: Specific instructions regarding the management and distribution of trust assets.

State-specific rules for the irrevocable trust form

Each state in the U.S. has its own regulations governing irrevocable trusts. These rules can affect how the trust is established, the necessary documentation, and the legal requirements for signatures and notarization. It is essential to consult state laws or a legal professional to ensure compliance with local regulations when completing the irrevocable trust form. This ensures that the trust is valid and enforceable in the relevant jurisdiction.

Quick guide on how to complete irrevocable trust form 497329970

Complete Irrevocable Trust Form effortlessly on any device

Virtual document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, adjust, and electronically sign your documents quickly without delays. Manage Irrevocable Trust Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to adjust and electronically sign Irrevocable Trust Form with ease

- Find Irrevocable Trust Form and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to confirm your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and electronically sign Irrevocable Trust Form and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable trust form?

An irrevocable trust form is a legal document that establishes a trust that cannot be altered or revoked once created. This form is crucial for asset protection and estate planning, allowing you to designate beneficiaries while relinquishing control over the assets placed in the trust.

-

How can I create an irrevocable trust form using airSlate SignNow?

Creating an irrevocable trust form with airSlate SignNow is simple and efficient. Our platform allows you to quickly draft, edit, and eSign your trust documents online, ensuring you can handle all your estate planning needs with ease and security.

-

What are the benefits of using airSlate SignNow for an irrevocable trust form?

Using airSlate SignNow for your irrevocable trust form offers several advantages, such as streamlined document management and the ability to eSign securely. Our platform enhances collaboration, allowing multiple parties to review and sign documents efficiently, ensuring a smoother process overall.

-

Is there a cost associated with using the irrevocable trust form template on airSlate SignNow?

Yes, while airSlate SignNow offers a variety of pricing plans, you can use templates for creating an irrevocable trust form at competitive rates. We provide a cost-effective solution for individuals and businesses looking to simplify their document signing and management processes.

-

Are there integrations available for managing my irrevocable trust form?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to manage your irrevocable trust form alongside your other business applications. This flexibility improves workflow and ensures that you can access your documents when you need them.

-

Can I track the status of my irrevocable trust form after sending it out for signatures?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your irrevocable trust form in real-time. You'll receive notifications when the document is viewed, signed, or requires your attention, ensuring you stay informed throughout the signing process.

-

What features does airSlate SignNow offer for eSigning an irrevocable trust form?

Our platform provides a host of features for eSigning your irrevocable trust form, including customizable workflows, secure storage, and integrations with popular business tools. With advanced security measures and user-friendly navigation, airSlate SignNow ensures your documents are safe and easily accessible.

Get more for Irrevocable Trust Form

- 31519 employer intake form for public completion v21

- Cinemark jobs fill online printable fillable blankpdffiller form

- Authority to deduct form

- Forms human resources umass boston

- Beech bend application form

- Print name as shown on social security card form

- Application part one form

- Checkwriters direct deposit form

Find out other Irrevocable Trust Form

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares