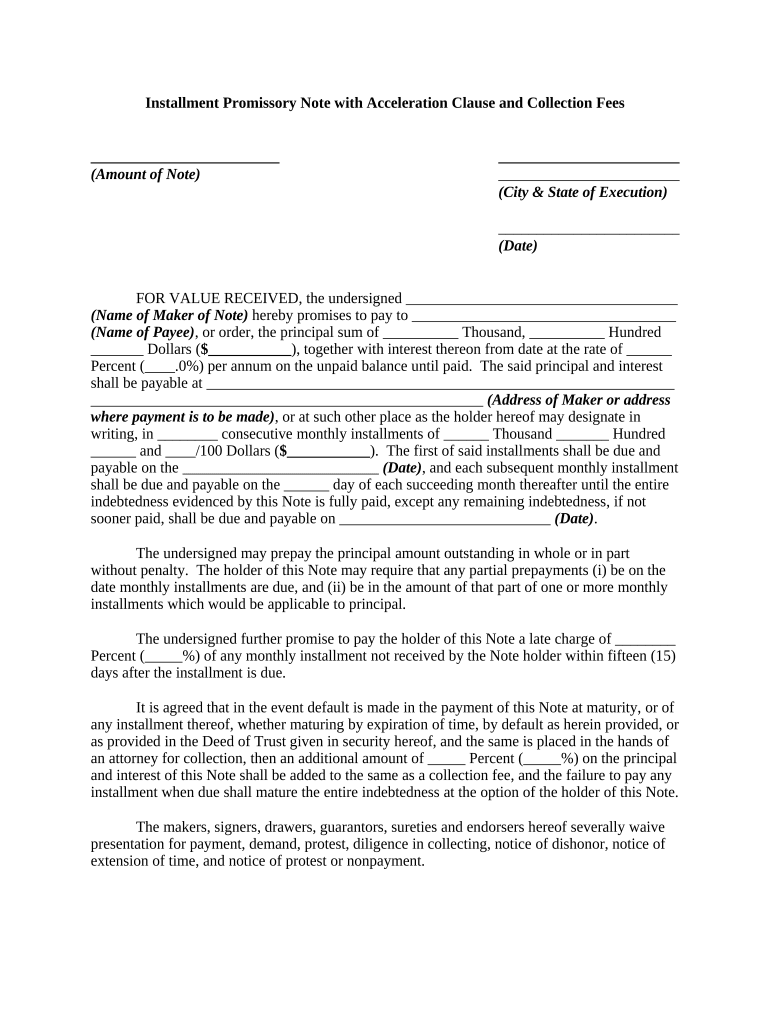

Acceleration Clause Form

What is the acceleration clause?

The promissory acceleration clause is a provision in a loan agreement that allows the lender to demand full repayment of the outstanding balance if specific conditions are met. This clause is often included in promissory notes and other financial agreements to protect the lender's interests. It typically comes into effect if the borrower defaults on payments, breaches the terms of the agreement, or experiences significant changes in financial status. Understanding this clause is crucial for both lenders and borrowers to ensure compliance and avoid unexpected financial obligations.

Key elements of the acceleration clause

Several key elements define the acceleration clause in a promissory note. These include:

- Default conditions: Specific events that trigger the clause, such as missed payments or bankruptcy.

- Notification requirements: The lender's obligation to inform the borrower of the default and the acceleration of the loan.

- Repayment terms: Details on how the borrower must repay the total outstanding balance once the clause is activated.

- Legal enforceability: The clause must comply with state laws to be enforceable in court.

Steps to complete the acceleration clause

Completing the acceleration clause involves several important steps to ensure it is legally binding and effective. These steps include:

- Review the loan agreement: Understand the terms and conditions related to the acceleration clause.

- Identify trigger events: Clearly outline what constitutes a default under the agreement.

- Draft the clause: Write the clause using clear and concise language, specifying all necessary elements.

- Obtain signatures: Ensure all parties involved sign the document to validate the clause.

Legal use of the acceleration clause

The legal use of the acceleration clause is governed by state laws and regulations. It is essential for lenders to ensure that the clause is compliant with these laws to avoid disputes. The clause must be clearly articulated in the loan documents and should not contain ambiguous language that could lead to misinterpretations. Courts typically uphold acceleration clauses as long as they meet legal standards and are properly executed. Borrowers should be aware of their rights and obligations under the clause to protect themselves from potential legal issues.

Examples of using the acceleration clause

Examples of how the acceleration clause can be applied include:

- A borrower misses two consecutive payments on a mortgage, prompting the lender to invoke the acceleration clause and demand full repayment.

- A business loan agreement includes an acceleration clause that activates if the business undergoes a significant change in ownership, allowing the lender to call the loan due.

- A promissory note for a personal loan stipulates that if the borrower files for bankruptcy, the lender can accelerate the loan and require immediate payment of the remaining balance.

How to use the acceleration clause

Using the acceleration clause effectively requires understanding its implications and ensuring proper execution. Lenders should clearly communicate the terms of the clause to borrowers at the outset. In the event of a default, the lender must follow the notification process outlined in the loan agreement. This involves formally informing the borrower of the default and the activation of the acceleration clause. It is crucial to document all communications and actions taken to enforce the clause, as this will provide legal protection if disputes arise.

Quick guide on how to complete acceleration clause

Effortlessly Prepare Acceleration Clause on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Acceleration Clause on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Steps to Modify and Electronically Sign Acceleration Clause with Ease

- Locate Acceleration Clause and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools exclusively provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method of sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious navigation through forms, and errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Acceleration Clause to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a promissory acceleration clause?

A promissory acceleration clause is a provision in a loan agreement that allows lenders to demand full repayment if certain conditions are met. Typically, this clause becomes active if the borrower defaults on payments or violates other terms. Understanding this clause is crucial for borrowers to manage their obligations effectively.

-

How can airSlate SignNow help me manage promissory acceleration clauses?

With airSlate SignNow, you can easily create, send, and eSign documents that include a promissory acceleration clause. Our platform allows for seamless collaboration and secure storage of your loan documents, making it simpler to track compliance with such clauses. This ensures you maintain control over your agreements.

-

What are the benefits of using airSlate SignNow for documents containing promissory acceleration clauses?

Using airSlate SignNow for documents with a promissory acceleration clause enhances your workflow by providing an easy-to-use eSigning solution. It eliminates the need for paper documents, speeds up the signing process, and allows for real-time tracking of document status. This helps to ensure prompt compliance and communication with all parties involved.

-

Is airSlate SignNow cost-effective for small businesses dealing with promissory acceleration clauses?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing promissory acceleration clauses. Our pricing plans are designed to cater to different needs and budgets, allowing businesses to access high-quality eSigning features without breaking the bank. This affordability makes it an ideal choice for businesses of all sizes.

-

Does airSlate SignNow integrate with other tools for managing promissory acceleration clauses?

Absolutely! airSlate SignNow offers integrations with a variety of tools that can streamline the management of promissory acceleration clauses. By connecting with platforms like CRM systems or accounting software, you can ensure that all relevant information is accessible, fostering better management of your agreements.

-

Can I customize my documents including promissory acceleration clauses in airSlate SignNow?

Yes, airSlate SignNow allows for full customization of your documents, including those containing promissory acceleration clauses. You can add specific terms, clauses, and conditions that suit your business needs. This flexibility ensures that your agreements are tailored to reflect your unique requirements.

-

What security measures does airSlate SignNow have for documents with promissory acceleration clauses?

airSlate SignNow takes the security of your documents, including those with a promissory acceleration clause, very seriously. We employ encryption, secure cloud storage, and strict access controls to protect your sensitive information. This commitment to security allows you to focus on your business without worrying about document safety.

Get more for Acceleration Clause

- Funeral director case reports form

- Daily math review 6th grade form

- Entering sixth grade language arts review packet stlouisparish form

- Solicitud de beca primera vez uvm campus quer taro queretaro uvmnet form

- Professional development request form 2018 19

- Lim college 1098 t form

- Colfax school district form

- Springdale high school transcript request form

Find out other Acceleration Clause

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form