Sample Letter Tax Form

What is the Sample Letter Tax

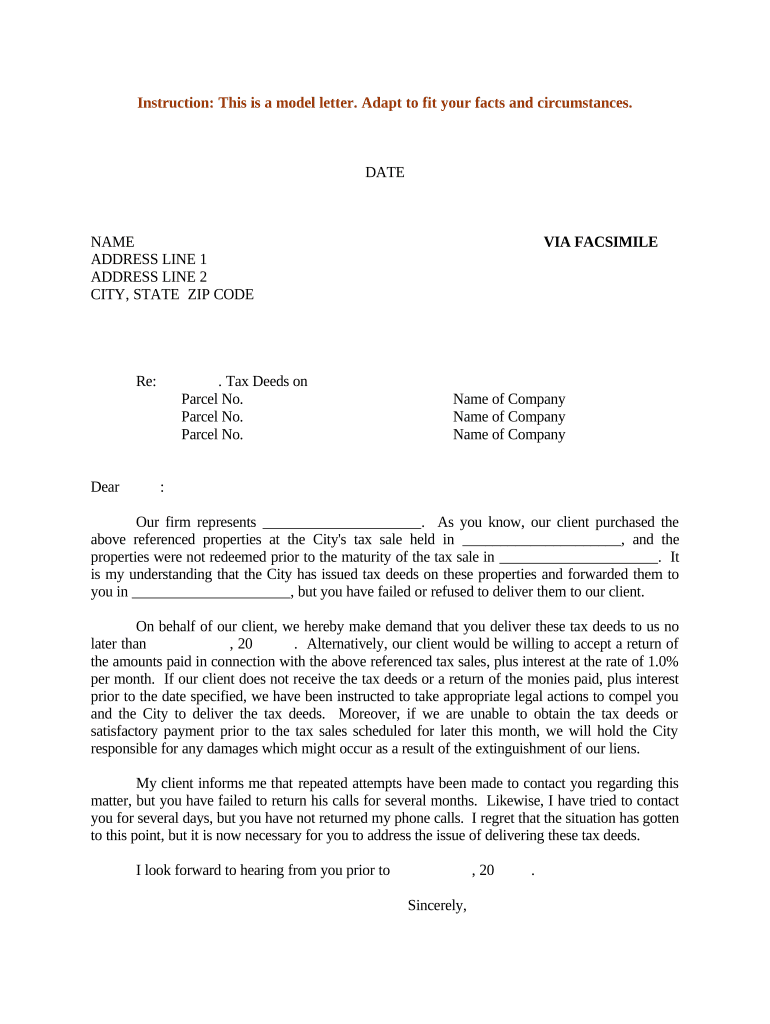

The sample letter tax serves as a formal document used to communicate specific tax-related information to the Internal Revenue Service (IRS) or other relevant entities. This letter may be necessary for various purposes, such as clarifying tax obligations, requesting information, or submitting documentation. Understanding the purpose and requirements of this letter is crucial for ensuring compliance with tax regulations.

How to use the Sample Letter Tax

Using the sample letter tax involves filling out the document with accurate and relevant information. Taxpayers should clearly state their intent, whether it is to request clarification on a tax matter, provide additional information, or respond to an IRS inquiry. It is important to include personal details such as name, address, and taxpayer identification number. Additionally, ensure that the letter is signed and dated to validate its authenticity.

Steps to complete the Sample Letter Tax

Completing the sample letter tax requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary information, including your tax identification number and any relevant tax documents.

- Clearly state the purpose of the letter at the beginning.

- Provide detailed information regarding your tax situation or inquiry.

- Include any supporting documents that may strengthen your case.

- Review the letter for accuracy and completeness.

- Sign and date the letter before submission.

Legal use of the Sample Letter Tax

The sample letter tax is legally binding when it meets specific criteria outlined by the IRS. It must be accurately completed and submitted in accordance with IRS guidelines. This letter may be used in legal contexts, such as disputes regarding tax assessments or audits. Ensuring compliance with legal standards is essential for the letter to be recognized as valid and enforceable.

IRS Guidelines

The IRS provides specific guidelines for submitting tax-related correspondence, including the sample letter tax. It is important to adhere to these guidelines to avoid delays or complications. Key points include using the correct format, addressing the letter to the appropriate IRS office, and including all necessary information. Familiarizing oneself with these guidelines can help taxpayers navigate the process more effectively.

Required Documents

When submitting the sample letter tax, certain documents may be required to support your claims or inquiries. Commonly required documents include:

- Previous tax returns

- W-2 forms or 1099s

- Any notices received from the IRS

- Proof of payment or correspondence related to the tax issue

Including these documents can provide clarity and strengthen your position when communicating with the IRS.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the sample letter tax. Be aware of relevant deadlines, such as:

- Filing deadlines for annual tax returns

- Deadlines for responding to IRS notices

- Time limits for appeals or disputes

Missing these deadlines can result in penalties or loss of rights to appeal, making it essential to stay informed about important dates.

Quick guide on how to complete sample letter tax

Prepare Sample Letter Tax seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, since you can easily locate the right form and securely store it online. airSlate SignNow provides all the resources needed to create, modify, and eSign your documents quickly without interruptions. Manage Sample Letter Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Sample Letter Tax with ease

- Locate Sample Letter Tax and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device of your preference. Modify and eSign Sample Letter Tax and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter tax?

A sample letter tax is a template that businesses can use to draft letters related to tax matters, such as requests for tax documents or inquiries. By using a sample letter tax, individuals can ensure that they include all necessary details and comply with standard practices.

-

How can airSlate SignNow help with my sample letter tax?

airSlate SignNow allows you to easily create and eSign your sample letter tax documents online. With our platform, you can customize your letters and send them securely, ensuring that your tax communications are professionally handled.

-

What features does airSlate SignNow offer for creating tax letters?

airSlate SignNow offers features such as customizable templates for sample letter tax, eSignature functionality, and document tracking. These tools make it simple to manage your tax correspondence efficiently and effectively.

-

Is there a pricing plan for using airSlate SignNow for tax letters?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. By choosing the appropriate plan, you can efficiently create, send, and track your sample letter tax documents at a cost-effective rate.

-

Can I integrate airSlate SignNow with other tools for tax letter management?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to streamline your workflow when managing sample letter tax and other tax-related documents. This makes it easier to collaborate with your team and maintain organization.

-

What benefits do I gain from using airSlate SignNow for tax letters?

Using airSlate SignNow for your sample letter tax provides increased efficiency, enhanced security, and improved organization. Our platform simplifies the process of sending and eSigning letters, making it easier for you to meet your tax obligations.

-

Is airSlate SignNow suitable for businesses of all sizes for tax letter needs?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes when it comes to managing sample letter tax. Whether you're a small startup or a large corporation, our platform can cater to your needs effectively.

Get more for Sample Letter Tax

- Personnel security form

- Minor authorization change rochester institute of technology form

- Scholarship for national school of rv park campground arvc form

- Appeal cover sheet form

- Csn phone number form

- Elgin community college pta form

- Exed community college application form

- Hazing form fitchburg state university fitchburgstate

Find out other Sample Letter Tax

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy