Agreement Negotiating Loan Form

What is the Agreement Negotiating Loan

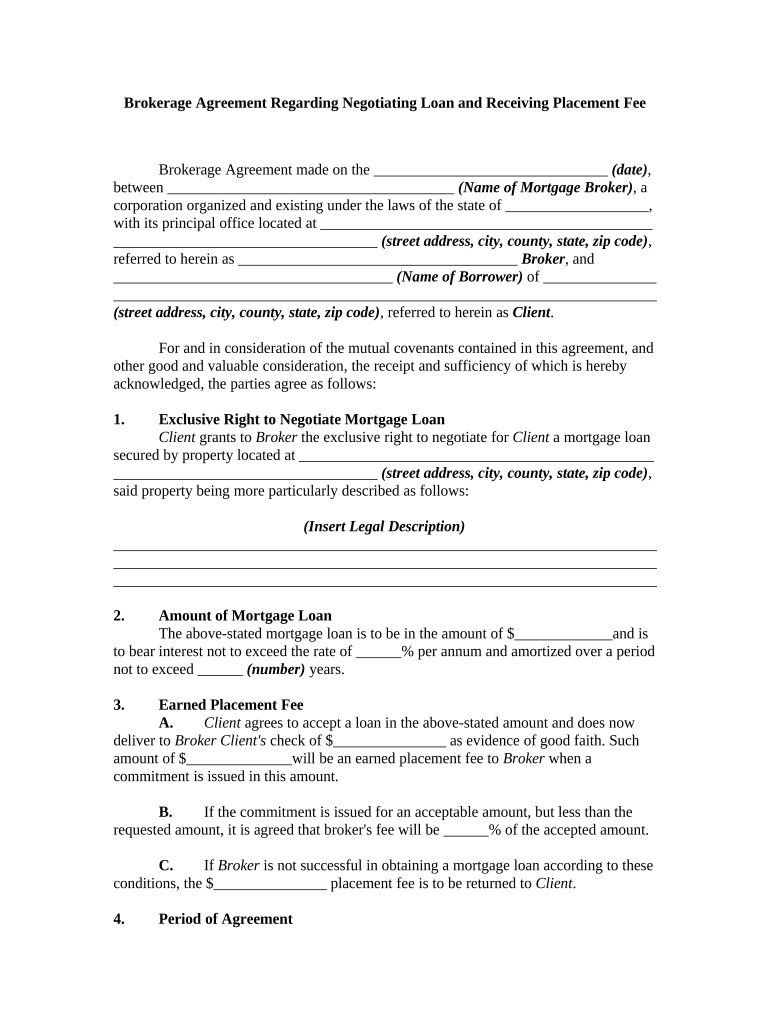

The Agreement Negotiating Loan is a formal document used in the context of securing financing, typically for real estate or business purposes. This agreement outlines the terms under which a lender agrees to provide funds to a borrower. It includes critical details such as the loan amount, interest rate, repayment schedule, and any fees associated with the loan, including the placement fee. Understanding the components of this agreement is essential for both parties to ensure clarity and compliance with legal standards.

Key elements of the Agreement Negotiating Loan

Several key elements make up the Agreement Negotiating Loan, ensuring that both the lender and borrower are protected. These elements typically include:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Terms: The schedule outlining how and when payments will be made.

- Placement Fee: A fee charged by the broker or lender for arranging the loan.

- Default Clauses: Terms that specify what happens if the borrower fails to make payments.

- Legal Compliance: Assurance that the agreement adheres to applicable laws and regulations.

Steps to complete the Agreement Negotiating Loan

Completing the Agreement Negotiating Loan involves several important steps to ensure that all parties understand their rights and obligations. Here is a structured approach:

- Gather Documentation: Collect all necessary financial documents, including income statements and credit history.

- Negotiate Terms: Discuss and agree on the loan amount, interest rate, and placement fee with the lender.

- Draft the Agreement: Prepare the agreement, ensuring all key elements are included and clear.

- Review Legal Compliance: Verify that the agreement meets all legal requirements and regulations.

- Sign the Agreement: Both parties should sign the document, ideally using a secure electronic signature solution for validation.

- Retain Copies: Keep copies of the signed agreement for future reference and record-keeping.

Legal use of the Agreement Negotiating Loan

The legal use of the Agreement Negotiating Loan is governed by various federal and state laws. It is crucial for both lenders and borrowers to understand these regulations to avoid potential disputes. The agreement must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA), which facilitate the use of electronic signatures in legal documents. Additionally, understanding state-specific regulations regarding lending practices is essential for ensuring that the agreement is enforceable.

Who Issues the Form

The Agreement Negotiating Loan is typically issued by financial institutions, such as banks or credit unions, or by licensed mortgage brokers. These entities are responsible for providing the necessary documentation and ensuring that the terms of the loan comply with legal standards. Borrowers should ensure that they are working with reputable institutions that adhere to all regulatory requirements to protect their interests.

Placement Fee Explanation

The placement fee is a critical component of the Agreement Negotiating Loan. This fee is charged by the broker or lender for their services in arranging the loan. It compensates the lender for the time and resources spent on processing the loan application and facilitating the transaction. Understanding the placement fee, including how it is calculated and when it is due, is essential for borrowers to avoid unexpected costs and ensure transparency in the lending process.

Quick guide on how to complete agreement negotiating loan

Effortlessly Create Agreement Negotiating Loan on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers a great environmentally friendly substitute for conventional printed and signed paperwork, allowing you to easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Agreement Negotiating Loan on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and electronically sign Agreement Negotiating Loan without hassle

- Locate Agreement Negotiating Loan and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Update and eSign Agreement Negotiating Loan and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a placement fee in airSlate SignNow?

A placement fee in airSlate SignNow refers to the cost associated with integrating our electronic signature solutions into your existing systems. This fee ensures that you receive personalized support during implementation, making the transition seamless and efficient for your business.

-

How does the placement fee affect overall pricing?

The placement fee is a one-time charge that contributes to the overall pricing structure of airSlate SignNow. It provides value through dedicated support and resources, ensuring that you maximize the benefits of our eSignature solution.

-

Are there any additional costs beyond the placement fee?

Apart from the placement fee, airSlate SignNow might have subscription plans that include various features tailored to your business needs. It’s essential to review our pricing page for a complete breakdown of potential costs associated with the platform.

-

What are the benefits of paying the placement fee?

Paying the placement fee allows access to expert assistance during setup and training on how to utilize airSlate SignNow effectively. This investment ensures that your team is well-equipped, ultimately enhancing your document workflows and eSigning processes.

-

How does airSlate SignNow handle the placement fee for large enterprises?

For large enterprises, the placement fee may vary based on specific customization and integration needs. Our team collaborates closely with clients to finalize fees and ensure that solutions are tailored to fit large-scale operations efficiently.

-

Can the placement fee be waived or reduced?

In certain promotional periods, airSlate SignNow might offer discounts that could waive or reduce the placement fee. Contact our sales team for more information about current promotions and customized pricing options for your business.

-

What integrations are available that justify the placement fee?

The placement fee supports integrations with various platforms such as CRM systems, document management tools, and more. These integrations enhance your workflow by allowing seamless data transfer and improved efficiency in document management.

Get more for Agreement Negotiating Loan

- Macarthur gateway client intake form

- Nappy changingtoileting chart bqccsb welcome form

- Loan discharge authority form msa national

- Periodic residential tenancy agreement sagovau logo form

- Firearm safety course booking form victoria police

- Community groups loch village form

- Form gipa

- Onlineacuedu 401043236 form

Find out other Agreement Negotiating Loan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors