Gift Form

What is the affidavit form

An affidavit form is a written statement confirmed by oath or affirmation, used as evidence in legal proceedings. It serves as a declaration of facts that the affiant (the person making the affidavit) believes to be true. Affidavits are commonly used in various legal contexts, including court cases, property transactions, and financial matters. They can cover a wide range of topics, such as identity verification, asset ownership, and personal testimony.

How to use the affidavit form

Using an affidavit form involves several key steps. First, the affiant must clearly state the facts they wish to declare. This includes providing personal information, such as name and address, along with the specific details of the statement being made. Next, the affiant must sign the affidavit in the presence of a notary public or another authorized official who can administer oaths. This step is crucial, as it lends legal weight to the document. After signing, the affidavit can be submitted to the relevant parties, such as a court or a financial institution.

Key elements of the affidavit form

Several key elements must be included in an affidavit form for it to be considered valid. These elements typically include:

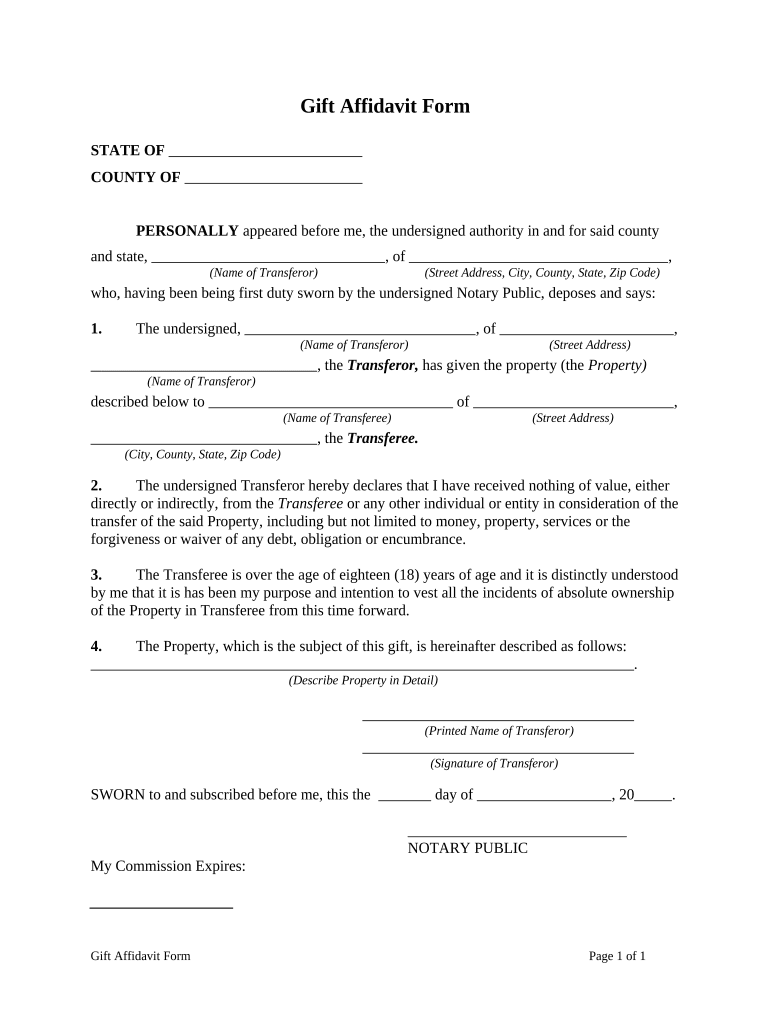

- Title: The document should be labeled as an affidavit.

- Affiant's Information: Full name, address, and contact details of the person making the affidavit.

- Statement of Facts: A clear and concise declaration of the facts being attested to.

- Oath or Affirmation: A statement confirming that the information provided is true to the best of the affiant's knowledge.

- Signature: The affiant's signature, along with the date of signing.

- Notary Section: A section for the notary public to sign and stamp, verifying the affidavit's authenticity.

Steps to complete the affidavit form

Completing an affidavit form involves a straightforward process. Here are the steps to follow:

- Gather necessary information, including personal details and the facts to be declared.

- Fill out the affidavit form accurately, ensuring all information is clear and complete.

- Review the document for any errors or omissions before signing.

- Sign the affidavit in the presence of a notary public or authorized official.

- Ensure the notary public completes their section, which includes their signature and seal.

- Make copies of the signed affidavit for your records and for submission to the relevant parties.

Legal use of the affidavit form

Affidavit forms are legally binding documents when executed properly. They can be used in various legal situations, such as court proceedings, to support claims or defenses. The information contained in an affidavit can be presented as evidence, and false statements made in an affidavit can lead to serious legal consequences, including charges of perjury. Therefore, it is essential to ensure that all information provided is truthful and accurate.

State-specific rules for the affidavit form

Each state in the United States may have specific rules and requirements regarding the use of affidavit forms. These can include variations in the format, required language, and the presence of witnesses or notaries. It is important to consult state laws or legal resources to ensure compliance with local regulations when preparing an affidavit. Understanding these state-specific rules helps to ensure that the affidavit is valid and enforceable in the intended jurisdiction.

Quick guide on how to complete gift form

Prepare Gift Form effortlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, since you can easily access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your files swiftly and without impediments. Manage Gift Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-centric process today.

How to edit and eSign Gift Form effortlessly

- Find Gift Form and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Gift Form and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an affidavit form and how is it used?

An affidavit form is a written statement confirmed by oath or affirmation, serving as a legal document. It is commonly used in various legal proceedings, including court cases and property transactions, to present facts that the affiant declares to be true. Using airSlate SignNow, you can easily create, customize, and eSign affidavit forms securely.

-

How can I create an affidavit form using airSlate SignNow?

Creating an affidavit form with airSlate SignNow is straightforward. Simply select a template or start from scratch, add the necessary fields for signatures and information, and customize it as needed. Once done, you can send it for eSignature, streamlining the entire process efficiently.

-

What are the pricing plans for using airSlate SignNow for affidavit forms?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs. You can choose from a free trial or select a paid plan based on features such as unlimited document signing and advanced integrations. For affidavit forms, our affordable plans ensure you have access to all necessary tools without breaking the budget.

-

Are affidavit forms legally binding when signed electronically?

Yes, affidavit forms signed electronically via airSlate SignNow are legally binding. Our platform complies with various regulations and laws to ensure the authenticity and security of eSignatures. This means you can confidently use our service for creating and signing affidavit forms.

-

What features does airSlate SignNow offer for managing affidavit forms?

airSlate SignNow offers a range of features to manage affidavit forms effectively. These include customizable templates, easy drag-and-drop functionality, real-time tracking of document status, and secure cloud storage. These features streamline how you create, sign, and manage your affidavit forms.

-

Can I integrate airSlate SignNow with other applications for affidavit forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when dealing with affidavit forms. You can connect it with tools like Google Drive, Dropbox, and various CRM systems, making data management easier and more efficient.

-

What are the benefits of using airSlate SignNow for affidavit forms?

Using airSlate SignNow for affidavit forms provides numerous benefits, including faster turnaround times, increased efficiency, and enhanced security. Our platform eliminates the need for physical paperwork, allowing you to create, send, and sign affidavits remotely. Additionally, eSigning is environmentally friendly and cost-effective.

Get more for Gift Form

Find out other Gift Form

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors